Prism Johnson Limited was incorporated in 1992 and is amongst the largest integrated building materials companies in India, with a wide range of products, namely cement, ready-mixed concrete, tiles, sanitaryware and bath fittings. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

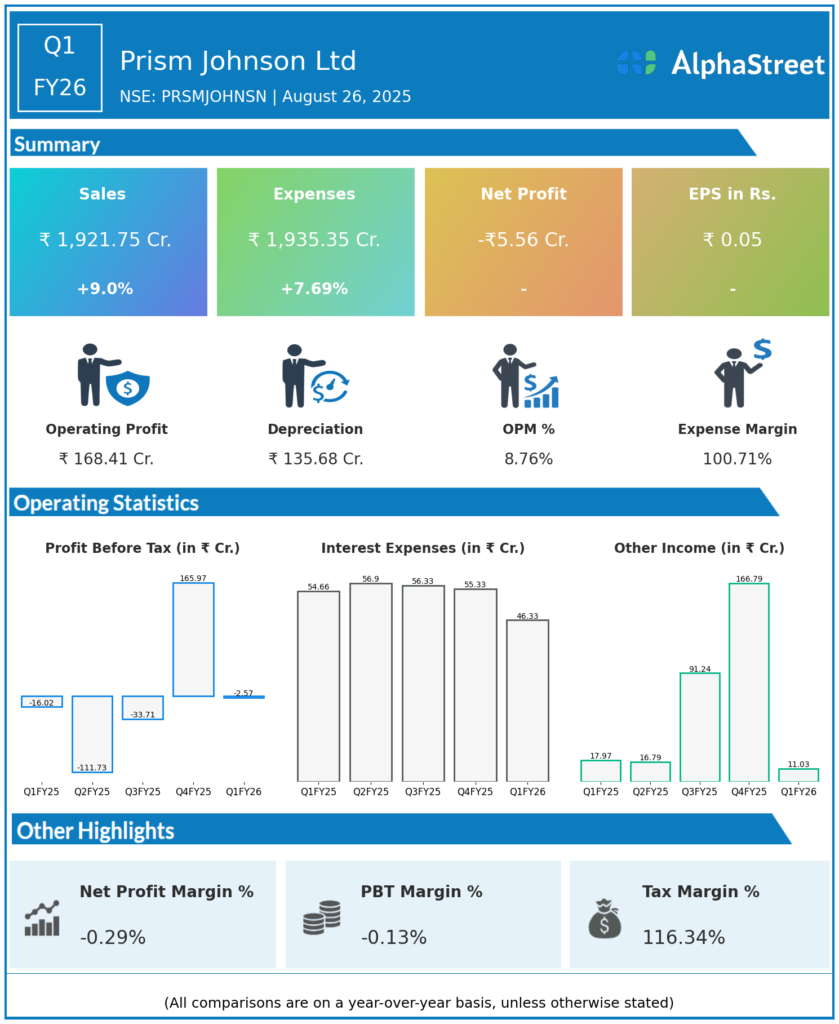

Consolidated Revenue from Operations: ₹1,921.75 crores, exhibiting modest growth with challenges in sales mix and volume.

-

Standalone Revenue: ₹1,235 crores, a slight decline due to subdued demand in cement and building materials segments.

-

Profit Before Tax (PBT): ₹18 crores, marginal improvement YoY but constrained by high interest and depreciation costs.

-

Profit After Tax (PAT): -₹2.57 crores, showing slight positive margin despite operational challenges.

-

Earnings Per Share (EPS): ₹0.05.

-

Operating Profit Margin (OPM): Approximately 6%, relatively stable but under pressure from rising costs.

-

Debt-to-Equity Ratio: About 1.02, indicating moderate leverage.

-

Return on Equity (ROE): Negative at -4%, impacted by weak profitability.

-

Segments: Cement, ready-mixed concrete, tiles, sanitaryware, and bath fittings; steady focus on product diversification.

Management Commentary & Strategic Decisions

-

Company emphasizes strengthening integrated building materials portfolio, with ongoing investments in capacity and innovation.

-

Focus on improving cost efficiencies and market penetration in specific geographies to counter pricing pressure.

-

Management is cautious about near-term sales growth but optimistic on long-term prospects driven by infrastructure demand and urbanization.

-

The company has not declared dividend recently, prioritizing cash conservation for operations and debt servicing.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹2,102 crores approximately.

-

Profit Before Tax (PBT): ₹18 crores.

-

Profit After Tax (PAT): ₹121 crores.

-

EPS: Approximately ₹2.57.

-

Operating Profit Margins: Around 6%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.