“We are happy to report that the revenue for Q4 came in at USD 274.55 million, giving us a growth of 3.9% quarter-on-quarter and 26.3% on year-on-year basis. On a constant currency basis, this translates into a sequential revenue growth of 3.5%. In rupee terms, the growth came in at 3.9% quarter-on-quarter and 37.6% on a year-on-year basis. For the full year FY23, we achieved a revenue of USD 1,035.98 million, giving us a robust growth of 35.3% year-on-year.”

-Sandeep Kalra, Executive Director and Chief Executive Officer

Stock Data

| Ticker | PERSISTENT |

| Industry | IT |

| Exchange | NSE & BSE |

Share Price

| Last 1 Month | -2% |

| Last 6 Months | 20.8% |

| Last 12 Months | 42.1% |

Business Basics

Persistent Systems Limited is a global software development company that specializes in delivering innovative digital solutions to businesses across various industries. With a strong focus on technology-driven services, Persistent Systems helps organizations navigate digital transformations, optimize operations, and drive business growth. The company offers a wide range of services, including software development, product engineering, cloud computing, data analytics, artificial intelligence, and machine learning. Persistent Systems leverages cutting-edge technologies and frameworks to develop custom software solutions tailored to the specific needs of its clients. These solutions span across domains such as healthcare, banking and financial services, manufacturing, retail, and more.

Persistent Systems has a strong track record of delivering high-quality software solutions and has established long-term partnerships with clients worldwide. The company’s expertise lies in its ability to understand complex business challenges, design scalable solutions, and deliver them on time and within budget. Through its global delivery centers and a talented pool of software engineers and consultants, Persistent Systems provides end-to-end software development services and supports clients throughout the software development lifecycle. Moreover to its software development capabilities, Persistent Systems also offers specialized services in areas such as digital transformation, Internet of Things (IoT), cybersecurity, and blockchain. The company helps businesses harness the power of emerging technologies to drive innovation, improve efficiency, and gain a competitive edge in the market.

Q4 FY23 Financial Performance

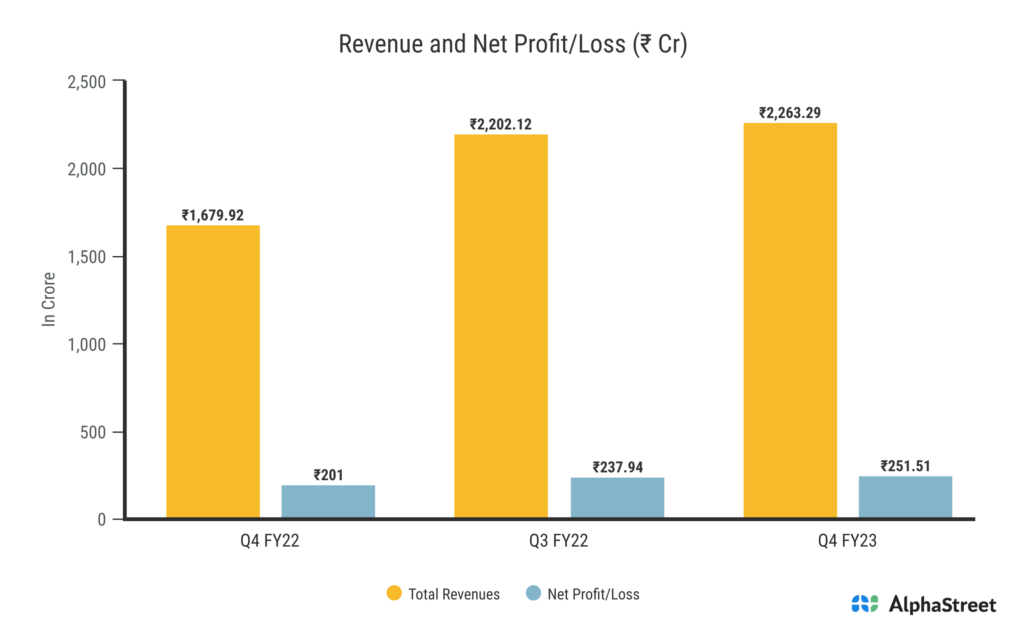

Persistent Systems Limited reported Total Income for Q4 FY23 of ₹2,263.29 Crores up from ₹1,679.92 Crore year on year, a rise of 34.7%. Consolidated Net Profit of ₹251.51 Crores, up 25.1% from ₹201 Crores in the same quarter of the previous year. The Earnings per Share is ₹ 32.91 in this quarter.

