Quick Heal Technologies is engaged in the business of providing security software products. The Company caters to both domestic and international market. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

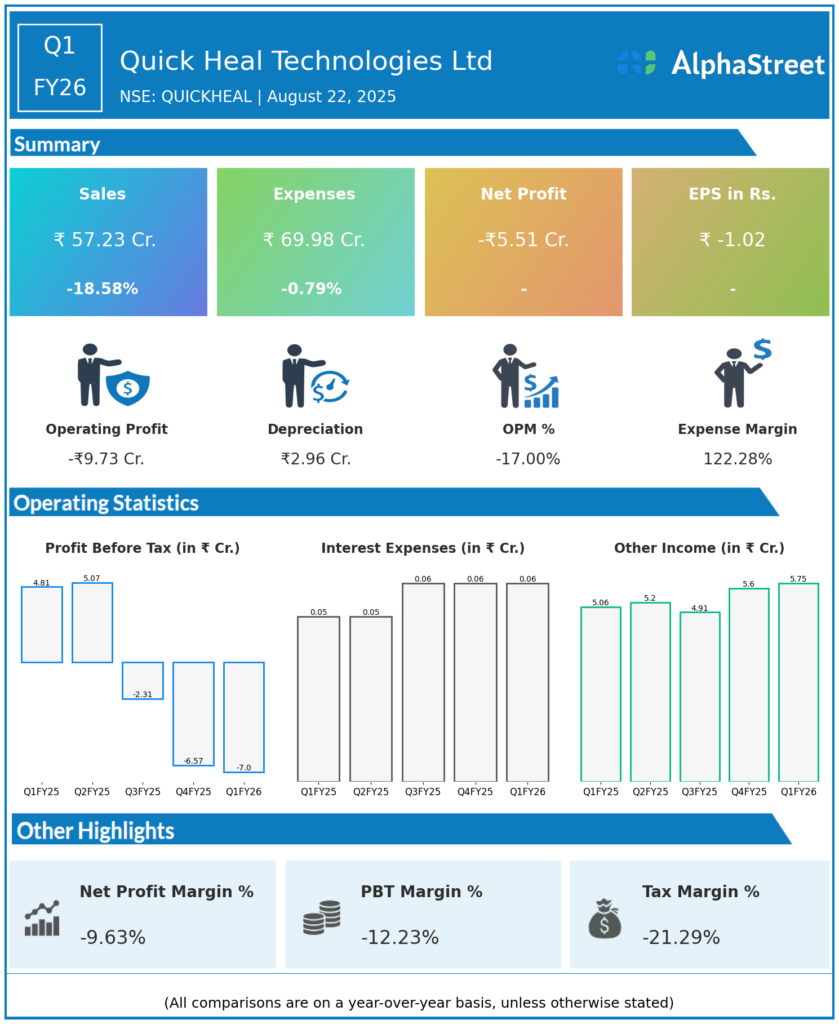

- Revenue from Operations: ₹57.23 crores, down 13.8% QoQ (from ₹65.14 crores in Q4 FY25) and down 18.5% YoY (from ₹70.29 crores in Q1 FY25).

-

Total Expenses: ₹69.98 crores, down 4.5% QoQ and down 0.8% YoY.

-

EBITDA: -₹9.7 crores, margin -17.0% (negative).

-

Profit Before Tax (PBT): -₹7.00 crores, shifting from positive ₹13.55 crores (Q4 FY25) and ₹4.81 crores (Q1 FY25).

-

Profit After Tax (PAT): -₹5.51 crores (net loss), compared to loss of ₹3.25 crores in Q4 FY25 and profit of ₹4.03 crores in Q1 FY25.

-

Earnings Per Share (EPS): -₹1.02, from -₹0.60 in Q4 FY25 and ₹0.75 in Q1 FY25.

-

Tax: ₹1.49 crores credit in Q1 FY26.

Management Commentary & Strategic Decisions

-

The management acknowledged a challenging quarter due to soft demand in the domestic retail and enterprise cybersecurity segment, exacerbated by macro pressures on IT spending.

-

Quick Heal is advancing strategic initiatives focused on growth: launching new AI-driven cybersecurity platforms, expanding B2B and government verticals, and international market forays.

-

They are implementing cost rationalization and operational improvements to restore profitability amid lingering margin pressure and competitive challenges.

-

Management expects revenue stabilization from Q2 onwards as new contracts are initiated and enterprise demand strengthens.

-

Partnerships such as the MoU with BHASHINI aim to increase cybersecurity and data privacy literacy across India’s diverse linguistic landscape, a move expected to aid brand positioning.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹65.14 crores, down 18.6 percent on the YoY basis.

-

Total Expenses: ₹73.30 crores.

-

Profit Before Tax (PBT): ₹13.55 crores.

-

Profit After Tax (PAT): -₹3.25 crores a rise of more than 500 percent from same quarter last year.

-

Earnings Per Share (EPS): -₹0.60 vs ₹2.6 during the same quarter last year

-

EBITDA: -₹8.5 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.