Incorporated in 1985, Privi Speciality Chemicals Ltd (Formerly known as Privi Speciality Ltd.) is primarily engaged in the manufacturing, supply and exports of aroma and fragrance chemicals used in soaps, detergents, shampoos, and other fine fragrances. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

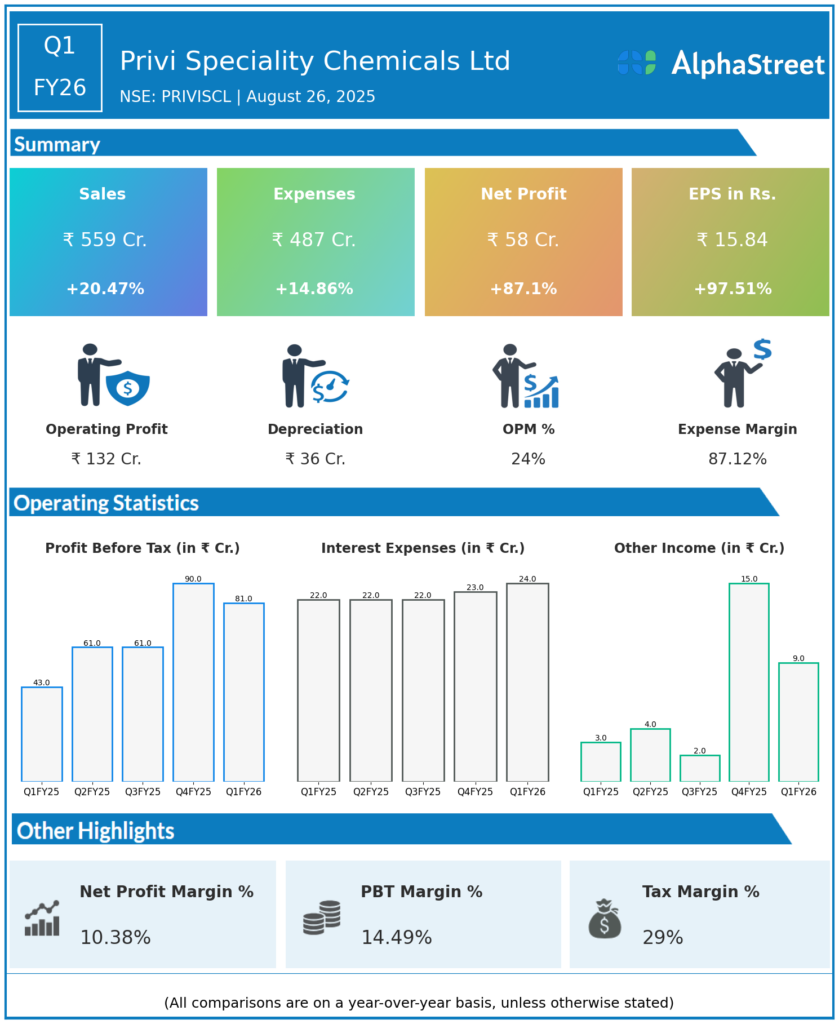

Consolidated Revenue from Operations: ₹558.8 crores, up 20.4% YoY (Q1 FY25: ₹464.0 crores) and up 12.6% QoQ (Q4 FY25: ₹497.2 crores).

-

Total Income: ₹567.8 crores, up 21.7% YoY (Q1 FY25: ₹466.7 crores), up 15.4% QoQ (Q4 FY25: ₹491.9 crores).

-

Total Expenses: ₹486.6 crores, up 14.8% YoY (Q1 FY25: ₹423.8 crores), up 8.6% QoQ (Q4 FY25: ₹448.0 crores).

-

EBITDA: ₹141.1 crores, up 45% YoY, margin expands to 24.8% (+400 bps).

-

Profit Before Tax (PBT): ₹81.2 crores, up 89% YoY (Q1 FY25: ₹42.9 crores), up 84.7% QoQ (Q4 FY25: ₹44.0 crores).

-

Profit After Tax (PAT): ₹57.6 crores, up 87% YoY (Q1 FY25: ₹31.5 crores), up 80.6% QoQ.

-

EPS: ₹15.84, up 97.5% YoY (Q1 FY25: ₹8.10), up 92.7% QoQ.

-

PAT Margin: 10.1%, improved from 6.7% last year.

-

ROE (Q1): 19.6% (up 670 bps YoY); ROCE: 18.2% (up 500 bps YoY).

-

About 70% of business is contracted for FY26, giving strong demand visibility.

Management Commentary & Strategic Decisions

-

Management reaffirmed 20% annual growth guidance, with a goal of ₹5,000 crores revenue and ₹1,000 crores EBITDA in 3–5 years.

-

Margin expansion reflects robust demand, productivity improvements, and favorable product mix adjustment in both domestic and export markets.

-

Significant capacity expansion and debottlenecking to finish by March 2026.

-

Ongoing merger of Privi Fine Science and Privi Biotechnology subsidiaries for operational simplification and efficiency.

-

Privi earned a Platinum EcoVadis ESG rating, among world’s top 1% chemical companies for sustainability.

-

Management sees stable demand for aroma chemicals and growing export/India consumption in FMCG, personal care, and household segments.

Q4 FY25 Earnings Results

-

Consolidated Revenue from Operations: ₹614 crores.

-

Total Income: ₹481.9 crores.

-

Total Expenses: ₹481 crores.

-

EBITDA: ₹97.1 crores, margin 19.5%.

-

Profit Before Tax (PBT): ₹44.0 crores.

-

Profit After Tax (PAT): ₹64 crores.

-

EPS: ₹17.01.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.