Incorporated in the year 1943, Radico Khaitan is one of the most recognised IMFL (Indian Made Foreign Liquor) brands in India. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

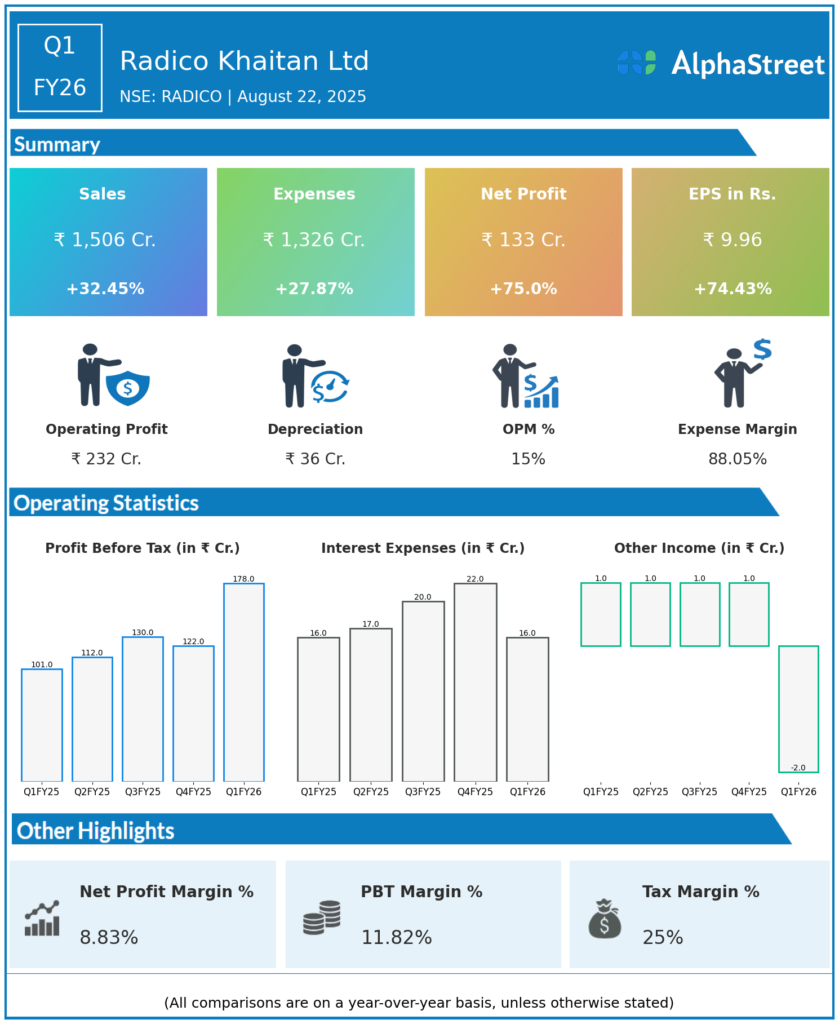

Revenue from Operations (Net): ₹1,506 crores, up 32.4% YoY (Q1 FY25: ₹1,136.5 crores) and up 15.5% QoQ (Q4 FY25: ₹1,304.1 crores).

-

Gross Profit: ₹647.7 crores, up 38.8% YoY.

-

EBITDA: ₹230.7 crores, up 55.6% YoY (Q1 FY25: ₹148.2 crores); margin expands to 15.3% (vs. 13.0% last year).

-

Profit Before Tax (PBT): ₹177.6 crores, up 75.2% YoY (Q1 FY25: ₹101.4 crores).

-

Profit After Tax (PAT) / Net Profit: ₹133 crores, up 75% YoY (Q1 FY25: ₹76 crores).

-

Basic EPS: ₹9.96, up 74.4% YoY (Q1 FY25: ₹5.71).

-

Total Comprehensive Income: ₹132.2 crores, up 74.5% YoY.

-

Total Expenses: ₹1,326.06 crores, up 27.8% YoY.

-

Net Debt (June 30, 2025): ₹409.8 crores, reduced by ₹163.7 crores from March 2025.

-

IMFL Volume: 9.72 million cases, up 37.5% YoY—highest ever quarterly volume.

-

Prestige & Above: 3.84 million cases, up 40.8% YoY.

-

Regular & Others: 5.42 million cases, up 52.1% YoY.

-

Management Commentary & Strategic Decisions

-

The company achieved record-breaking volumes, highest-ever quarterly sales, and EBITDA, driven by strong momentum in premiumization and robust demand in core markets.

-

Chairman Dr. Lalit Khaitan highlighted significant progress in the premium portfolio, margin expansion from stable raw material costs, and a favorable product mix.

-

Management remains focused on sustainable, profitable, volume-led growth, supported by strengthening of premium brands, expanding distribution, and recent launches in luxury segments (e.g., Morpheus Super Premium Whisky and The Spirit of Kashmyr luxury vodka).

-

The company continues net debt reduction, targeting a debt-free balance sheet in 24–30 months.

-

Strategic priorities include launching products in super-premium categories, expanding into sports, fashion, music, and luxury collaborations, and further market penetration.

Q4 FY25 Earnings Results

-

Revenue from Operations (Net): ₹1,304.1 crores, up 20.8 percent on the YoY basis.

-

Gross Profit: ₹566.9 crores.

-

EBITDA: ₹174.5 crores, margin 13.4%.

-

Profit Before Tax (PBT): ₹121.5 crores.

-

Profit After Tax (PAT) / Net Profit: ₹91 crores, up 59.6 percent on the YoY basis.

-

Basic EPS: ₹6.78, up 59.5 percent from the same quarter last year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.