Quess Corp Limited (Quess) is India’s leading business services provider, leveraging its extensive domain knowledge and future-ready digital platforms to drive client productivity through outsourced solutions.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

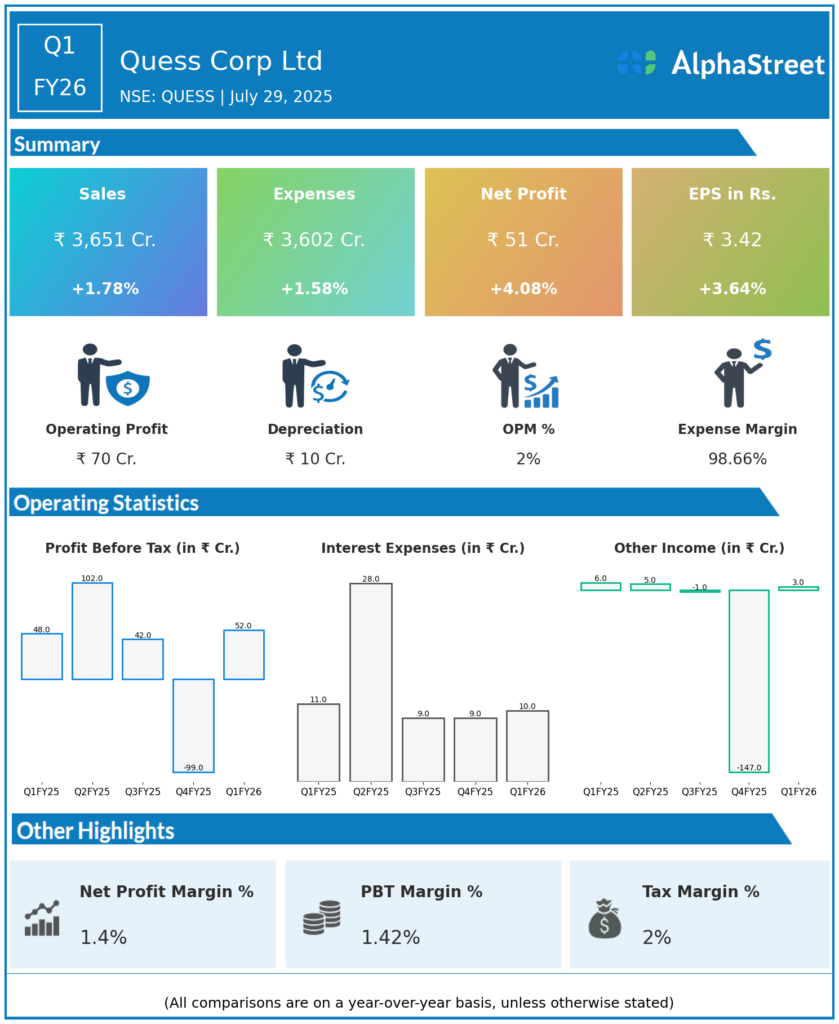

Revenue: ₹3,651 crore, up 2% YoY.

-

EBITDA: ₹70 crore, up 10% YoY, margin at 1.9% (up 15 bps YoY).

-

PAT (Net Profit): ₹51 crore, up 4% YoY.

-

EPS: ₹3.4/share.

-

Headcount: Around 462,000, down 7% YoY but slightly higher QoQ.

-

Segment Performance:

-

General Staffing revenue at ₹3,122 crore (flat YoY); Professional Staffing revenue grew 31% YoY to ₹244 crore, with a 47% surge in EBITDA.

-

Overseas business saw mild growth, while digital platforms faced challenges.

-

-

Recognition: Quess was ranked No.1 Staffing Company in India by Staffing Industry Analysts and recognized as a Great Place to Work for the sixth straight year.

-

Hiring and Deals: Secured 79 new mandates in Q1 FY26.

Key Management & Strategic Decisions

-

Strategic Focus Post-Demerger: The company is now more focused on its core workforce management and staffing business, enabling sharper execution in leading segments and innovation.

-

Dividend Policy: Commitment to a shareholder-friendly payout, increasing free cash flow returns.

-

Growth Initiatives: Continued emphasis on Professional Staffing, GCC, and technology-led hiring; signed 45 new enterprise clients in Q4 FY25 and holds 1,300+ open mandates, particularly in non-tech and emerging tech roles.

-

Digital Transformation: Investments continue in digital platforms, though that business faced margin pressure in Q1. Efficiency and digitization are ongoing priorities.

-

Talent and Market Quality: Despite slight reduction in headcount, the company is focused on higher-value roles and retaining enterprise contracts.

-

Cost and Margin Discipline: Results show improved EBITDA and PAT despite moderate revenue growth, reflecting strong expense management.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue: ₹14,967 crore, up 9% YoY.

-

EBITDA: ₹262 crore, up 12% YoY.

-

Adjusted PAT: ₹210 crore, up 54% YoY.

-

EBITDA Margin: 2%.

-

EPS: Not directly stated, but strong improvement implied.

-

Net Cash: Increased to ₹255 crore from ₹39 crore in the prior year, demonstrating robust free cash generation.

-

Dividend: Final dividend of ₹6/share declared; new dividend policy announced to distribute up to 75% of free cash flow to shareholders.

-

Business Drivers: Growth led by standout performance in Professional Staffing (EBITDA up 42% YoY) and international businesses. General Staffing and GCC (Global Capability Centers) demand remained resilient.

-

Demerger Impact: This quarter marked the first results post-demerger, with the company sharpening focus on core business and improving market penetration.

-

Management Commentary: Management emphasized increased market penetration, better cost control, and a vision to achieve 20% return on equity by leveraging new business focus and digital platforms