Persistent Systems’ Segment Revenue

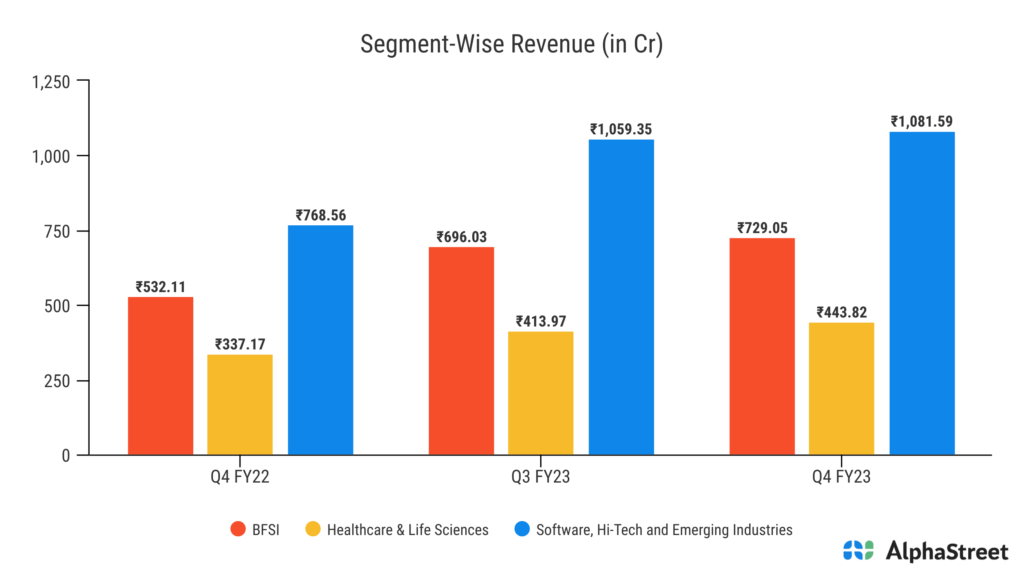

Persistent Systems operates across three key segments: BFSI (Banking, Financial Services, and Insurance), Healthcare & Life Sciences, and Software, Hi-Tech, and Emerging Industries. Each segment represents a distinct industry vertical and contributes to the overall revenue of the company.

In the BFSI segment, Persistent Systems provides technology solutions and services to banking, financial services, and insurance organizations. The company helps clients in this sector modernize their IT infrastructure, develop innovative financial products and services, enhance customer experience, and improve operational efficiency. Persistent Systems leverages its expertise in software development, data analytics, and digital technologies to deliver solutions that address the unique needs and challenges of the BFSI industry.

The Healthcare & Life Sciences segment focuses on delivering technology solutions to healthcare providers, pharmaceutical companies, and life sciences organizations. Persistent Systems helps these entities leverage digital technologies to enhance patient care, optimize clinical operations, accelerate drug discovery and development, and improve overall operational efficiency. The company’s solutions in this segment span areas such as electronic health records, telemedicine, clinical data management, regulatory compliance, and health analytics.

The Software, Hi-Tech, and Emerging Industries segment caters to software product companies, technology startups, and businesses in emerging industries. Persistent Systems offers a range of services, including software product development, platform engineering, cloud enablement, digital transformation, and IoT solutions. The company helps clients in this segment accelerate innovation, bring new products to market, and navigate the complexities of the rapidly evolving technology landscape.

Company’s Key Deal Wins For Q4 By Industry Segments

In Software, Hi-tech and Emerging Industries, the company was selected by a Fortune-50 Technology company as the engineering partner for its Data Warehouse products, as well as its Mobile Application Development products. It is a $100 million deal that spans five years and entails both the execution of a product roadmap and the migration of end users to the customer’s cutting-edge platform. As part of the agreement, the company has licensed the source code for providing extended support for the earlier version of the product for enterprise customers who do not wish to move to the next version. A top provider of Marketing Technology Solutions also chose Persistent to offer engineering and infrastructure support for its platform.

For Banking, Financial Services and Insurance, A renowned private equity firm chose Persistent to create a procurement and contract solution for its procurement group and modernize its enterprise data warehouse. Persistent was chosen by a leading company in the Fractional Trading and Embedded Finance industries to create an integration platform for onboarding and servicing its local customers. On the insurance front, a top provider of property and casualty insurance chose the company to create a cloud-based Data Lake to support policy administration, claims analysis, and risk level forecasting for the underwriting procedure.

On the Healthcare and Life Sciences side, the company was chosen by one of the largest Pharma and Diagnostic companies to build and integrate genomic workflow management tools for all of the client’s acquired businesses, resulting in a significant increase in experimental throughputs. A major player in the scientific instrumentation industry also chose the company to develop an enterprise data platform for streamlining governance and operations across a number of business groups, including operations, supply-chain management, finance, and procurement.

Persistent Systems’ Order Book

The total contract value of the orders in the Q4 order book is $421.6 USD, and the total contract value of the new bookings is $250.3 USD. This suggests a steady increase in TCV of 16.8% on an annual basis. The contract value of this TCV is around $310.4 million annually, of which $168.3 million comes from new bookings. The company’s total TCV exceeded $1.6 billion on a yearly basis. There is a $1.17 billion Annual Contract Value component to this. For the entire year FY23, this translates into TCV growth of 32.8% and ACV growth of 24.1%.