Pidilite Industries Limited is a leading manufacturer of adhesives and sealants, construction chemicals, craftsmen products, DIY products and polymer emulsions in India. Most of the products have been developed through strong in-house R&D. The brand name Fevicol has become synonymous with adhesives to millions in India and is ranked amongst the most trusted brands in the country. Some of the other major brands are M-Seal, Fevikwik, Fevistik, Roff, Dr. Fixit, Fevicryl, Motomax, Hobby Ideas, Araldite. Presenting below are its Q1 FY26 earnings.

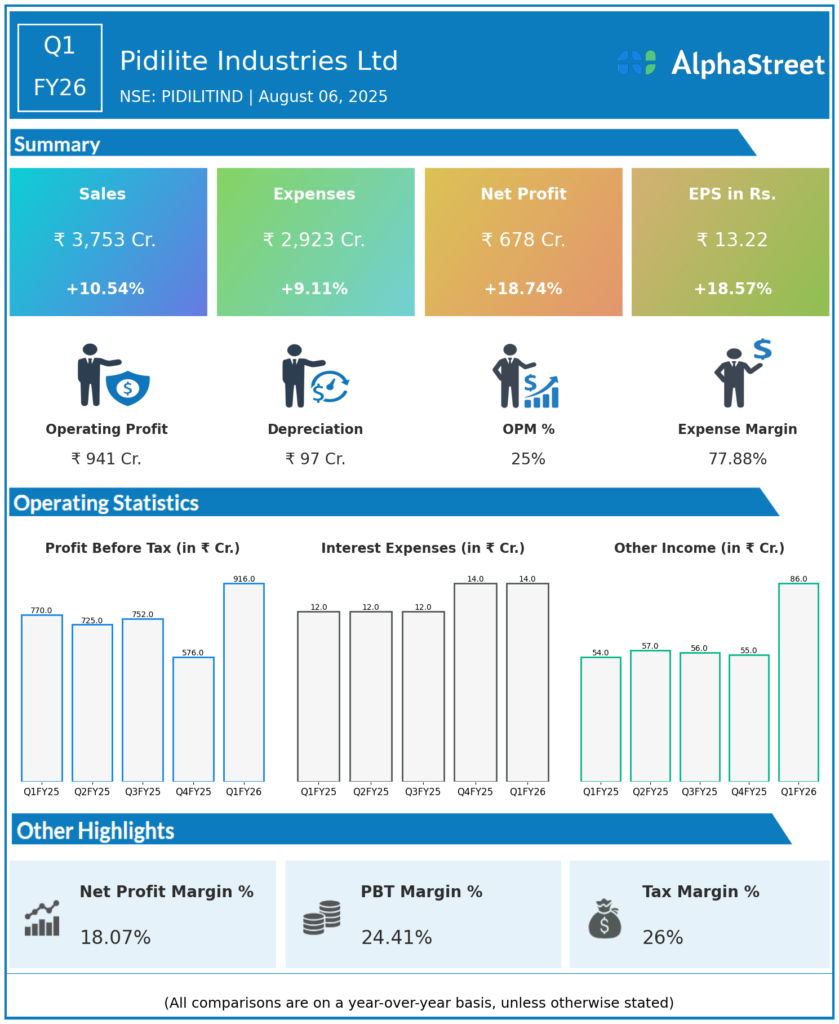

Q1 FY26 Earnings Summary

-

Consolidated Revenue: ₹3,753 crore, up 10.5% year-over-year (YoY).

-

Net Profit (PAT): ₹678 crore, up 18.7% YoY from ₹571 crore approximately last year.

-

EBITDA: ₹941 crore, up 16% YoY.

-

EBITDA Margin: Expanded by 110 basis points to 25%.

-

Volume Growth: Approximately 9.9% for the quarter, at the higher end of management’s guided range (8–10%).

-

Special Dividend: The board approved a special dividend of ₹10 per share, with the record date fixed on August 13, 2025.

-

Bonus Issue: Board approved a 1:1 bonus issue (one share for every share held) pending record date announcement.

Key Management Commentary & Strategic Highlights

-

Management highlighted that the quarter surpassed expectations with strong volume-led revenue growth and margin expansion.

-

Focus remains on driving volume growth in core adhesives and construction chemicals businesses while continuously improving operational efficiencies.

-

The bonus share issue and special dividend reflect management’s confidence in robust cash flow and balance sheet strength.

-

The company continues investing in new product innovation, market expansion, and cost management to sustain growth momentum.

Q4 FY25 Earnings Summary

- Pidilite Industries Ltd reported Revenues for Q4FY25 of ₹3,141.00 Crores up from ₹2,902.00 Crore year on year, a rise of 8.24%.

- Total Expenses for Q4FY25 of ₹2,620.00 Crores up from ₹2,453.00 Crores year on year, a rise of 6.81%.

- Consolidated Net Profit of ₹428.00 Crores up 40.79% from ₹304.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹8.30, up 40.44% from ₹5.91 in the same quarter of the previous year.

-

The focus on volume growth, operating margin improvement, and market leadership remained steady into Q4 FY25.

To view the company’s previous earnings, click here