Quick Heal Technologies is engaged in the business of providing security software products. The Company caters to both domestic and international market. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

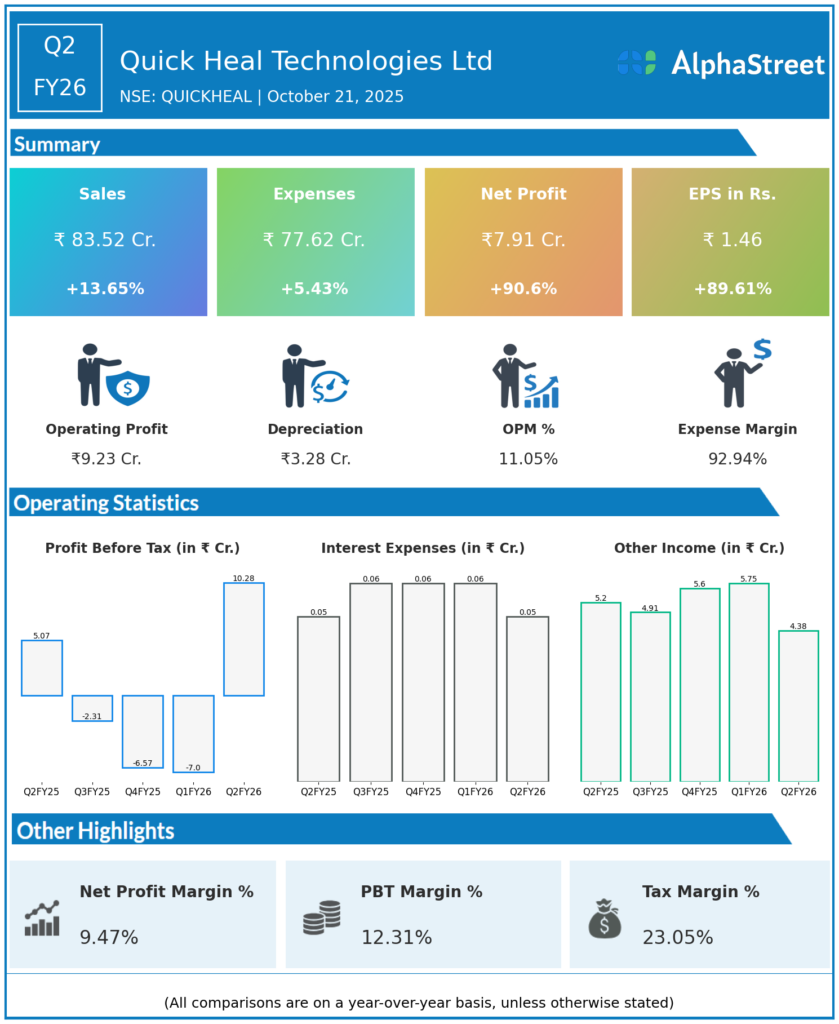

Revenue: ₹83.5 crore, up 13.6% YoY from ₹73.5 crore in Q2 FY25, and up 45.9% QoQ from ₹57.2 crore in Q1 FY26.

-

EBITDA: ₹9.2 crore, a sharp rise of 200.7% YoY compared to ₹3.1 crore in Q2 FY25, marking a strong margin expansion to 11.1% from 4.2% YoY.

-

Profit After Tax (PAT): ₹7.9 crore, nearly doubled from ₹4.2 crore in Q2 FY25 and a decisive turnaround from the loss of ₹5.5 crore in Q1 FY26.

-

PAT Margin: 9.5%, improved by 380 basis points YoY.

-

EPS: ₹9.43 per share.

-

Segments:

-

Enterprise segment revenue up 30% YoY to ₹36.9 crore.

-

Consumer segment revenue up 8.3% YoY to ₹59.5 crore.

-

-

New Developments: Signed MOUs with BHASHINI for AI-powered cybersecurity solutions; onboarded first enterprise customer for their Seqrite Data Privacy Management Platform.

-

International Expansion: Gaining momentum with new cybersecurity service contracts and industry recognition globally.

Management Commentary and Strategic Insights

-

Kailash Katkar, Chairman & MD:

“Q2 FY26 demonstrated a strong performance across consumer and enterprise verticals. Our AI-led innovation agenda is driving differentiated cybersecurity solutions that address evolving market needs. The recovery in consumer business and acceleration in enterprise offerings reflect our balanced growth approach and positioning for sustained profitability.”. -

The company is focused on consolidating its security stack, embracing generative AI technologies, and expanding privacy-driven application and data decoupling capabilities.

-

Management is optimistic on leveraging AI innovation, expanding market reach, and improving profitability in future quarters.

Q1 FY26 Earnings Results

-

Revenue: ₹57.2 crore.

-

EBITDA: Negative ₹9.7 crore, indicating earlier margin pressures leading to losses.

-

PAT: Negative ₹5.51 crore, a loss in Q1 before significant recovery in Q2 FY26.

-

The quarter marked a turnaround starting point due to operational improvements and market momentum in Q2.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.