Pondy Oxides & Chemicals Ltd. (POCL) has strategically positioned itself for robust growth, evidenced by its recent acquisition of 123 acres of industrial land in Mundra, Gujarat. This acquisition, valued at INR 41.40 crore, is set to bolster POCL’s presence in the western region of India and expand its global export capabilities, leveraging the proximity to the port and the region’s industrial development.

In line with its expansion strategy, POCL is increasing its lead production capacity from 1,32,000 metric tonnes to 2,04,000 metric tonnes annually. This expansion will occur in two phases, with the first phase focusing on increasing capacity by 36,000 metric tonnes at the Thervoykandigai Unit in Tamil Nadu. The state-of-the-art plant, expected to be operational by Q3 2024-25, will feature advanced automation and low carbon footprint technologies, aligning with POCL’s commitment to sustainable manufacturing practices and ESG implementation.

To finance this expansion, POCL completed a preferential issue and allotment of equity shares and warrants, raising INR 132.50 crore. The initial receipt of INR 70.60 crore will fund the first phase of the expansion, with the remaining funds anticipated within 18 months from February 28, 2024. Additionally, POCL plans to establish R&D facilities to develop value-added products, enhancing its top and bottom lines.

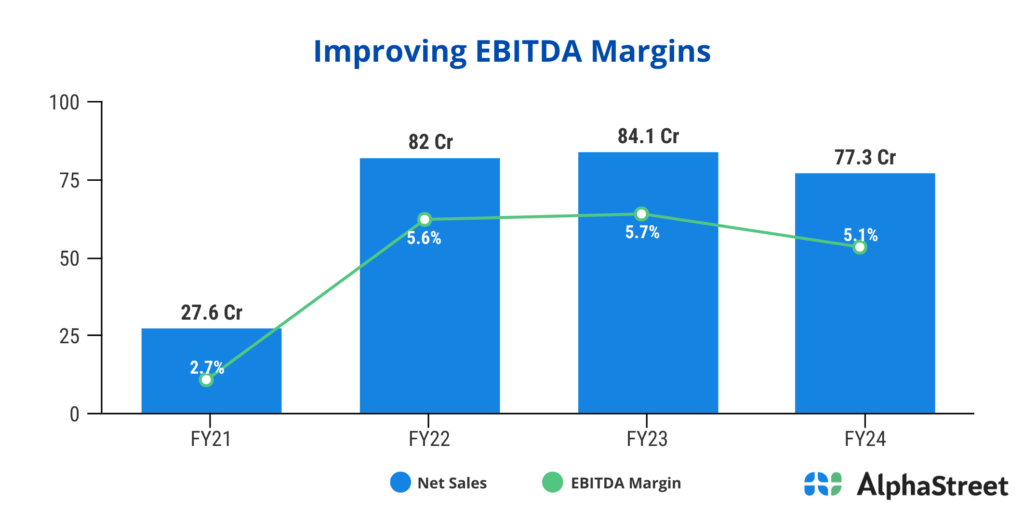

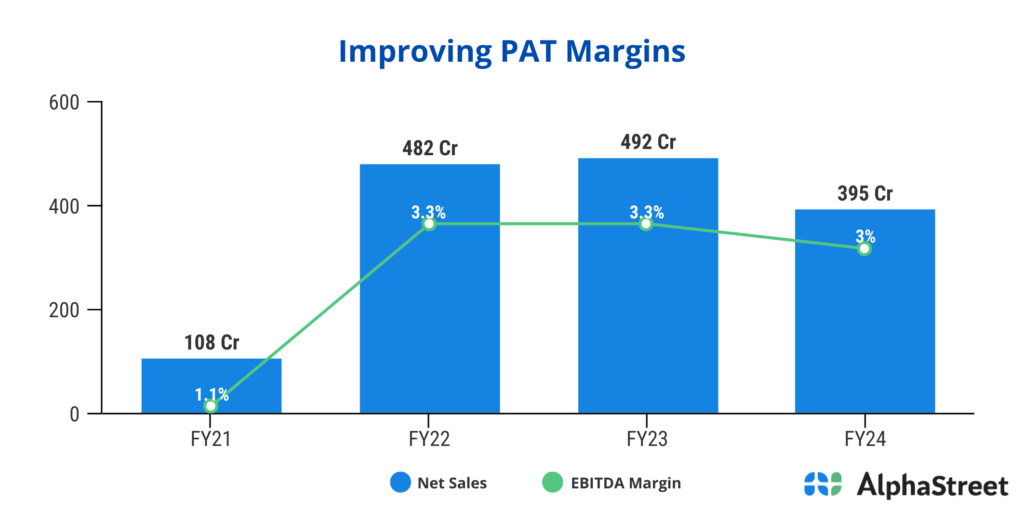

Operationally, POCL reported a 25% increase in smelting capacity utilization in FY ’24, from 34,000 metric tonnes to 42,500 metric tonnes. The company also maintained a stable sales mix, with 40% domestic and 60% export sales. The Lead Division’s margins remained steady at 6.3%, despite a slight overall drop in EBITDA and PAT margins due to increased finance costs.

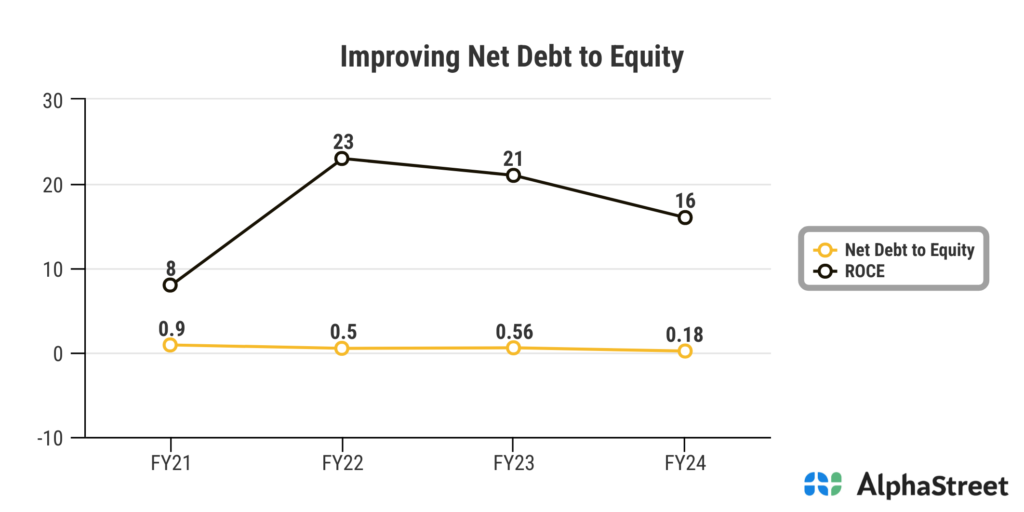

Financially, POCL’s revenue from operations rose by 4% to INR 1,524 crore, with consolidated revenues reaching INR 1,541 crore. The company significantly reduced its consolidated net debt by 52% to INR 71 crore, improving its net debt to equity ratio to 0.2.

With a positive cash flow from operations of INR 64.31 crore and improved working capital days, POCL demonstrates a strong financial position.

The Board’s recommendation of a 50% dividend for FY ’24 underscores POCL’s commitment to shareholder value. As the company continues to expand and innovate, it is well-positioned to capitalize on future market opportunities and enhance its operational and financial performance.

POCL will be declaring its Q1FY25 results on 22 July 2024. Post this, its conference call will be held on 24 July 2024 at 3:00 PM. Please click on this link to register.