Prism Johnson Limited was incorporated in 1992 and is amongst the largest integrated building materials companies in India, with a wide range of products, namely cement, ready-mixed concrete, tiles, sanitaryware and bath fittings.

Q2 FY26 Earnings Results

-

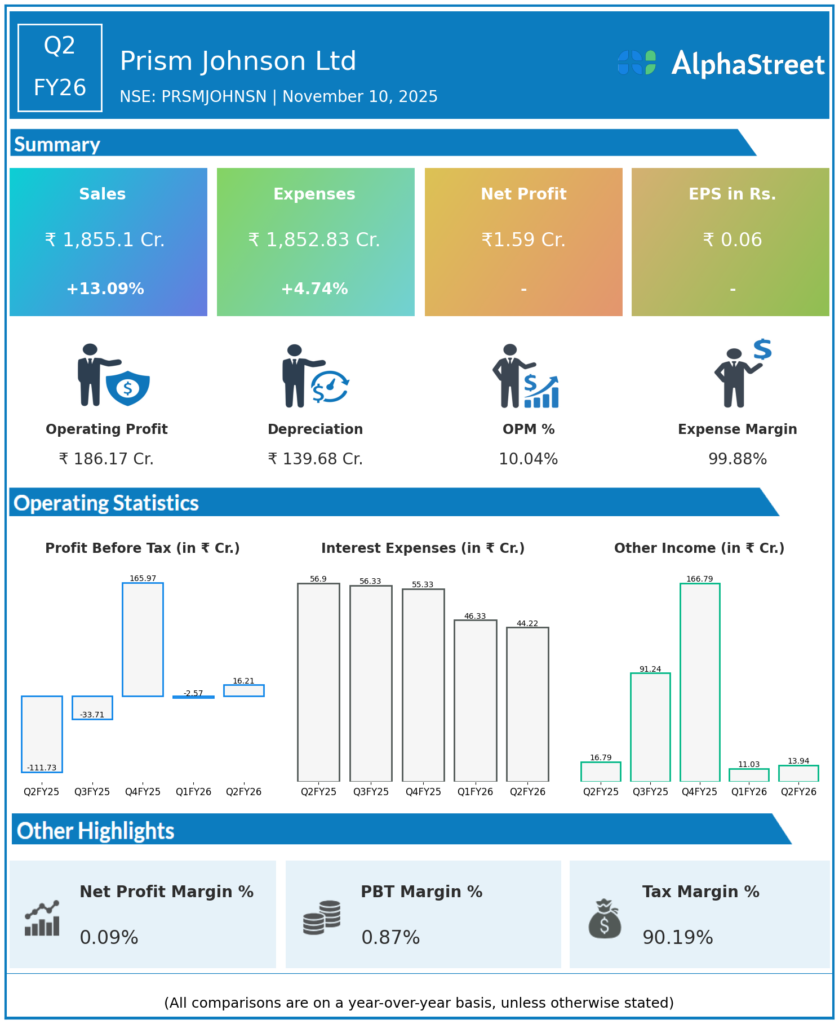

Revenue from Operations: ₹1,855 crore, up 13% YoY from ₹1,763.15 crore in Q2 FY25, but down 8.59% QoQ from ₹2,102.33 crore in Q1 FY26.

-

Operating Profit (PBDIT excluding other income): ₹168.41 crore, operating margin of 8.89% (up from 7.57% in Q2 FY25 but below 9.04% in Q1 FY26).

-

Net Profit (PAT): Net loss of ₹1.59 crore, compared to a loss of ₹78 crore in Q2 FY25 and a profit of ₹2.54 crore in Q1 FY26.

-

EBITDA increased sharply to ₹178 crore from ₹43 crore in Q2 FY25, with margin expansion from 2.8% to 10.4%.

-

Depreciation rose to ₹135.68 crore from ₹111.57 crore YoY, impacting profitability.

-

Interest cost stood at ₹46.33 crore.

-

Employee costs increased 9.41% YoY to ₹173.94 crore.

-

Gross profit margin improved to 6.85% from 5.24% YoY.

Management Commentary & Strategic Insights

-

Prism Johnson has made a significant turnaround from a ₹78 crore loss in Q2 FY25 to a net profit turnaround of ₹18 crore in the latest quarter.

-

The company has controlled operating costs and implemented efficiency improvements to support margin expansion.

-

Management remains cautious due to persistent high fixed costs, including depreciation and interest, which compress cash generation.

-

Focus is on operational performance improvement, cost optimization, and addressing capital efficiency challenges.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹2,102.33 crore

-

Net Profit (PAT): ₹2.54 crore, significant sequential decline due to higher costs.

-

Operating margin steady but under pressure nonetheless reflecting industry seasonality and cost dynamics.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.