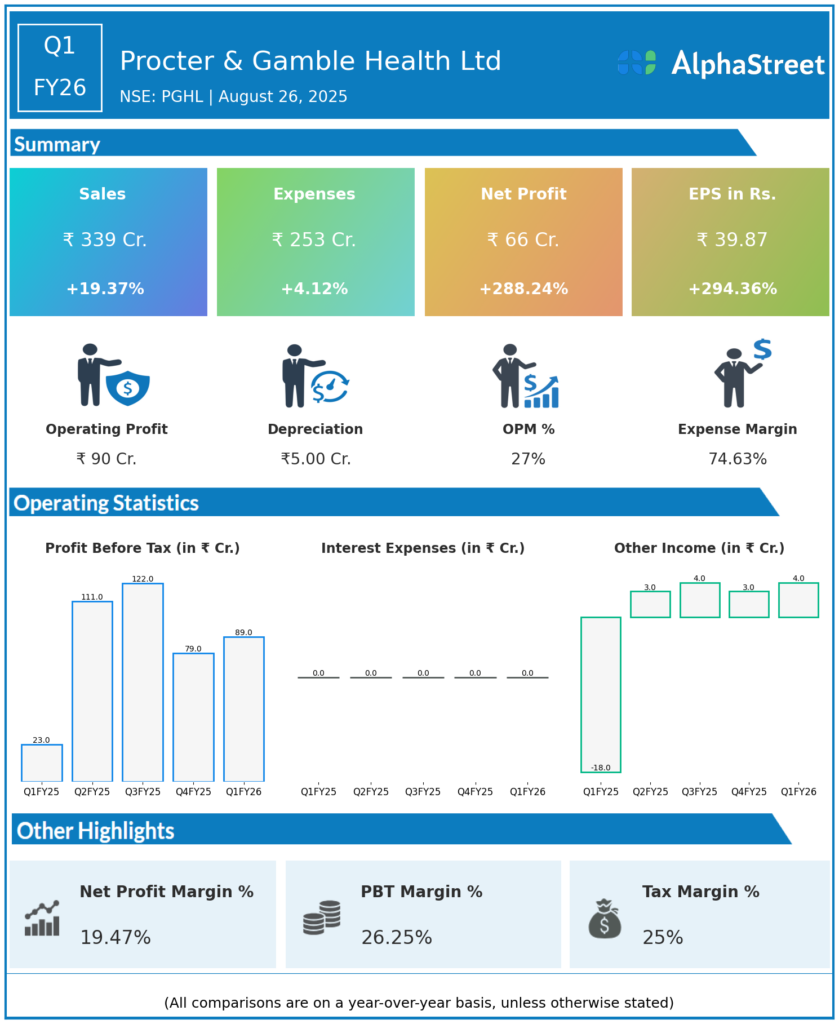

P&G Health Ltd (formerly Procter & Gamble td) (erstwhile Merck Limited) is engaged in the business of manufacturing and marketing of pharmaceuticals and chemicals. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹338.74 crores, up 19.3% YoY (Q1 FY25: ₹283.88 crores) and up 9% QoQ (Q4 FY25: ₹310.99 crores).

-

Total Income: ₹342.77 crores, up 19.8% YoY (Q1 FY25: ₹286.01 crores), up 9.1% QoQ (Q4 FY25: ₹314.10 crores).

-

Total Expenses: ₹253.84 crores, up 7.8% YoY (Q1 FY25: ₹235.44 crores), up 7.8% QoQ (Q4 FY25: ₹235.44 crores).

-

EBIT: ₹88.93 crores, up 289% YoY from ₹22.83 crores.

-

Profit Before Tax (PBT): ₹88.81 crores, up 289% YoY (Q1 FY25: ₹22.83 crores).

-

Profit After Tax (PAT): ₹66.18 crores, up 288% YoY (Q1 FY25: ₹16.78 crores), up 8% QoQ (Q4 FY25: ₹61.18 crores).

-

Net Profit Margin: 19.3% (Q1 FY25: 5.9%).

-

EPS: ₹39.87, up from ₹10.11 in Q1 FY25 and ₹36.86 in Q4 FY25.

-

EBIT Margin: 25.94% (Q1 FY25: 8.05%).

-

Cash Position: Strong, with broad-based performance in domestic and export business.

Management Commentary & Strategic Decisions

-

MD Milind Thatte cited momentum and strong start to FY26, driven by superior brand building, market initiatives, and improved supply chain capabilities.

-

Strategy focused on a portfolio of highly recommended health brands (Neurobion, Livogen, SevenSeas, Evion, Polybion, Nasivion), performance-driven brand choice, and constructive disruption.

-

Company highlighted disciplined cost management, operational efficiencies, and meaningful innovation to achieve balanced and sustainable growth.

-

Continued engagement with consumers and healthcare professionals through innovation backed by science and community initiatives remains a priority.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹310.99 crores.

-

Total Income: ₹314.10 crores.

-

Total Expenses: ₹230 crores.

-

PAT: ₹61.18 crores.

-

EPS: ₹36.86.

-

Net Profit Margin: 19.5%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.