Rail Vikas Nigam Ltd was Incorporated in 2003 by the Govt. of India, it is engaged in the business of implementing various types of Rail infrastructure projects assigned by MoR including doubling, gauge conversion, new lines, railway electrification, major bridges, workshops, Production Units and sharing of freight revenue with Railways as per the concession agreement entered into with Ministry of Railway. Presenting below are its Q1 FY26 earnings results.

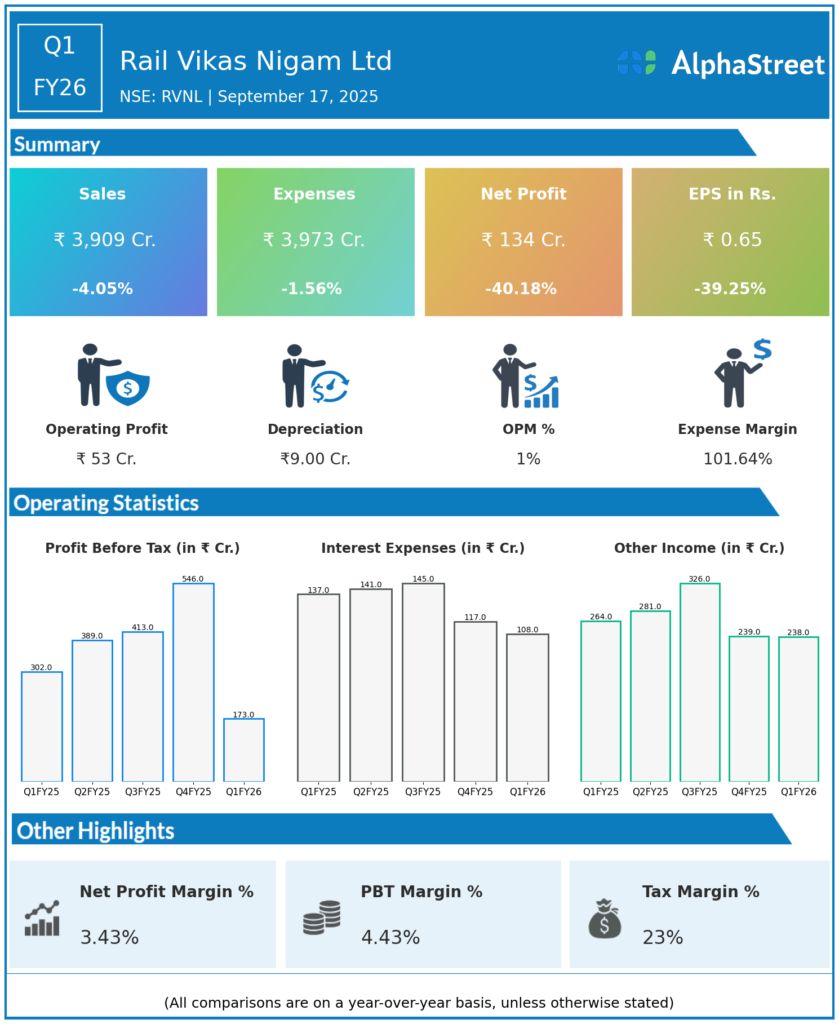

Q1 FY26 Earnings Results

-

Total Income: ₹4,136.96 crores, down 40.9% QoQ (Q4 FY25: ₹6,994.31 crores) and down 4.6% YoY (Q1 FY25: ₹4,336.75 crores).

-

Revenue from Operations: ₹3,908.77 crores, down 4.05% YoY (Q1 FY25: ₹4,073.80 crores).

-

Profit Before Tax (PBT): ₹164.04 crores, down 71.8% QoQ (Q4 FY25: ₹581.90 crores) and down 45.4% YoY (Q1 FY25: ₹300.25 crores).

-

Profit After Tax (PAT): ₹134.36 crores, down 71.9% QoQ (Q4 FY25: ₹478.40 crores) and down 40% YoY (Q1 FY25: ₹223.92 crores).

-

Earnings Per Share (EPS): ₹0.65, down 69.6% QoQ (Q4 FY25: ₹2.30) and down 39.2% YoY (Q1 FY25: ₹1.10).

-

Total Expenses: ₹3,972.92 crores, slightly down 1.6% YoY (Q1 FY25: ₹4,036.50 crores).

-

Other Income: ₹228.19 crores, down from ₹262.95 crores YoY.

-

Share of Profit from Joint Ventures: Increased to ₹9.37 crores from ₹1.36 crores YoY.

-

Receivables: ₹1,275.25 crores due from Krishnapatnam Railway Company including ₹889.95 crores interest on delayed payments; dispute on interest calculation under board review.

Key Management Commentary & Strategic Highlights

-

Management indicated subdued project execution impacting revenue and profitability this quarter.

-

Expense control helped limit margin erosion, but a softer topline and lower other income weighed on net profit.

-

Strong growth in joint venture profits provides some offset to reduced core earnings.

-

The company is progressing with new project awards and maintaining a robust order book to support medium-term growth.

-

RVNL established a new wholly-owned subsidiary for road development in Andhra Pradesh to diversify infrastructure portfolio.

Q4 FY25 Earnings Results

-

Total Income: ₹6,994.31 crores.

-

Profit After Tax (PAT): ₹478.40 crores.

-

EPS: ₹2.30.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.