PTC India Financial Services Limited (NSE: PFS) reported a sharp decline in profitability for the third quarter of fiscal year 2026, as interest income contracted and overall revenue trends weakened. The infrastructure finance firm’s quarterly results highlight ongoing operational challenges.

Quarterly Financial Results

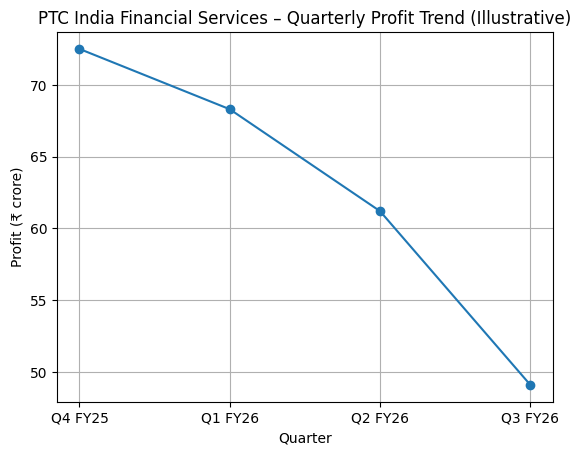

PTC India Financial Services posted net profit of ₹49.09 crore for the quarter ended December 31, 2025, down from ₹67.14 crore in the year-ago period, a decline of about 27%. Total income for the quarter stood at ₹125.04 crore, compared with ₹158.12 crore in Q3 FY25, primarily due to lower interest income. Interest income dropped to ₹110.06 crore from ₹156.70 crore in the previous year’s corresponding quarter. Basic and diluted earnings per share were reported at ₹0.76, down from ₹1.05 a year ago.

Revenue from operations on a standalone basis was ₹121.74 crore, marking a 7.7% sequential decline from the preceding quarter and a 23% year-on-year reduction. The PAT margin contracted significantly from prior periods, reflecting pressure on core earnings.

Operational Update

The results underscore persistent moderation in loan disbursements and interest income, the principal drivers of revenue for the NBFC. Sequential contraction in net sales for the seventh consecutive quarter signals subdued credit activity and demand among infrastructure finance clients. Operating metrics indicate a squeeze on profitability as funding costs remain difficult to cut in line with decreasing yields.

Borrowing costs, including finance expenses, showed limited movement, constraining the company’s ability to restore margins despite softer interest outlays. The company’s net interest margin and cost-to-income indicators will be closely watched in ensuing quarters.

Outlook

Analysts tracking the sector note that ongoing declines in revenue and interest income may complicate near-term growth prospects for the NBFC. The broader credit environment for infrastructure finance remains cautious amid macroeconomic uncertainty, and interest rate dynamics could influence profitability in future quarters. For the nine months ended December 31, 2025, PTC India Financial Services’ cumulative revenue was ₹399.14 crore, down from ₹482.76 crore in the prior year period, while net income for the nine months rose to ₹273.86 crore from ₹158.89 crore a year earlier. This mixed performance suggests uneven momentum across reporting periods.