Persistent Systems provides software engineering and strategy services to help companies implement and modernize their businesses. It has its own software and frameworks with pre-built integration and acceleration. It also has partnership with providers such as Salesforce and AWS.

Q3 FY26 Earnings Results

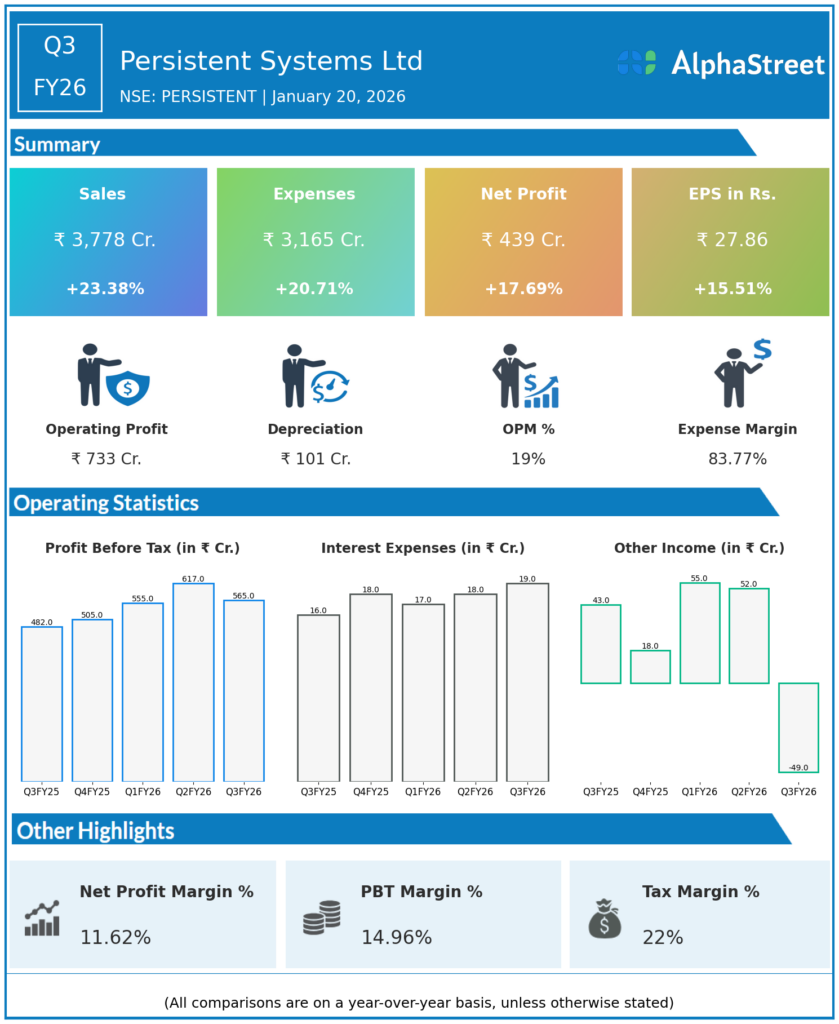

- Revenue from Operations: ₹3,778.2 crore, up 5.5% QoQ from ₹3,581.6 crore in Q2 FY26 and up 23.4% YoY from ₹3,062.3 crore in Q3 FY25.

- Revenue (USD): USD 422.5 million, up 4.0% QoQ and 17.3% YoY.

- EBIT (reported): ₹542.8 crore, up 19.1% YoY from ₹455.7 crore; reported EBIT margin 14.4% vs 14.9% in Q2 FY26 and 14.9% in Q3 FY25.

- EBIT (adjusted, ex New Labour Codes): ₹631.8 crore, EBIT margin 16.7%, indicating about 230 bps one‑time margin impact from labour‑code provisions.

- Profit After Tax (PAT): ₹439.4 crore, up 17.8% YoY from ₹373.0 crore, but down ~6–7% QoQ from ~₹471.4 crore in Q2 FY26 due to the one‑time New Labour Codes impact (~1.8% hit on PAT).

- PAT margin: 11.6% in Q3 FY26 vs 12.7% in Q2 FY26 and ~12.2% in Q3 FY25.

- Cash & bookings:

- Total Contract Value (TCV): USD 674.5 million.

- Annual Contract Value (ACV): USD 501.9 million.

- Dividend: Interim dividend of ₹22 per share declared for FY26.

Management Commentary & Strategic Decisions – Q3 FY26

- Management highlighted this as the 23rd consecutive quarter of revenue growth, with 4.0% QoQ and 17.3% YoY growth in USD terms, driven by deeper participation in strategic client programmes and steady demand across data, cloud and digital engineering.

- The New Labour Codes had a one‑time impact of around 2.3% on EBIT margin and 1.8% on PAT margin; management emphasised that underlying profitability (16.7% EBIT margin ex‑impact) remains strong and in line with its steady‑improvement trajectory.

- Strategic focus areas:

- Scaling AI‑led engineering and data‑centric solutions, with Persistent recognised as a “Frontier Firm” by Microsoft and among India’s most valuable brands by Kantar, reinforcing its positioning in high‑value digital transformation.

- Maintaining robust deal momentum across Software & Hi‑Tech, BFSI, and Healthcare & Life Sciences; key wins in Q3 included AI‑led digital commerce, cloud migration, cybersecurity and data‑platform programmes.

- Continuing disciplined capital allocation via dividends while investing in talent and platforms to sustain double‑digit growth and mid‑teens margins over the medium term.

Q2 FY26 Earnings Results

- Revenue from Operations: USD 406.2 million, up 4.2% QoQ and 17.6% YoY; in INR terms, revenue of about ₹3,581.6 crore, up 23.6% YoY.

- EBIT: ₹583.7 crore, up 43.7% YoY; EBIT margin 16.3%, up 230 bps YoY from 14.0% and slightly higher QoQ.

- Profit After Tax (PAT): ₹471.4 crore, up 45.1% YoY, with PAT margin at 13.2%.

- Bookings:

- TCV: USD 609.2 million.

- ACV: USD 447.9 million.

- Sector and regional performance: BFSI led industry growth at ~30% YoY, while Europe delivered ~37.9% YoY revenue growth, signalling strong traction outside the US as well.

- Headcount: 26,224 employees, with merit increases implemented for all global employees in Q2 FY26.

Management Commentary & Strategic Directions – Q2 FY26

- Management called Q2 FY26 a “robust” quarter, with double‑digit revenue and profit growth driven by strong order wins, expanding margins and broad‑based demand across key verticals.

- Margin expansion to 16.3% EBIT and 13.2% PAT was credited to operating leverage, improved delivery efficiency and a richer mix of high‑value digital‑engineering and cloud projects.

- Strategic priorities:

- Advancing the AI strategy, reflected in two CII National AI Awards, and embedding AI across service lines to drive higher productivity and differentiated offerings.

- Leveraging strong BFSI and Europe momentum while deepening client relationships in Software & Hi‑Tech and Healthcare to sustain high‑teens growth.

- Maintaining disciplined hiring and merit increases to support growth while keeping utilisation and margins in a healthy band.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.