Company Overview

Eternal Ltd (ETERNAL.NS) operates consumer internet platforms across food delivery, quick commerce, and B2B supplies in India. Its core businesses include food delivery, Blinkit quick commerce, and Hyperpure supplies to restaurants. The company has focused on scale expansion, faster delivery infrastructure, and selective profitability improvements across segments.

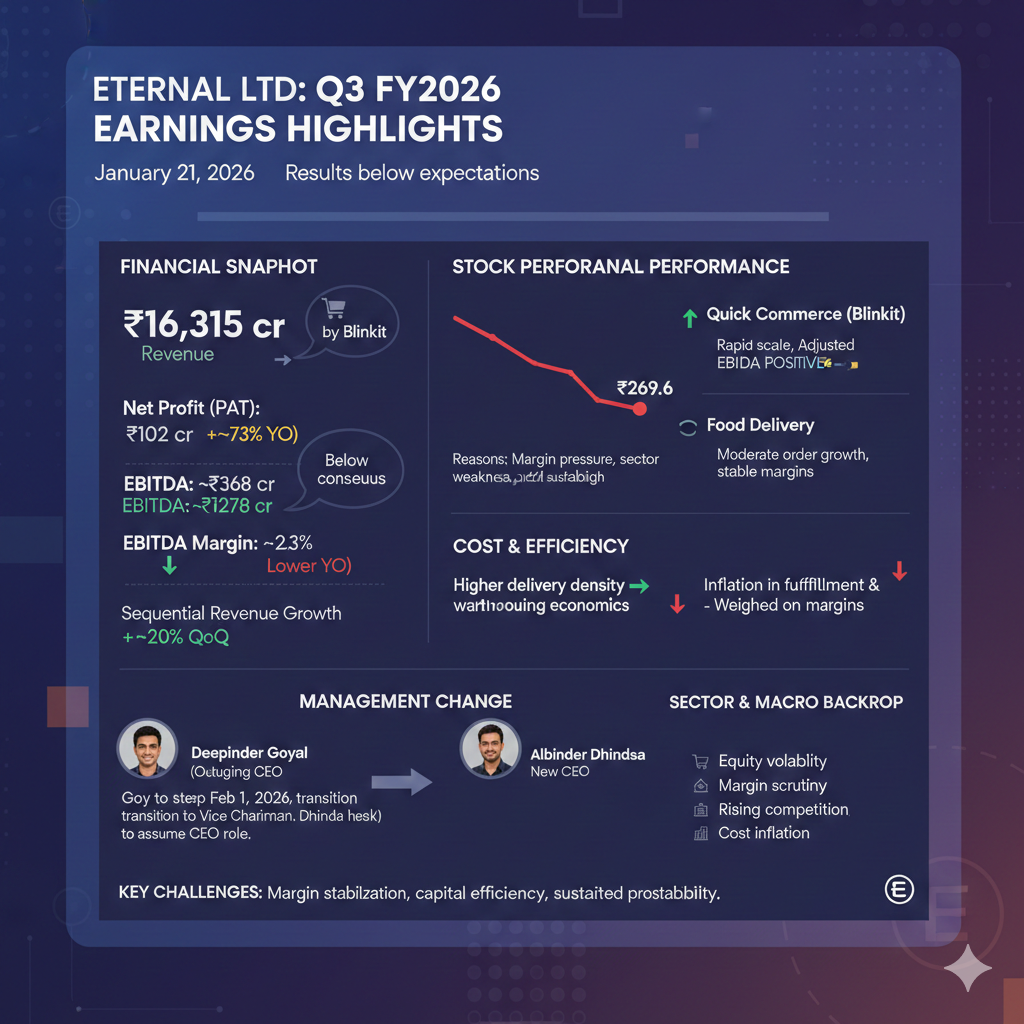

Financial Summary – Q3 FY2026

Jan 21, 2026 – Shares of Eternal Ltd fell about 4.2% to ₹269.6 in trade following its quarterly earnings release. The stock is down roughly 27–30% from its 52-week high of about ₹368 and has underperformed in recent months amid margin pressure and broader weakness in consumer internet stocks.

Key Metrics

| Metric | Q3 FY26 | YoY Change | Comments |

| Revenue (₹ cr) | 16,315 | +~202% | Driven primarily by Blinkit scale-up |

| Net Profit (PAT) (₹ cr) | 102 | +~73% | Below consensus expectations |

| EBITDA (₹ cr) | ~368 | +~127% | Improved operating leverage |

| EBITDA Margin | ~2.3% | Lower YoY | Impacted by quick commerce costs |

| Sequential Revenue Growth | +~20% QoQ | — | Continued scale expansion |

Revenue growth was led by quick commerce volumes, while food delivery showed steadier growth. Margins declined year-on-year as cost intensity remained elevated.

Share Price Performance

The stock has trended lower over the past year despite strong revenue growth. Recent declines reflect investor caution around profit sustainability, working capital intensity, and sector-wide valuation compression. Shares remain well below their annual peak.

Operational Performance

Segment Performance

- Quick Commerce (Blinkit): Continued rapid scale-up. Adjusted EBITDA turned positive during the quarter.

- Food Delivery: Moderate order growth with stable contribution margins.

- Hyperpure: Mixed performance with steady demand from institutional customers.

Cost and Efficiency

- Higher delivery density improved unit economics sequentially.

- Operating leverage improved, but inflation in fulfillment and warehousing costs weighed on margins.

Revenue and Profit Trends

- Sequential revenue growth recorded across FY26 quarters.

- Profitability improved quarter-on-quarter but remained volatile.

- EBITDA growth outpaced revenue growth due to scale benefits.

EBITDA and Margin Dynamics

EBITDA increased sequentially, reflecting improved absorption of fixed costs. Margins remained below historical levels due to the high cost structure of quick commerce and continued investment in logistics infrastructure.

Year-Over-Year and Full-Year Context

- Q3 FY26 marked one of the strongest YoY revenue expansions in the company’s history.

- FY25 revenue stood at approximately ₹20,200 crore, with net profit of about ₹527 crore.

- FY26 year-to-date performance shows faster scale but lower margin stability.

Sector and Macro Backdrop

Consumer internet and delivery stocks in India faced pressure amid:

- Broader equity market volatility

- Margin scrutiny across quick commerce models

- Rising competition and cost inflation

Risk appetite for high-growth internet names remained muted during the period.

Competitive Landscape

Eternal competes primarily with:

- Swiggy in food delivery and instant commerce

- Other regional quick commerce platforms

The sector remains characterized by:

- Aggressive pricing

- High logistics costs

- Gradual movement toward contribution-level profitability

Blinkit’s inventory-led model supported revenue growth but increased capital and operating intensity.

Management and Corporate Developments

The company announced that Deepinder Goyal will step down as CEO effective February 1, 2026, transitioning to vice chairman. Blinkit head Albinder Dhindsa will assume the CEO role, reflecting strategic emphasis on quick commerce.

Summary

Eternal delivered strong top-line growth in Q3 FY26 driven by quick commerce scale and higher delivery density. Sequential profitability improved, but margins remained under pressure due to cost intensity. The stock continues to trade well below its annual highs amid sector-wide caution and execution risk. Investor focus remains on margin stabilization, capital efficiency, and sustained profitability across core segments.