PTC India Ltd. has a positive outlook for the future. The company is well-positioned to benefit from the growth in the power sector in India. The government’s focus on renewable energy and the push towards electric mobility are expected to drive demand for power in the coming years. PTC India Ltd. has a strong presence in the renewable energy segment and is well-equipped to capitalize on the growth opportunities in this segment. The company has also diversified its business by entering into the business of power project management and consultancy services related to the power sector.

| Stock Data | |

| Ticker | PTC |

| Exchange | NSE |

| Industry | POWER |

| Price Performance | |

| Last 5 Days | +0.16% |

| YTD | +8.76% |

| Last 12 Months | -3.19% |

*As of 24.04.2023

Company Description:

PTC India Ltd. is a leading power trading company in India. It was incorporated in 1999 as a government-owned company, and later became a public limited company in 2007. The company is engaged in the business of power trading, power procurement, power project management, and consultancy services related to the power sector. In this research report, we will analyze the financial and operational performance of PTC India Ltd. and its future prospects.

In conclusion, PTC India Ltd. has shown consistent growth in revenue and profit over the last five years. The company has a strong presence in the power trading market in India and is well-positioned to benefit from the growth in the power sector. PTC India Ltd.’s diversification into the business of power project management and consultancy services related to the power sector is expected to provide further growth opportunities for the company. Overall, PTC India Ltd. is a promising company with a positive outlook for the future.

Key Strengths:

- Strong Market Position: PTC India Ltd. has a strong market position in the power trading segment in India. The company has established relationships with various stakeholders in the power sector, including power generators, transmission companies, and distribution companies.

- Diversified Business Model: PTC India Ltd. has diversified its business by entering into the business of power project management and consultancy services related to the power sector. This has helped the company to generate additional revenue streams and reduce its dependence on power trading.

- Focus on Renewable Energy: PTC India Ltd. has a strong focus on renewable energy. The company has a dedicated Renewable Energy Division and is actively involved in the development of renewable energy projects in India. This has helped the company to capitalize on the growth opportunities in the renewable energy segment.

- Strong Financials: PTC India Ltd. has shown consistent growth in revenue and profit over the last five years. The company has a strong balance sheet and a low debt-to-equity ratio, which provides it with the financial flexibility to pursue growth opportunities.

- Experienced Management: PTC India Ltd. has a well-qualified and experienced management team. The company’s management has a deep understanding of the power sector in India and has a track record of delivering strong financial and operational performance.

Key Opportunities:

- Growth in the Renewable Energy Sector: The Indian government has set a target of achieving 450 GW of renewable energy capacity by 2030. PTC India Ltd., with its strong focus on renewable energy, is well-positioned to capitalize on this growth opportunity.

- Expansion of Power Trading Activities: PTC India Ltd. can expand its power trading activities to new markets within India and also explore opportunities in the international market. This will help the company to further diversify its revenue streams and increase its market share.

- Participation in Power Projects: PTC India Ltd. can participate in power projects as a developer or an investor. This will help the company to generate additional revenue streams and also provide it with greater control over the supply of power.

- Collaboration with International Partners: PTC India Ltd. can collaborate with international partners to bring new technologies and best practices to the Indian power sector. This will help the company to enhance its capabilities and improve its competitiveness.

- Development of Ancillary Services: PTC India Ltd. can develop ancillary services such as energy storage and demand response to provide additional value to its customers. This will help the company to diversify its business and also provide it with a competitive advantage.

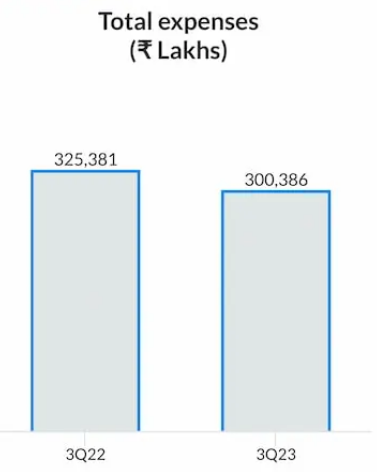

Financial Results:

PTC India Ltd.’s revenue in Q3FY23 fell 6% to ₹ 3,13,885 lakhs. Consolidated Profit After Tax came at ₹ 10,448 lakhs in Q3FY23 showcasing a 66% rise on an YoY basis. In this quarter’s results, the reports suggested that the firm has continued to deliver consistent performance in all key operational and financial indicators in Q3Y23.