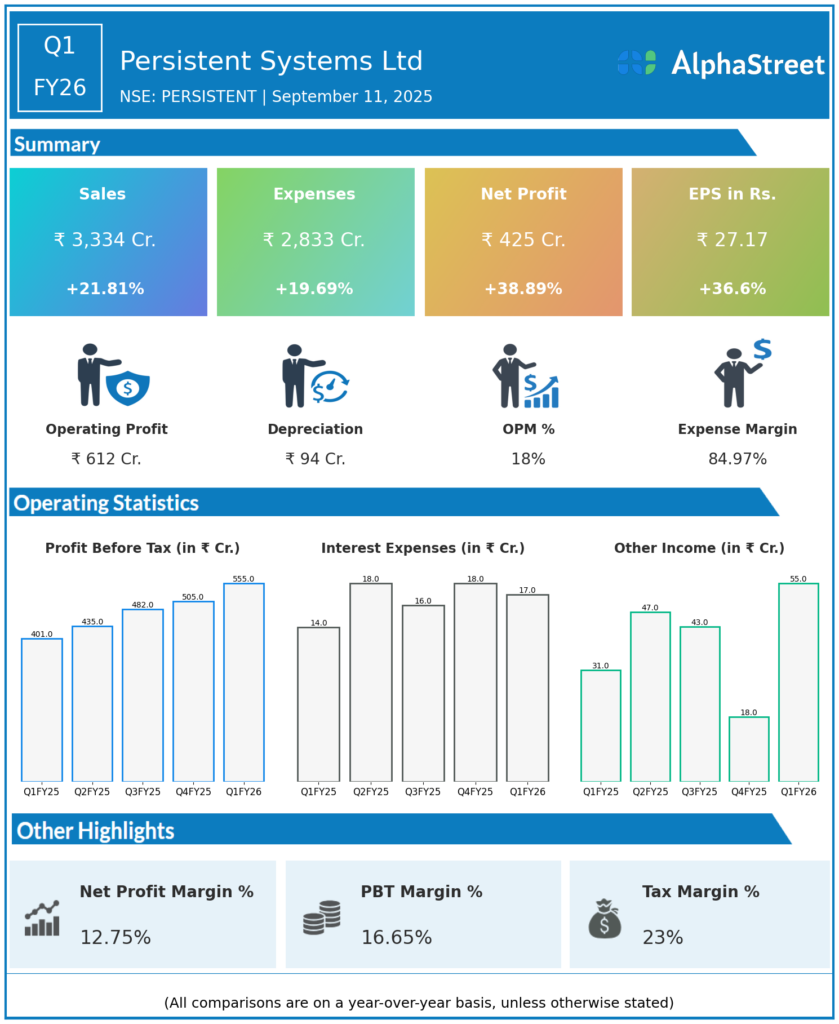

Persistent Systems provides software engineering and strategy services to help companies implement and modernize their businesses. It has its own software and frameworks with pre-built integration and acceleration . It also has partnership with providers such as Salesforce and AWS. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Revenue: ₹3,333.6 crores, up 21.8% YoY (Q1 FY25: ₹2,737.2 crores) and 2.8% QoQ (Q4 FY25: ₹3,248.2 crores).

-

EBIT: ₹517.8 crores, up 34.8% YoY (Q1 FY25: ₹384.3 crores) and up 2.5% QoQ (Q4 FY25: ₹505.6 crores); EBIT margin 15.5%.

-

Profit Before Tax (PBT): ₹555.4 crores, up 38.7% YoY and 9.9% QoQ.

-

Profit After Tax (PAT): ₹424.94 crores, up 38.7% YoY (Q1 FY25: ₹306.4 crores), up 7.4% QoQ (Q4 FY25: ₹396 crores).

-

PAT Margin: 12.7%.

-

Total Contract Value (TCV): $520.8 million for Q1; Annual Contract Value (ACV): $385.3 million.

-

Vertical Growth: BFSI: 30.7% YoY, Software & Hi-tech: 14.1%, Healthcare & Life Sciences: 12.4%.

-

Headcount: Expanded by 746 employees sequentially; annual wage hikes postponed by a quarter.

-

Dividend: ₹15 per share approved in AGM in July 2025.

Key Management Commentary & Strategic Highlights

-

CEO Sandeep Kalra and Founder Anand Deshpande highlighted 21 consecutive quarters of double-digit YoY growth, strong execution in AI-led digital transformation, and Persistent’s leadership in platform-driven industrial solutions.

-

The launch of SASVA 3.0 (AI-powered digital engineering platform) and deep client partnerships boosted deal wins, especially in BFSI, fueling higher TCV and reinforcing the $2 billion revenue target by FY27.

-

Operational discipline maintained margins despite industry wage and attrition pressures; management aims to sustain profitable growth while investing in AI, niche verticals and workforce expansion.

-

Strategic pivot toward larger, recurring client engagements—number of clients above $5M annual revenue rose to 56 in Q1.

-

AI, cloud, and next-gen platform deals expected to remain main growth levers, with expanding demand from global customers.

Q4 FY25 Earnings Results

-

Total Revenue: ₹3,242 crores.

-

EBIT: ₹505.6 crores.

-

PAT: ₹396 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.