Rain Industries Limited (RAIN) is a leading vertically integrated producer of carbon, cement and Advanced materials products. Headquartered in India, RAIN has manufacturing facilities in eight countries across three continents. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

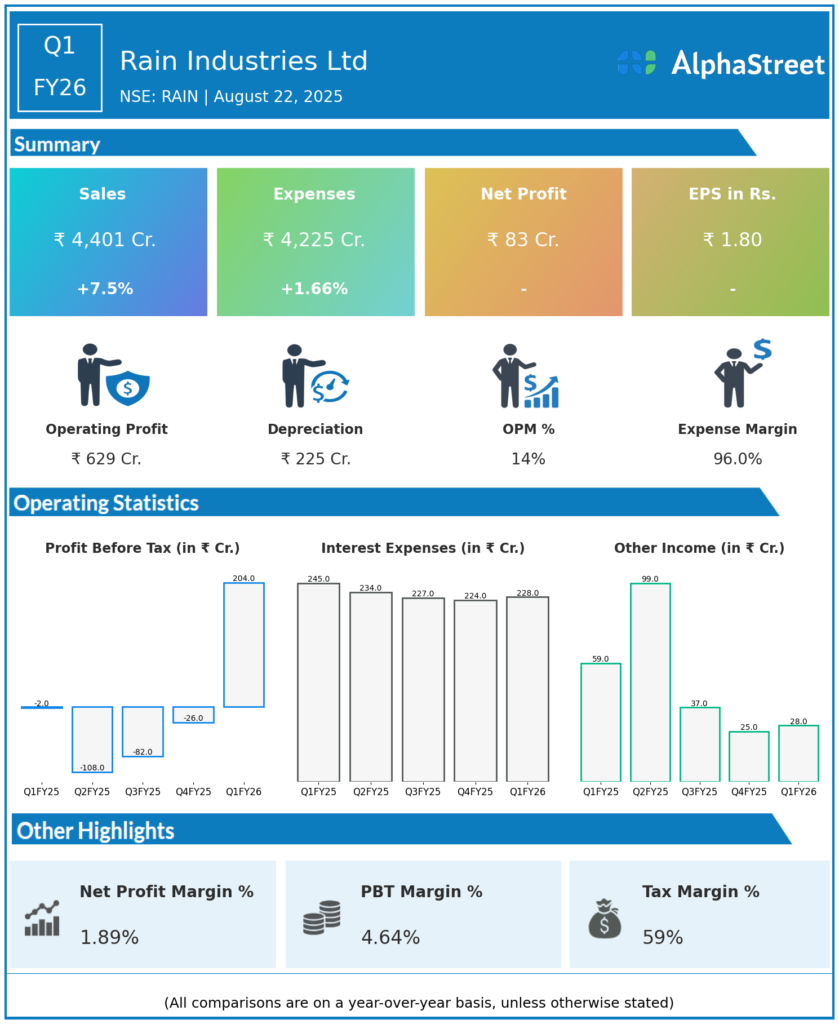

Total Income: ₹4,401 crores, up 16.79% QoQ from ₹3,768 crores in Q4 FY25 and up 7.5% YoY from ₹4,094 crores in Q1 FY25.

-

Total Expenses: ₹4,225.30 crores, up 12.4% QoQ from ₹3,757.76 crores and up 1.7% YoY from ₹4,155.08 crores.

-

Profit Before Tax (PBT): ₹203.59 crores, a significant turnaround from losses of ₹33.86 crores in Q4 FY25 and ₹2.23 crores in Q1 FY25.

-

Profit After Tax (PAT): ₹82.99 crores, against losses of ₹115 crores in Q4 FY25 and -₹45 crores in Q1 FY25, marking a strong recovery.

-

Earnings Per Share (EPS): ₹1.80, compared to a negative ₹4.09 in Q4 FY25 and negative ₹2.32 in Q1 FY25.

-

EBITDA: ₹629 crores, up 70% YoY and 65% QoQ, with EBITDA margin improving significantly.

-

EBIT Margin: 9.75% in Q1 FY26, up from 5.23% in Q4 FY25.

-

Key Segments: Operates primarily in carbon products, cement, and renewable energy sectors.

-

Net Debt: ₹409.8 crores as of June 30, 2025, down from prior levels.

Management Commentary & Strategic Decisions

-

Management emphasized strong operational execution and recovery in commodity markets driving topline and profitability improvements.

-

They highlighted better cost control, production volume increases, and favorable pricing environment in carbon products and cement businesses.

-

The company expects continued demand growth and aims to maintain tight working capital management.

-

Continued investments in renewable energy projects are part of their long-term growth strategy.

-

Management also pointed to a stronger balance sheet and enhanced financial health after several quarters of losses.

Q4 FY25 Earnings Results

-

Total Income: ₹3,768 crores, up 2.67 percent on the YoY basis.

-

Total Expenses: ₹3,388 crores

-

Profit Before Tax (PBT): -₹33.86 crores (loss)

-

Profit After Tax (PAT): -₹115 crores (loss) vs -₹116 crores during the same quarter, last year

-

Earnings Per Share (EPS): -₹4.09 vs -₹4.34 during the same quarter, last year.

-

EBITDA Margin: Approximately 5.23%

-

Operational Challenges: Q4 FY25 results were impacted by weaker commodity prices and high expense base leading to losses.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.