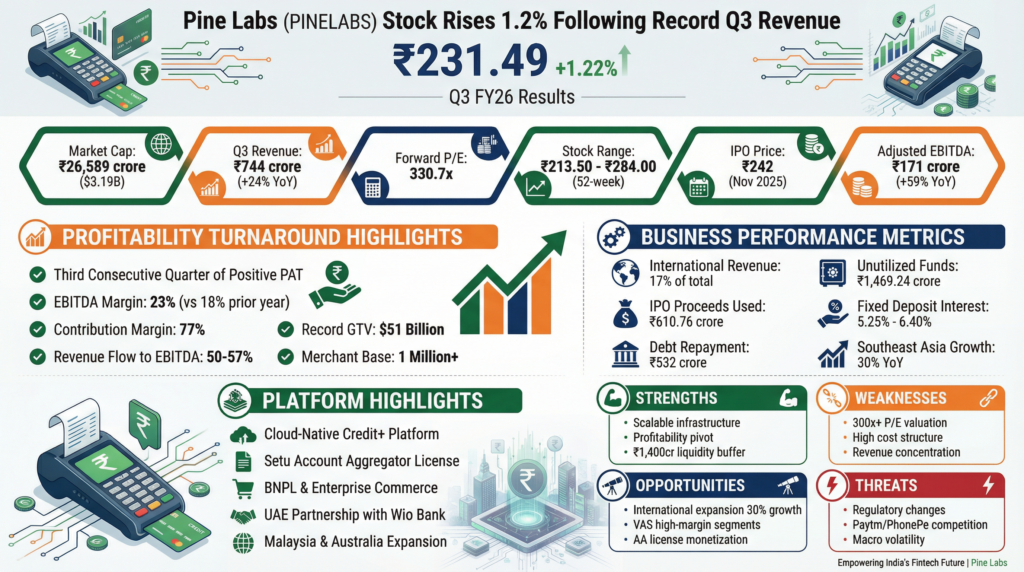

Strengths

- Scalable Infrastructure: Cloud-native “Credit+” platform allows for rapid merchant onboarding and high-volume processing.

- Profitability Pivot: Third consecutive quarter of positive PAT and expanding EBITDA margins (23%).

- Strong Liquidity: Over ₹1,400 crore in unutilized IPO proceeds provides a significant buffer for inorganic growth.

Weaknesses

- High Valuation: A forward P/E exceeding 300x leaves little room for operational misses.

- Cost Rigidity: Employee benefits and technical overheads remain high, accounting for nearly 40% of total expenses.

- Revenue Concentration: Domestic Indian merchant acquiring still drives the vast majority of the topline.

Opportunities

- International Expansion: Strong growth (30% YoY) in Southeast Asia and Middle East markets.

- Value-Added Services (VAS): High-margin segments like loyalty programs and “Setu” data infrastructure are outpacing core payments growth.

- Account Aggregator License: Full control of an NBFC-AA through Agya Technologies strengthens financial data monetization.

Threats

- Regulatory Changes: Evolving SEBI and RBI guidelines on digital payments and data localization.

- Competitive Intensity: Persistent pressure from both legacy banks and QR-led consumer fintechs like Paytm and PhonePe.

- Macroeconomic Volatility: Indirect exposure to consumer spending dips and trade-related inflationary pressures on merchant clients.