RailTel was incorporated in 2000, with the objective of creating nationwide broadband and VPN services, telecom, and multimedia network, to modernize the train control operation and safety system of Indian Railways. It is a “Navratna” PSU of the Government of India. At present, RailTel’s network passes through around 6,000 stations across the country, covering all major commercial centers.

Q2 FY26 Earnings Results

-

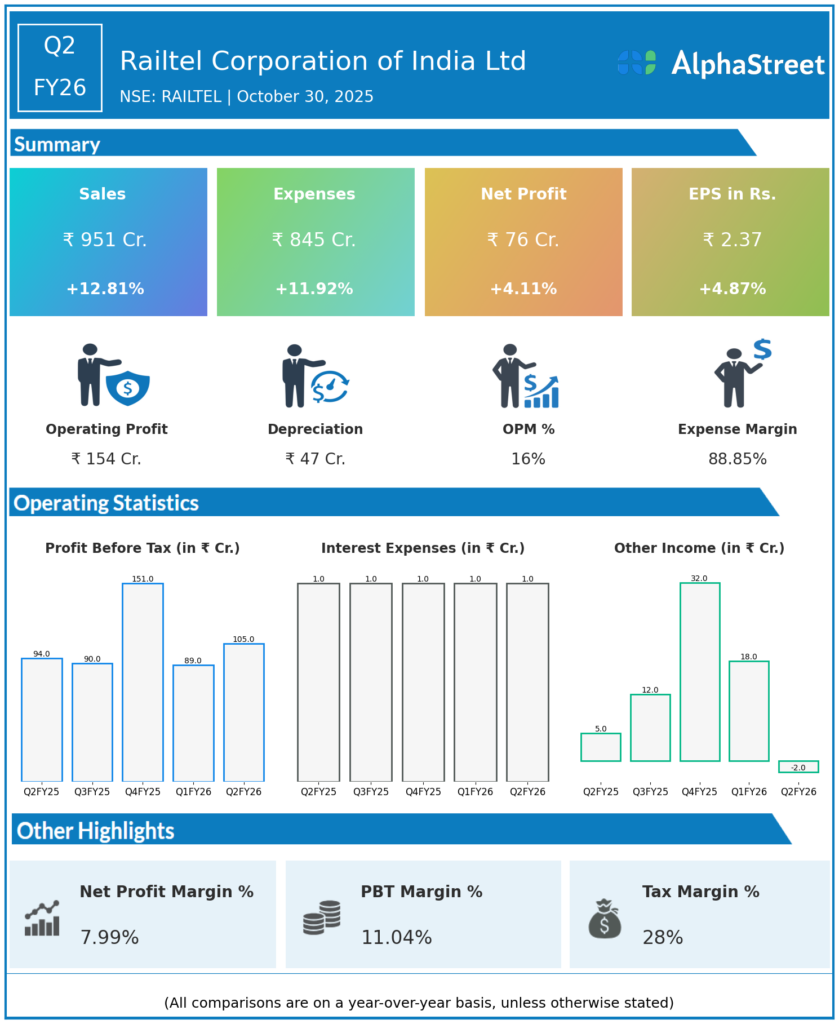

Revenue from Operations: ₹951 crore, up 12.8% YoY from ₹843 crore in Q2 FY25, and up 28% QoQ from ₹743 crore in Q1 FY26.

-

Total Income: ₹966 crore (including other income).

-

Profit After Tax (PAT): ₹76 crore, up 4.7% YoY from ₹72 crore, and up 15% QoQ from ₹66 crore.

-

Profit Before Tax (PBT): ₹105.3 crore, up 11.9% YoY from ₹94.1 crore.

-

EBITDA: ₹154 crore, up 19.5% YoY, EBITDA margin at 16.2%—margin expansion led by efficient scaling in telecom and project business.

-

Earnings Per Share (EPS): ₹2.37, up 5% YoY from ₹2.26.

-

Segment Revenue: Telecom services ₹367.5 crore (+8.7% QoQ), Project work services ₹583.8 crore (+15.5% YoY).

-

Expense Summary: Total expenses ₹844 crore (up 11.9% YoY), project expenses ₹560.9 crore (up 14.85% YoY), employee benefits ₹54.83 crore (up 3% YoY).

-

Interim Dividend: ₹1 per share declared for FY26. Record date: November 4, 2025.

-

Order Book: ₹8,251 crore, positioning RailTel for strong future growth.

Management Commentary & Strategic Decisions

-

Management highlighted robust operational performance driven by timely project executions and growth in broadband and telecom services.

-

Focus continues on digital infrastructure expansion under Digital India, railway modernization, and rural connectivity.

-

Company celebrates its 25th year with consistent profit and solid revenue momentum.

-

Strategic priorities include timely execution of new projects, cost management, and diversification of the international business.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹743.81 crore, up 33.3% YoY from ₹558 crore in Q1 FY25.

-

Total Income: ₹758 crore.

-

Profit After Tax (PAT): ₹66.1 crore, up 34.6% YoY from ₹48.67 crore.

-

EBITDA: ₹116 crore, up 11.5% YoY, with margin at 15.6% (down from 18.6% last year due to segment mix).

-

EPS: ₹2.06, compared to ₹1.52 in Q1 FY25.

-

Segment Revenue: Project work services ₹409 crore (+77.6% YoY), Telecom services ₹335 crore (+2.1% YoY).

-

Order booking: ₹721 crore for Q1 FY26; total order book at ₹7,197 crore.

-

Management expects 25% growth for FY26, with a focus on railway safety, digital infrastructure, and timely execution.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.