Rainbow Children’s Medicare Limited operates a multi-specialty pediatric, obstetrics, and gynecology hospital chain in India. The company offers a wide range of services such as newborn and pediatric intensive care, pediatric multi-specialty services, pediatric quaternary care, obstetrics, and gynecology. It is country’s largest pediatric hospital chain with 16 hospitals spread across 6 cities.

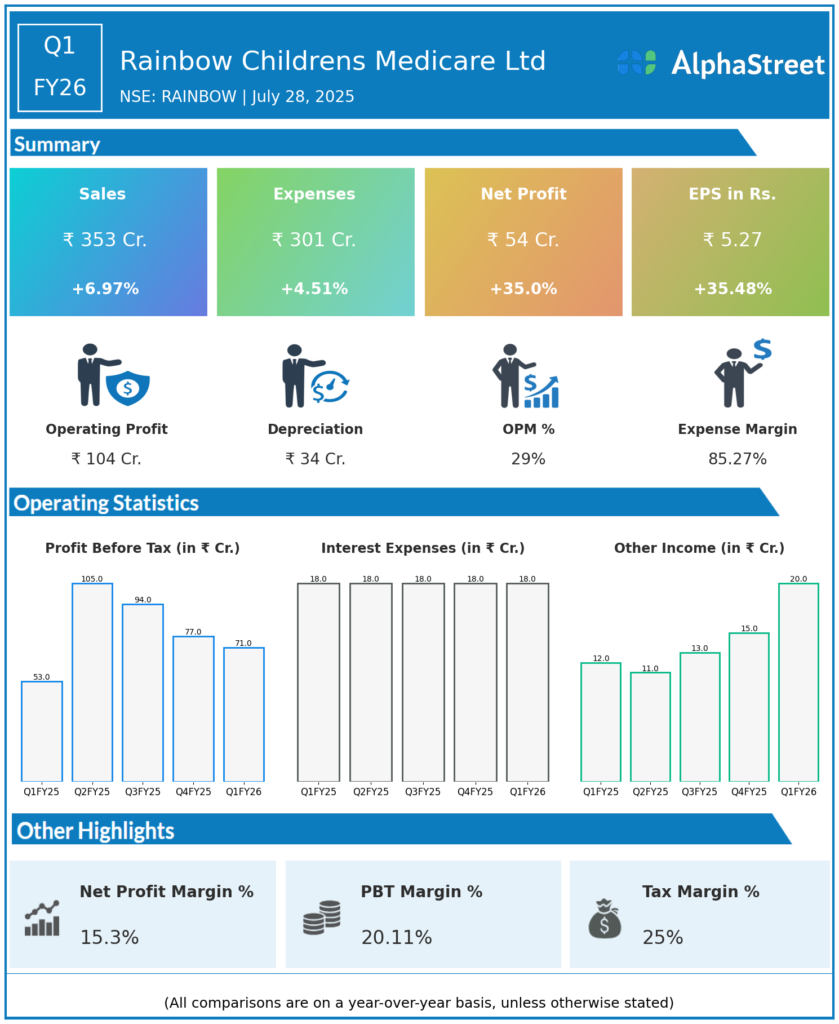

Q1 FY26 Earnings Summary (April–June 2025)

-

Total Income: ₹372.94 crore, up 5.4% QoQ and 9.0% YoY.

-

EBITDA: Not directly reported for Q1 FY26, but implied margin steady given sequential profit growth.

-

PAT: ₹53.81 crore, up 5.4% QoQ and up 35.4% YoY.

-

EPS: ₹5.30, +6% QoQ and +35.9% YoY.

-

Net Margin: Improved to 15% from 12% one year earlier; profit growth outpaced revenue growth due to better operational leverage.

-

Q1 revenue met analyst consensus; EPS beat estimates by 16%.

-

Recent Acquisition: Completed 76% stake in Prashanthi Medicare Pvt. Ltd for ₹32.6 crore, expanding presence in Andhra Pradesh.

-

Management Strengthening: Appointment of Dr. Pranathi Subrahmanyam Maddirala as Senior Management Personnel.

-

Shareholder Reward: Final dividend of ₹3 per share for FY25.

Key Management & Strategic Decisions Q1 FY26

-

Integration of Acquisitions: New hospital in Andhra Pradesh to deepen reach outside core Hyderabad market.

-

Continued Emphasis on Hub-and-Spoke Model: Helps drive occupancy and scale benefits.

-

Talent Retention & Incentive Schemes: Grant of employee stock options to align incentives, support growth.

-

Operational Focus: Maintaining cost discipline while ramping up new facilities, prioritizing utilization improvement and case-mix optimization.

-

Outlook: Management reiterated a targeted 16% annualized revenue growth over next three years, in line with industry growth.

Caveats & Context

-

There was a QoQ dip in Q4 due to seasonal occupancy pressure and losses from newly opened/under-ramp units, which is expected to self-correct as these ramp up.

-

Full details of Q1 FY26 management commentary will be clearer after the earnings call; current information is based on reported numbers and announced strategic actions.

Q4 FY25 Earnings Summary (January–March 2025)

-

Total Income: ₹353.88 crore, up 8.6% year-over-year (YoY) but down 14% quarter-over-quarter (QoQ).

-

EBITDA: ₹114.7 crore, +8.7% YoY. Margin improved slightly to 31.0%.

-

PAT (Net Profit): ₹51.06 crore, down 5.2% YoY and down 25.9% QoQ.

-

EPS: ₹5.00, compared to ₹5.30 in Q4 FY24 and ₹6.80 in Q3 FY25.

-

EBITDA Margin: 31% (flat YoY); occupancy declined ~200 bps YoY due to seasonality in paediatric segment. ARPOB (Average Revenue per Operating Bed) rose 7% YoY to ₹58,100 per day.

-

Strategic Expansion: The company continued bed expansion—aimed for 1,000 more over FY25–FY28 (780 announced so far); three new units saw reported start-up losses.

Key Management & Strategic Decisions Q4 FY25

-

Continued hub-and-spoke expansion model, announcing new centres predominantly in South India to strengthen market leadership.

-

Focused on cost discipline, operational efficiency, and leveraging scale, which helped maintain margins despite new unit drag.

-

Management noted that the bulk of new bed additions would be ramped up through FY26–28.

-

No major cost-cutting measures; priority remained on growth and clinical hiring.

-

Reported strong free cash flow (FCF) generation and maintained a healthy balance sheet