Procter & Gamble Hygiene and Health Care Limited is engaged in the manufacturing and selling of branded packaged fast moving consumer goods in the femcare and healthcare businesses. Its portfolio includes WHISPER – India’s leading Feminine Hygiene brand, and VICKS – India’s No. 1 Health Care brand and Old Spice. Presenting below are its latest Q1 FY26 earnings.

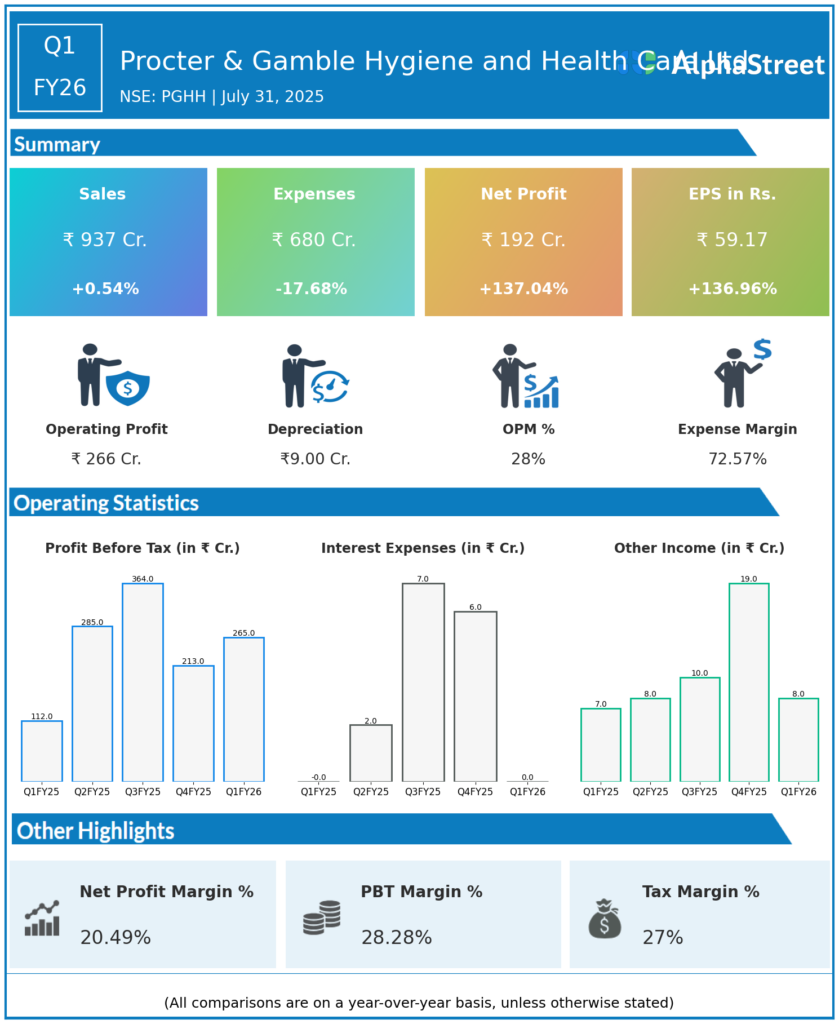

Q1 FY26 Earnings Summary (April–June 2025)

-

Net Profit (PAT): ₹192.06 crore, up 137% year-over-year (YoY) from ₹81.06 crore in Q1 FY25 and up 23% sequentially from Q4 FY25.

-

Revenue from Operations: ₹937.03 crore, up 1% YoY.

-

Total Income: ₹944.72 crore.

-

Total Expenses: ₹680.02 crore, down 17.75% YoY.

-

Gross Margin: Not explicitly reported; however, the profit surge was primarily driven by a sharp reduction in expenses, especially advertising expenditure, which almost halved YoY.

-

Advertising Spend: Down 55.3% YoY to ₹69 crore in the quarter.

-

Profit Before Interest, Depreciation, and Tax (PBIDT): ₹274 crore, up 118% YoY.

-

Profit Drivers: Significant profit increase attributed to lower base-period advertising investment and cost efficiencies.

-

Segment Performance: The company maintained market leadership in healthcare and feminine care through brands like Whisper and Vicks.

Key Management Commentary & Strategic Highlights

-

Management noted that the Q1 FY26 profit surge came from executing an integrated growth strategy, focusing on a daily-use product portfolio, productivity, constructive disruption, and agile organization structure.

-

CEO V Kumar stated the company delivered strong profits in a persistently challenging environment by prioritizing brand superiority, efficient advertising, and disciplined cost control.

-

PGHH leadership remains committed to sustainable, balanced growth and shareholder value, highlighting the importance of continuous portfolio improvement and productivity in all aspects of the business.

-

The company continues its focus on community initiatives, including the P&G Shiksha education program.

Q4 FY25 Earnings Summary (January–March 2025)

-

Net Profit (PAT): ₹156.10 crore, up 1.1% YoY from ₹154.37 crore in Q4 FY24.

-

Revenue from Operations: ₹989.13 crore, down marginally from ₹998 crore in Q4 FY24.

-

Total Income: ₹1,010.76 crore.

-

Total Expenses: ₹792.33 crore, up 8.88% YoY.

-

EBIT: ₹218.43 crore, margin at 21.61%.

-

Net Profit Margin: 15.44%.

-

Profit Movement: Q4 PAT was stable, but profit margins were pressured by slightly higher costs and relatively flat revenue growth.

To view its previous earnings, please Click Here