PTC India Financial Services Limited (PFS) is a NBFC registered with RBI which holds the status of Infrastructure Finance Company. It provides equity/debt financing solutions to the energy value chain. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

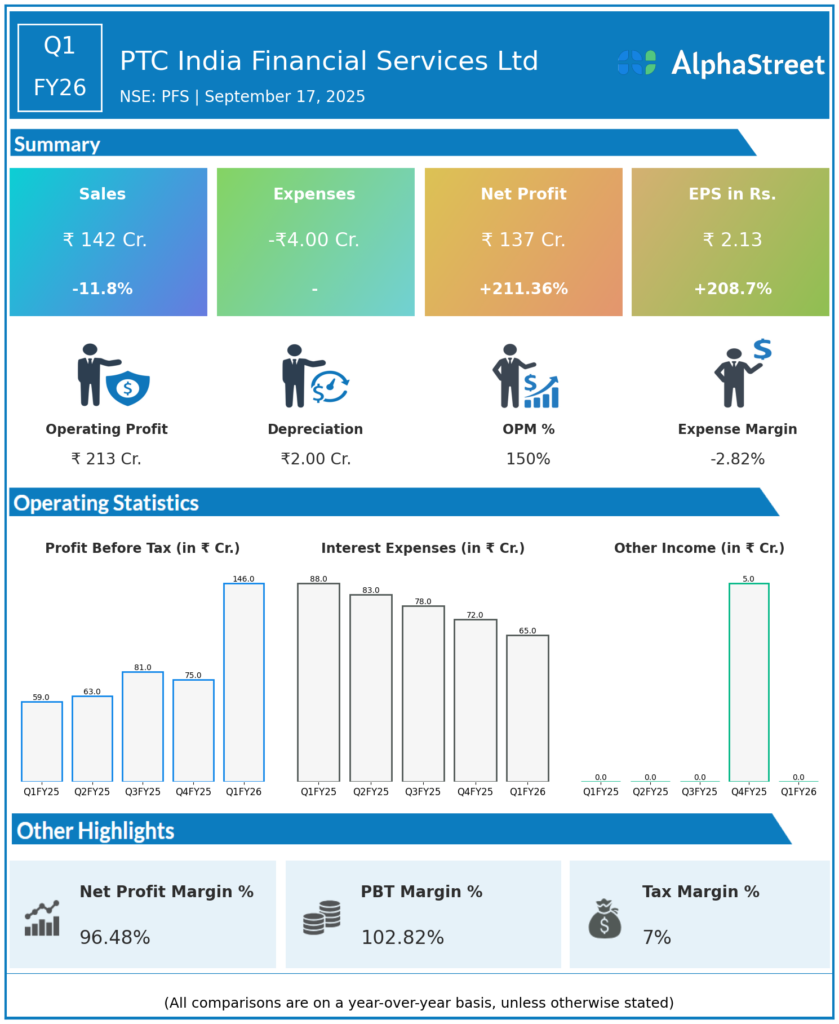

Total Income: ₹142.24 crores, down 19.6% QoQ (Q4 FY25: ₹176.92 crores) and down 11.8% YoY (Q1 FY25: ₹161.23 crores).

-

Total Expenses: ₹77.52 crores, down 26.2% QoQ and 20.2% YoY.

-

Profit Before Tax (PBT): ₹146.31 crores, up 659.3% QoQ (Q4 FY25: ₹19.27 crores) and up 146.6% YoY (Q1 FY25: ₹59.34 crores).

-

Profit After Tax (PAT): ₹136.63 crores, up 886.5% QoQ (Q4 FY25: ₹13.85 crores) and up 211% YoY (Q1 FY25: ₹44.40 crores).

-

Earnings Per Share (EPS): ₹2.13, up 950% QoQ (Q4 FY25: ₹0.20) and up 209% YoY (Q1 FY25: ₹0.70).

-

Profit Margin: 86%, up from 65% in Q1 FY25.

-

Tax Expense: ₹9.68 crores, up 78.6% QoQ but down 35.2% YoY.

Key Management Commentary & Strategic Highlights

-

Management highlighted exceptional profitability performance with substantial improvements in PAT and EPS, driven by effective expense management despite revenue decline.

-

The company’s ability to reduce total expenses by over 26% QoQ while maintaining operational efficiency contributed significantly to the profit surge.

-

As a subsidiary of PTC India Ltd and a specialized NBFC focusing on energy sector financing, the company continues to support renewable energy and power infrastructure projects.

-

Strategic focus remains on leveraging expertise in energy value chain financing, particularly in the expanding renewable energy sector.

-

The remarkable turnaround in profitability reflects improved operational discipline and better cost management practices.

Q4 FY25 Earnings Results

-

Total Income: ₹176.92 crores.

-

Total Expenses: ₹105.06 crores.

-

Profit Before Tax (PBT): ₹19.27 crores.

-

Profit After Tax (PAT): ₹13.85 crores.

-

EPS: ₹0.20.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.