Power Grid Corporation of India Limited is a Maharatna CPSU and India’s largest electric power transmission company. GoI holds a 51.34% stake in the company as on March 31, 2021. PGCIL was incorporated in 1989 to set up extra-high voltage alternating current and high-voltage direct current (HVDC) transmission lines.

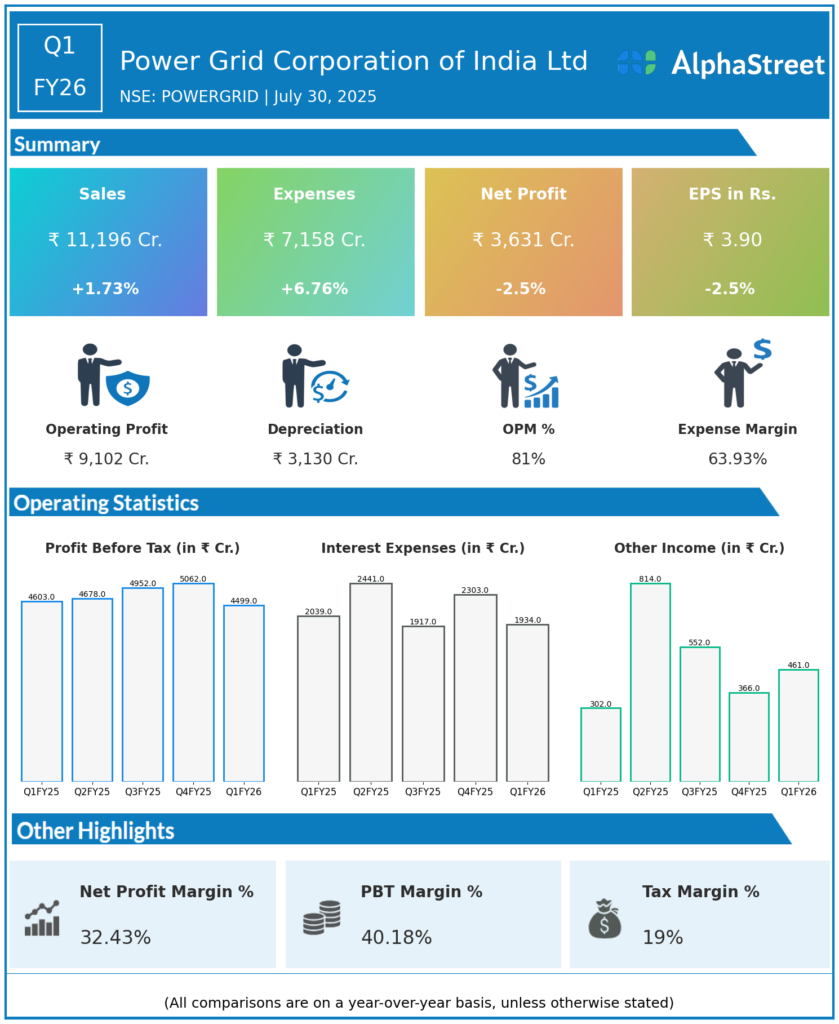

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Total Income: ₹11,196 crore, a slight increase compared to ₹10,850 crore in Q1 FY25 (+1.73% approx).

-

Revenue from Operations: ₹11,196 crore, up about 1.7% YoY.

-

Net Profit (PAT): ₹3,631 crore, down 2.5% YoY from ₹3,724 crore in Q1 FY25.

-

EBITDA: Approximately ₹6,682 crore, with an EBITDA margin near 87%.

-

Finance Costs: ₹1,934 crore, marginally lower than the previous year.

-

Tax Expense: ₹868 crore, slightly down YoY.

-

Segments: Transmission revenue was stable, consultancy and telecom segments showed strong growth (consultancy +42.8% YoY, telecom +17.7% YoY).

-

Earnings Per Share (EPS): Not separately disclosed.

Key Management Commentary & Strategic Highlights

-

Management highlighted steady asset performance and a robust project pipeline in transmission infrastructure.

-

The Board approved increasing borrowing limits to ₹25,000 crore for FY25-26 and plans to raise ₹30,000 crore for FY26-27.

-

Power Grid is actively participating in tariff-based competitive bidding projects to expand transmission capacity.

-

A joint venture with Nepal Electricity Authority is underway to enhance cross-border transmission connectivity.

-

The company remains optimistic about long-term growth driven by India’s increasing electricity demand and government initiatives for renewable energy integration.

-

Despite a slight dip in profit, operational margins and revenue growth remain stable given the regulated business model.

-

There is a focus on non-transmission businesses like consultancy and telecom to diversify revenue.

-

The outlook retains confidence in demand recovery as power consumption grows and new capacity is added.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Total Income: Around ₹11,279 crore, showing moderate growth.

-

Net Profit (PAT): ₹3,724 crore, steady with previous periods.

-

Growth supported by continued capitalisation of transmission assets and operational efficiencies.

-

Margins remained robust, supported by stable transmission revenue.

-

Continued focus on cost control and execution excellence noted by management.