The Co’s primary activities include supporting government borrowing program via underwriting of government securities issuances and trading in a gamut of fixed income instruments such as Government securities, Treasury Bills, State Development Loans, Corporate Bonds, Interest Rate Swaps and various money market instruments such as Certificates of Deposits, Commercial Papers etc.

Financial Results:

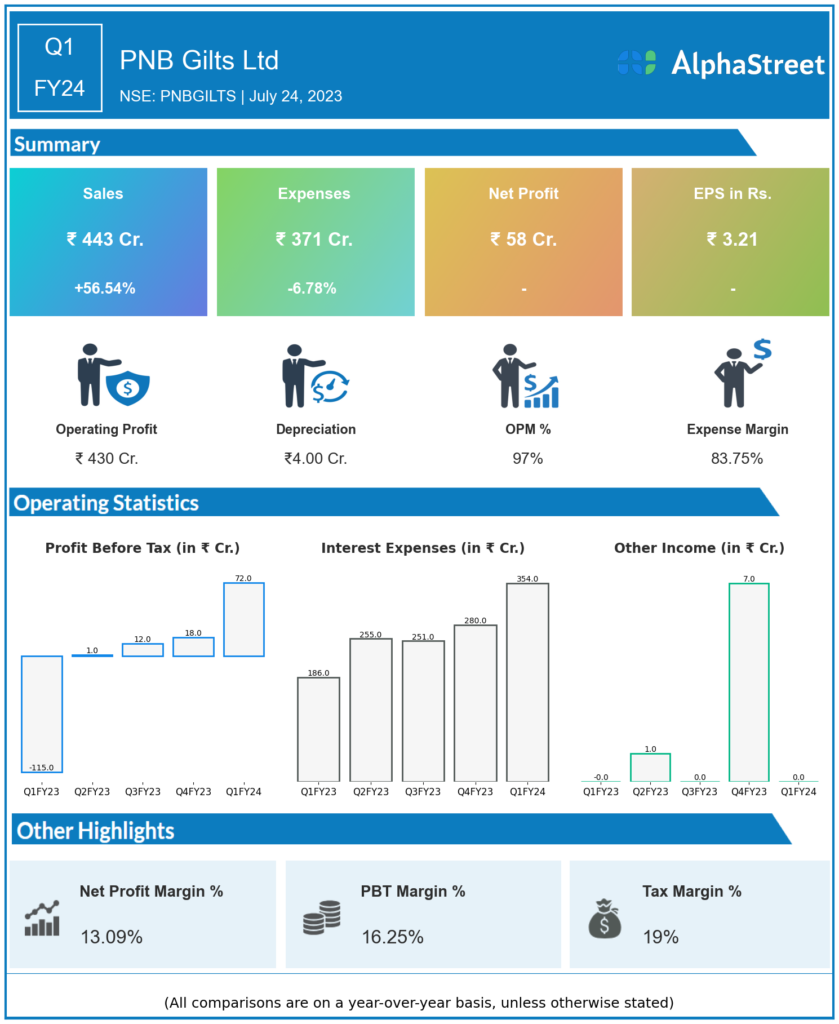

PNB Gilts Ltd reported Revenues for Q1FY24 of ₹443.00 Crores up from ₹283.00 Crore year on year, a rise of 56.54%.

Total Expenses for Q1FY24 of ₹371.00 Crores down from ₹398.00 Crores year on year, a fall of 6.78%.

Consolidated Net Profit of ₹58.00 Crores from -₹89.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹3.21, from -₹4.94 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.