Incorporated in 1995, RR Kabel provides consumer electrical products used for residential, commercial, industrial, and infrastructure purposes in two major segments, namely wires and cables including house wires, industrial wires, power cables, and special cables; and FMEG including fans, lighting, switches, and appliances.

Q2 FY26 Earnings Results:

-

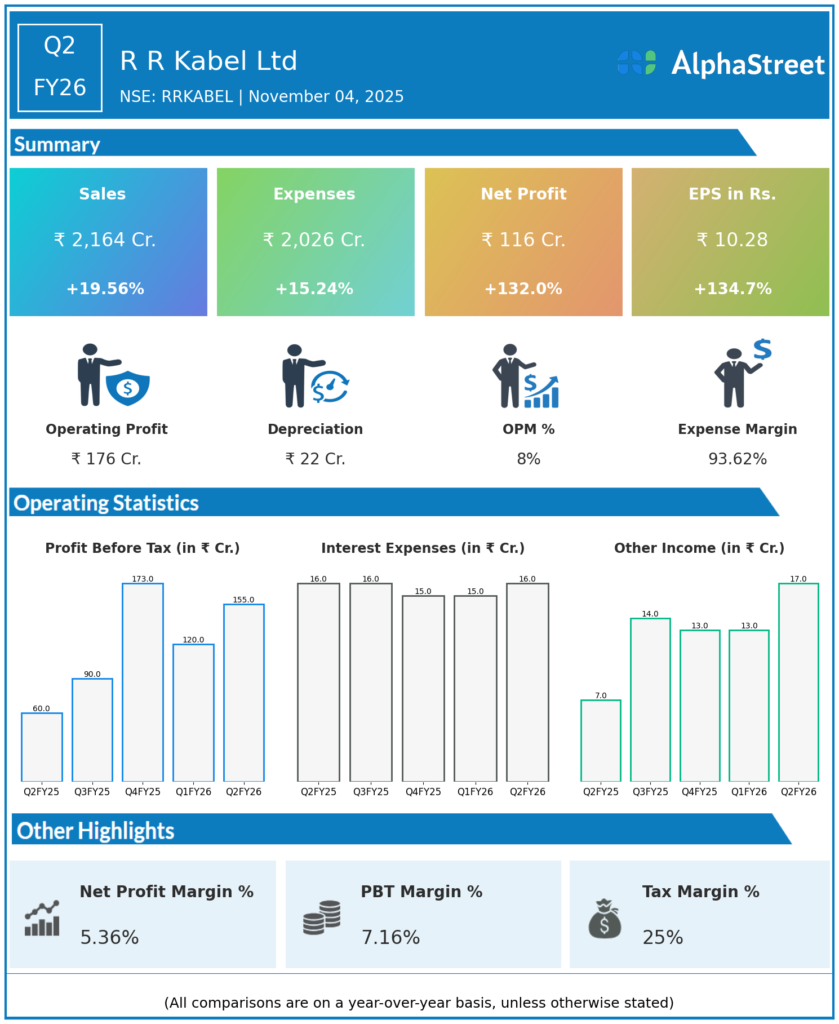

Revenue from Operations: ₹2,163.8 crore, up 19.5% YoY from ₹1,810 crore in Q2 FY25.

-

Profit After Tax (PAT): ₹116.3 crore, surged 133% YoY from ₹49.5 crore.

-

EBITDA: ₹176.1 crore, more than doubled from ₹85.6 crore last year.

-

EBITDA Margin: 8.13%, increased 341 basis points YoY.

-

Profit Before Tax (PBT): ₹154.9 crore, up 159.5% YoY.

-

Half-year revenue: ₹4,222 crore, up 16.7% YoY.

-

Half-year PAT: ₹206 crore, up 80.9% YoY.

-

Revenue mix: 91% from wires and cables, 9% from fast-moving electrical goods (FMEG).

-

Wires & Cables segment showed 22% revenue growth supported by 16% volume growth and higher realization.

-

FMEG segment maintained steady performance despite seasonal softness; operational efficiencies improved contribution margins.

-

Interim dividend declared of ₹4 per share (80% of face value).

Management Commentary & Strategic Insights:

-

MD Mahendrakumar Kabra stated Q2 FY26 was a landmark quarter with highest-ever half-yearly revenue and profitability.

-

Growth driven by resilient core wires and cables business and robust demand in domestic and international markets.

-

Focus on disciplined execution, strong fundamentals, and sustainable growth.

-

Rs 1,200 crore capex planned over next three years; addressing copper price volatility through hedging and pricing adjustments.

-

Confident of maintaining growth momentum and creating enduring value for stakeholders.

Q1 FY26 Earnings Results:

-

Revenue: ₹2,058.6 crore, up 13.9% YoY.

-

PAT: ₹89.77 crore, up 39.4% YoY from ₹64.4 crore.

-

Operating EBITDA: ₹143.1 crore, up 50% YoY.

-

PBT: ₹120 crore, margin improved by 107 basis points to 5.8%.

-

Strong growth in wires and cables segment; FMEG segment losses reduced significantly.

-

29% of revenue came from exports.

-

QoQ dip due to seasonality but strong annual growth visible.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.