PTC India Limited was established in 1999 by the Government of India as a Public-Private Initiative and is in the power trading business. It is promoted by Power Grid Corporation of India Limited (PGCIL), NTPC Limited (NTPC), Power Finance Corporation Limited (PFC) and NHPC Limited (NHPC). Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

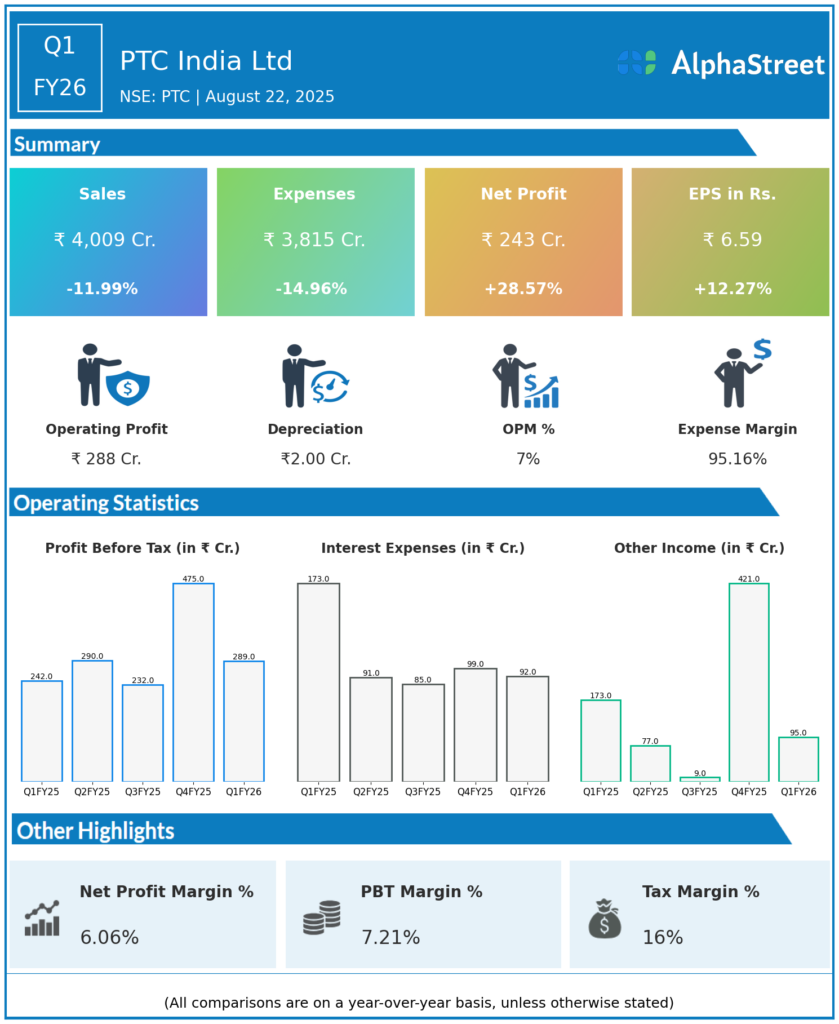

Total Income: ₹4,009 crores, up 37.1% QoQ from ₹2,924 crores in Q4 FY25; down 11.9% YoY from ₹4,687.82 crores in Q1 FY25.

-

Total Expenses: ₹3,815 crores, up 34.4% QoQ but down 14.9% YoY.

-

Profit Before Tax (PBT): ₹287.28 crores, up 120.3% QoQ from ₹130.39 crores; up 42.4% YoY from ₹201.68 crores.

-

Profit After Tax (PAT): ₹242.88 crores, down 34.6% QoQ from ₹372 crores; up 28.5% YoY from ₹189.44 crores.

-

Earnings Per Share (EPS): ₹6.59, down 44.5% QoQ from ₹11.8 and up 12.2% YoY from ₹5.87.

-

Standalone PAT: ₹140.96 crores, marginally lower by 2% YoY.

-

Trading Volume: 23,042 MU, up 13% YoY.

-

Core trading margin: 3.37 paise per unit.

-

Consulting income: ₹9.88 crores.

-

Total comprehensive income: ₹242.95 crores.

Management Commentary & Strategic Decisions

-

Chairman & MD Dr. Manoj Kumar Jhawar reported that a strong mix of trades across tenures contributed to the 13% growth in trading volume; short-term contracts contributed 60%, with the balance from medium- and long-term contracts.

-

Management remains optimistic about power demand, closely tied to India’s GDP growth trajectory.

-

The company is leveraging recent CERC regulatory changes (VPPAs, market coupling, first amendment of power market regulations) to launch new products and services for clients.

-

Emphasis is on project-based revenue growth, rising consulting income, and investment in digital, market-oriented solutions.

-

Strategic focus is on diversifying contract tenures, enhancing trading operations, and expanding solution consulting in the power sector.

Q4 FY25 Earnings Results

-

Total Income: ₹3,510.02 crores.

-

Revenue from Operations: ₹2,924 crores, down 16.6% on the YoY basis.

-

Profit Before Tax (PBT): ₹130.39 crores.

-

Profit After Tax (PAT): ₹372 crores (excluding exceptional item); consolidated PAT up 308% YoY to ₹371.87 crores due to a one-time exceptional gain from divestment of PTC Energy Ltd stake.

-

EPS: ₹11.88 vs ₹2.91 during the same quarter, last year.

-

Standalone PAT: ₹521.38 crores, up 529% YoY, boosted by exceptional item.

-

Dividend: Final dividend of ₹6.70 per share proposed for FY25.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.