PVR Limited (PVR) is India’s largest and most premium film exhibition company. It pioneered the multiplex revolution in India by establishing the first multiplex cinema in 1997 at New Delhi and continues to lead the market with relentless focus on innovation and operational excellence to democratise big‑screen movie experience. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

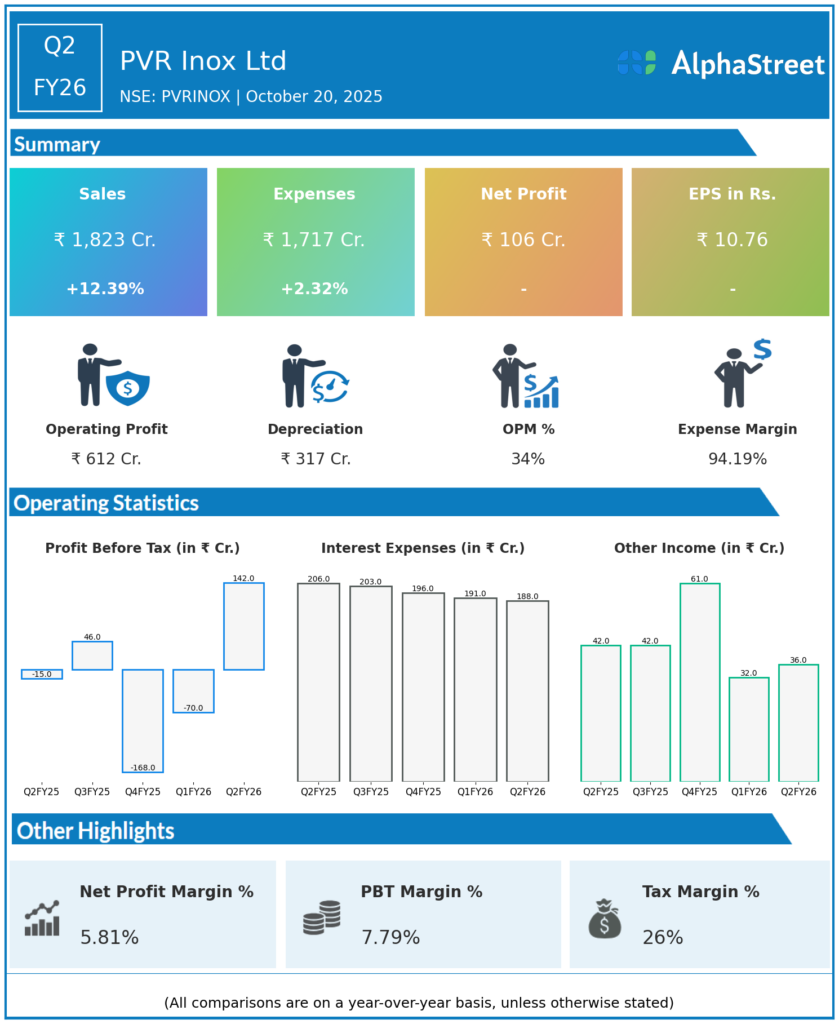

Consolidated Revenue: ₹1,823 crore, up 12.3% YoY from ₹1,622 crore in Q2 FY25 and a 24% increase QoQ over ₹1,469 crore in Q1 FY26.

-

Consolidated Net Profit (PAT): ₹106 crore, a turnaround from a loss of ₹12 crore in Q2 FY25 and a net loss of ₹54 crore in Q1 FY26, showing a strong profit recovery.

-

EBITDA: ₹612 crore, up 29.6% YoY from ₹479 crore, with EBITDA margin improving to 33.5% from 29.5% a year ago and 27% sequentially, reflecting better operational leverage and cost control.

-

Operating Profit before Depreciation, Interest, and Tax: ₹611.7 crore, margin at 33.55%.

-

Advertising Revenue: Grew 15% QoQ to highest levels since the pandemic, supporting F&B segment growth.

-

Segment Revenue:

-

Movie Exhibition: ₹1,800 crore, up from ₹1,579 crore YoY.

-

Movie Production and Distribution: Declined to ₹55 crore from ₹108 crore YoY.

-

-

Total Expenses: ₹1,717 crore, marginally higher than ₹1,679 crore last year due to inflation and content costs.

Operational Highlights

-

Box office and footfalls: Indian box office grew 15% YoY in H1 FY26, driven by a diverse slate of films across languages and scales rather than a few mega-blockbusters.

-

Notable films: 12 releases crossed ₹100 crore in Q2 alone, including big hits like Saiyaara (₹400 crore business) and Mahavatar Narsimha (₹300 crore approx.).

-

Initiatives: Value-driven offerings such as “Blockbuster Tuesdays” with ticket price cuts enhanced footfalls and consumer engagement.

-

New multiplex: Launched an all-laser 4-screen multiplex in Siliguri (931 seats), enhancing pan-India footprint.

-

Net Debt: ₹618.8 crore, reduced 57% YoY signaling deleveraging and improved balance sheet health.

Management Commentary

-

Ajay Bijli, Managing Director, stated:

“The first half of FY26 has been one of the strongest for Indian cinema in recent years, driven by quality content and diverse film releases. Our initiatives towards capital-light growth and innovation in multiplex experiences have helped enhance customer engagement and profitability.”. -

The company remains focused on consolidating market leadership, expanding advertising revenues, improving new content pipelines, and integrating technology for enhanced customer experience.

Q1 FY26 Earnings Results

-

Revenue: ₹1,469 crore.

-

Net Loss: ₹54 crore.

-

EBITDA: ₹479 crore; EBITDA margin at 27%

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.