Piramal Pharma Limited (PPL) is part of the Piramal group of companies. The company operates through 3 major segments: Contract development and manufacturing organisations, Complex hospital generics (critical care), and consumer healthcare (OTC). Company entered Pharma space back in 1988 with acquisition of Nicholas Laboratories and grew through a series of Mergers & Acquisitions and various organic initiatives. In 2010 the Domestic formulations business was sold to Abott for $3.7 billion and Diagnostic Services was sold to Super Religare Laboratories (SRL).

Q2 FY26 Earnings Results:

-

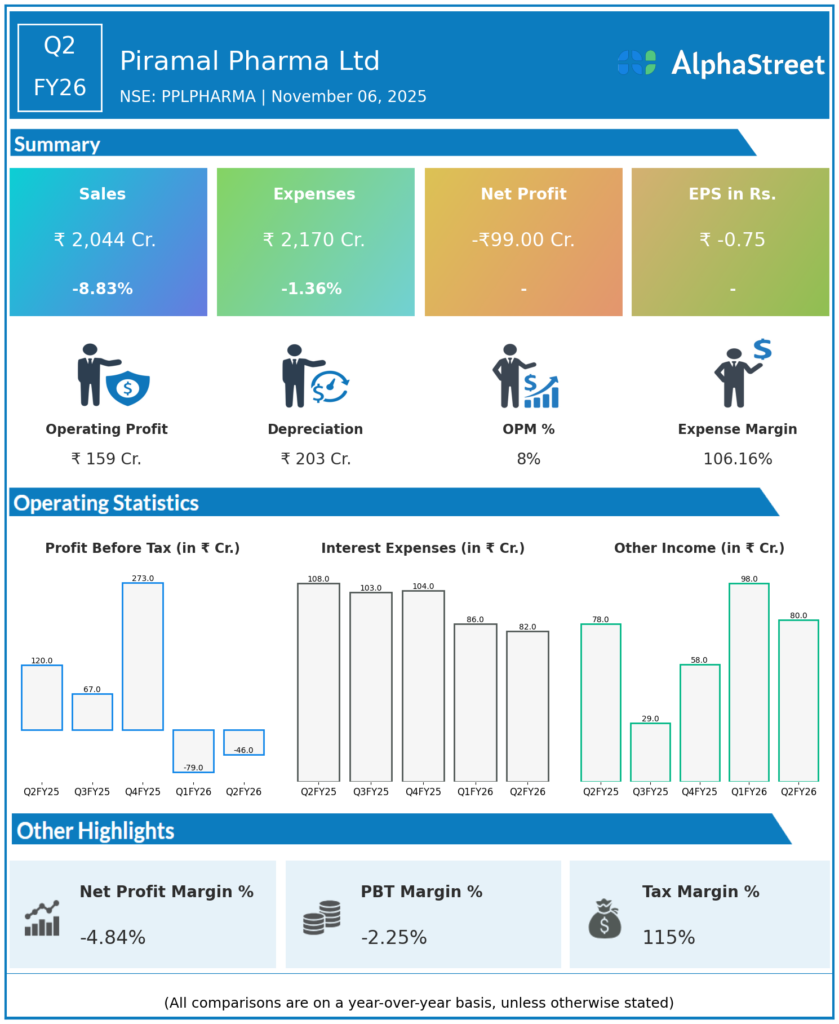

Revenue from Operations: ₹2,044 crore, down 9% YoY.

-

EBITDA: ₹224 crore, a 44% YoY decline; EBITDA margin compressed to 11% from 18% in Q2 FY25.

-

Net Loss: ₹99 crore (compared to ₹23 crore profit in Q2 FY25).

-

Profit Before Tax: -₹46 crore (down from ₹120 crore profit YoY).

-

The drop in revenue was largely due to inventory destocking by a customer on a large patent-protected CDMO product and slower order inflows, with delayed recovery in US biopharma funding.

-

CDMO segment revenue: ₹1,044 crore (down 21% YoY).

-

Complex Hospital Generics revenue was flat; India Consumer Healthcare division grew 15% YoY in Q2.

-

Net debt reduced by ₹228 crore during H1 FY26 (total ₹3,971 crore).

Management Commentary & Strategic Insights:

-

Chairperson Nandini Piramal noted the CDMO business suffered from customer destocking and global macro uncertainty but pointed to signs of recovery in biopharma funding in late September and October.

-

The company is receiving an uptick in requests for differentiated CDMO services and expects normalization in order flows.

-

Focus on leveraging new capacity (ADC, sterile fill-finish), digital/e-commerce for consumer segment, and cost optimization amid volatility.

-

Initiatives to resolve supply constraints in injectable anesthesia and pain business are underway.

-

Continued investments in regulatory approvals and differentiated product launches.

Q1 FY26 Earnings Results:

-

Revenue from Operations: ₹1,934 crore, down 0.9% YoY.

-

EBITDA: ₹165 crore, margin at 9% vs 11% YoY.

-

Net Loss: ₹82 crore (narrowed from ₹89 crore YoY).

-

CDMO revenue: ₹997 crore (down 6% YoY), but mid-teen growth excluding inventory destocking.

-

Complex Hospital Generics (CHG) division revenue up 1% YoY.

-

Power brands in the consumer healthcare division grew 20% YoY.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.