PVR Limited (PVR) is India’s largest and most premium film exhibition company. It pioneered the multiplex revolution in India by establishing the first multiplex cinema in 1997 at New Delhi and continues to lead the market with relentless focus on innovation and operational excellence to democratise big‑screen movie experience. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

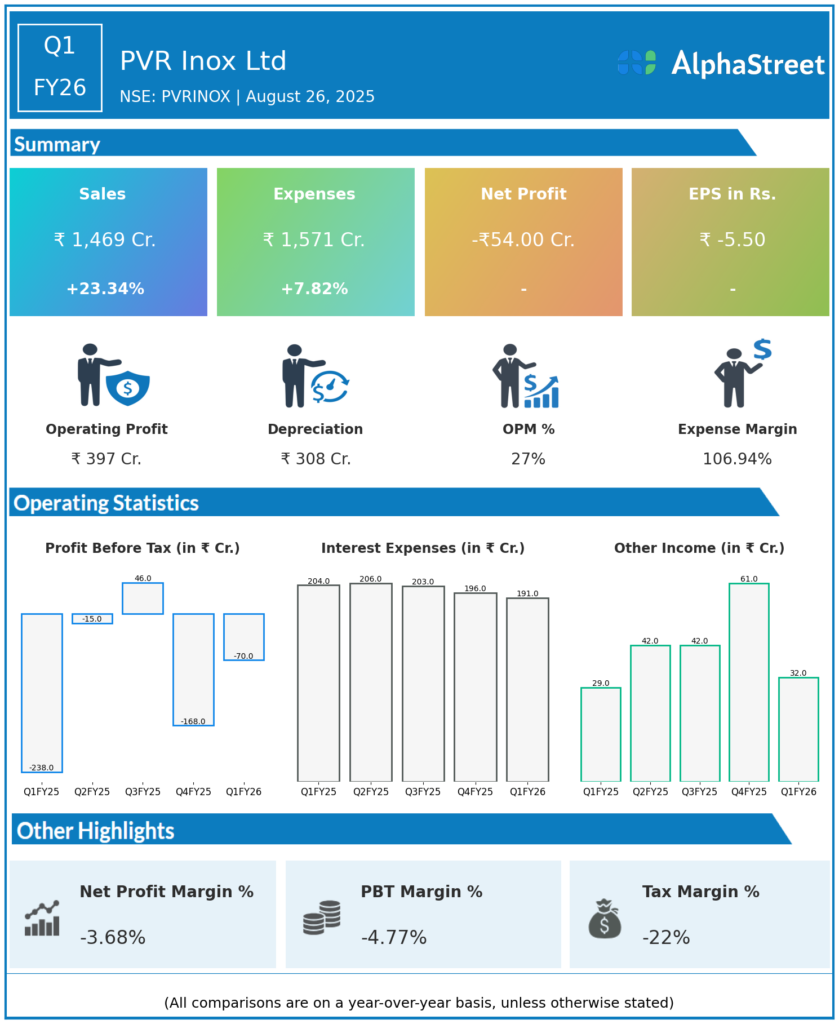

Revenue from Operations: ₹1,469 crores, up 23% year-on-year and 20% quarter-on-quarter, driven by strong box office and advertising recovery.

-

EBITDA: ₹114.1 crores, reflecting margin expansion due to operational efficiencies and higher footfalls.

-

Profit After Tax (PAT): ₹-54 crores (net loss), improving significantly from prior losses but still impacted by ongoing cost pressures and debt servicing.

-

Earnings Per Share (EPS): Negative ₹5.5 per share, improved from negative ₹12.7 in prior quarter.

-

Screen Count: Approximately 1,749 screens across 355 properties in India and Sri Lanka, confirming the largest multiplex footprint in the region.

-

Operating Metrics: Highest advertising revenue in past five quarters achieved in Q1 FY26, strengthening non-ticket income segments.

Management Commentary & Strategic Decisions

-

Management highlighted robust recovery in footfalls and in-movie advertising, contributing to top-line growth against a backdrop of easing COVID impacts.

-

Strategic emphasis on expanding premium offerings, enhancing customer experiences with tech integration, and strengthening F&B (Food & Beverage) margins.

-

Debt management remains a priority with focus on deleveraging through improved cash flows and asset monetization.

-

Expansion in tier 2 and tier 3 cities continues, cementing market leadership in multiplex entertainment.

-

Preservation of core brand values while driving innovation in loyalty and digital marketing noted as key growth drivers.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹1,250 crores.

-

EBITDA: ₹90 crores.

-

Profit After Tax (PAT): Net loss of ₹125 crores, showing ongoing efforts to recover profitability.

-

EPS: Negative ₹12.7 per share.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.