Piramal Pharma Limited (PPL) is part of the Piramal group of companies. The company operates through 3 major segments

(1) Contract development and manufacturing organisations (CDMO), (2) Complex hospital generics (critical care), and (3) consumer healthcare (OTC).

Company entered Pharma space back in 1988 with acquisition of Nicholas Laboratories and grew through a series of Mergers & Acquisitions and various organic initiatives. In 2010 the Domestic formulations business was sold to Abott for $3.7 billion and Diagnostic Services was sold to Super Religare Laboratories (SRL)

Financial Results:

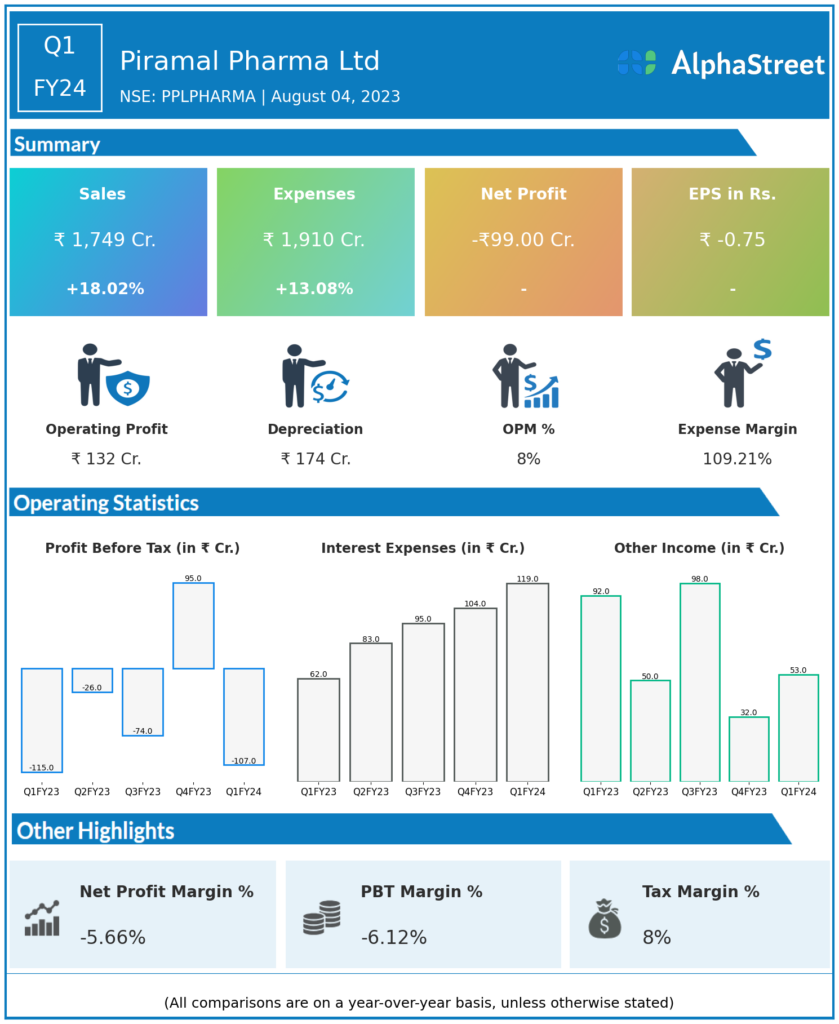

Piramal Pharma Ltd reported Revenues for Q1FY24 of ₹1,749.00 Crores up from ₹1,482.00 Crore year on year, a rise of 18.02%.

Total Expenses for Q1FY24 of ₹1,910.00 Crores up from ₹1,689.00 Crores year on year, a rise of 13.08%.

Consolidated Net Profit of -₹99.00 Crores from -₹109.00 Crores in the same quarter of the previous year.

The Earnings per Share is -₹0.75, from ₹NaN.00 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.