PSP Projects Limited (NSE: PSPPROJECT), an India-based construction and engineering firm, saw its stock trade slightly lower on January 30, 2026, following the release of its third-quarter financial results for the period ended December 31, 2025. The company reported an increase in quarterly revenue and profit, though cumulative nine-month profit declined compared with the prior year.

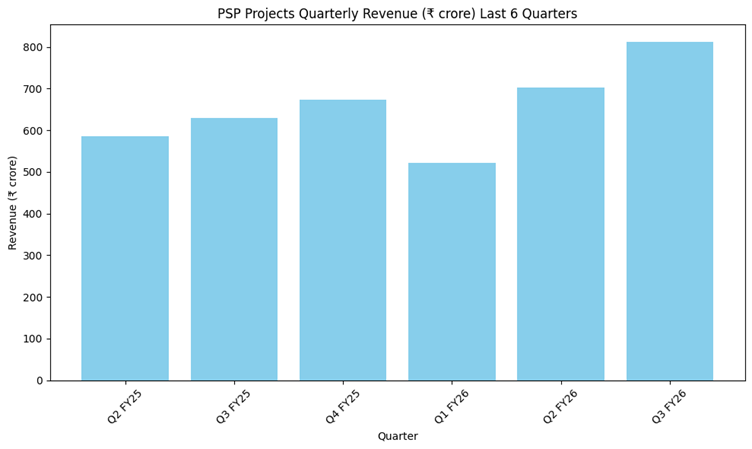

PSP Projects reported standalone revenue from operations of ₹771.22 crore in Q3 FY26, representing a 24% year-on-year increase and an 11% rise sequentially from the June quarter. Revenue growth was driven by higher project execution across segments.

On a consolidated basis, revenues also reflected growth over the corresponding quarter in the previous fiscal year. Profit after tax on a standalone basis increased during the quarter, contributing to overall quarterly earnings growth. Consolidated profit showed a significant year-on-year increase in Q3, supported by operating performance and cost management.

However, consolidated net profit declined compared with the same period a year earlier. While nine-month revenue expanded moderately on a year-on-year basis, the cumulative profit contraction reflected higher expenses and margin pressures across operations.

Order Book and Operations

PSP Projects reported a larger outstanding order book as of December 31, 2025, compared with the previous year. The total order book was ₹9,178 crore, reflecting an increase in secured work and project pipeline. Order inflows for the nine-month period rose significantly relative to the same period in the prior fiscal year, indicating continued demand for the company’s services across construction segments.

The company completed several projects during Q3 FY26, including infrastructure development works and components of institutional and industrial construction. Enhanced execution activity supported revenue recognition in the quarter and contributed to backlog conversion.

Operating Performance

PSP Projects’ EBITDA in Q3 FY26 stood at ₹51.91 crore, up from the year-ago quarter, with an EBITDA margin around 6.7% on revenue. Operating costs, including materials, construction expenses, and employee benefit costs, rose in absolute terms but remained in line with higher revenue.

The quarterly profit before tax increased compared with Q3 FY25, supported by higher revenue and moderate control of finance costs. Depreciation and other comprehensive costs were recorded as part of the earnings profile for the period.

Balance Sheet and Cash Flow

Data disclosed in the investor presentation highlighted the company’s financial position, including working capital deployment and order book funding. PSP Projects completed a qualified institutional placement (QIP) in the prior year to reduce outstanding borrowings, which was reflected in the balance sheet management disclosures.

Guidance and Outlook

While the company did not disclose specific future guidance in the earnings presentation, management noted continued focus on project execution and securing new orders. The expanded order book and recent contract wins provide visibility on revenue prospects, according to official disclosures.

Industry Context

PSP Projects operates in India’s construction and infrastructure segment, where order inflows and execution rates vary with public and private sector spending. The company’s order book growth aligns with broader industry activity in infrastructure development and urban project execution.

The company’s quarterly results show a mix of growth in current period revenue and profitability, offset by weaker cumulative profit performance over the nine-month period.