PC Jeweller is engaged in the business of manufacturing, sale and trading of gold jewellery, diamond-studded jewellery and silver items and operates in different geographical areas. The Company’s export business of gold jewellery is on a B2B basis through its dealers based in the Gulf via Dubai based firms. The company has a team of in-house designers. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Results:

-

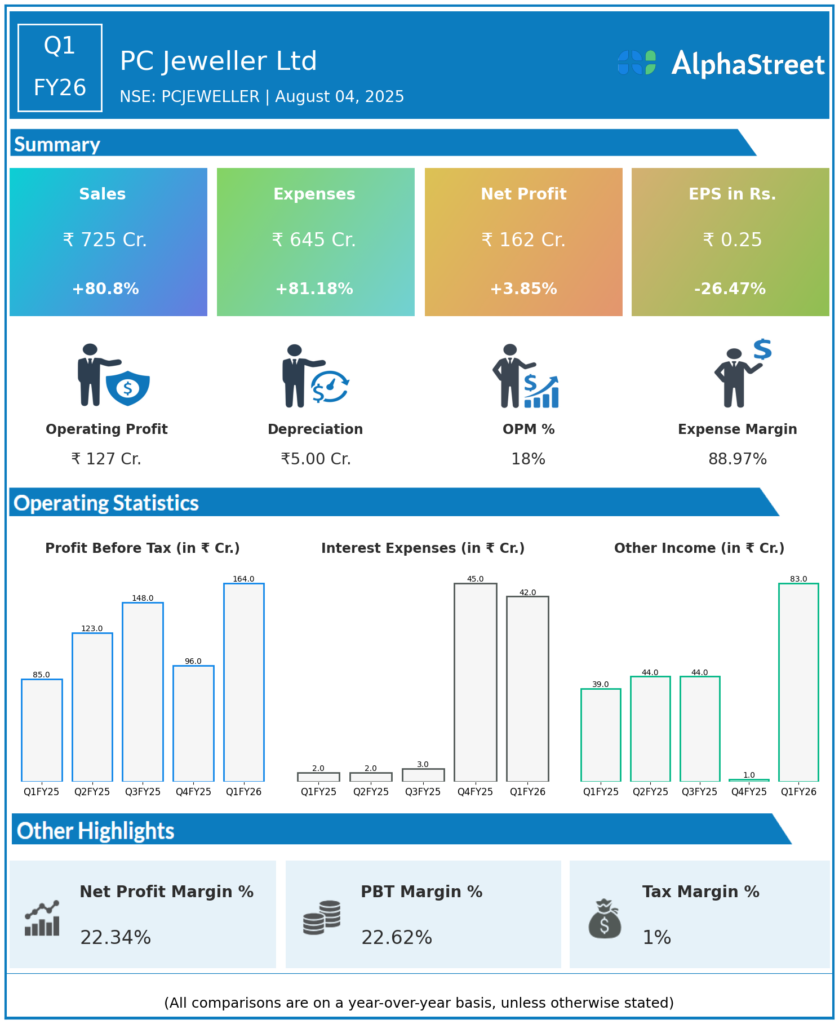

Consolidated Revenue: ₹725 crore, up 80.8% year-over-year (YoY) from ₹401 crore in Q1 FY25.

-

Net Profit (PAT): ₹162 crore, up 4% YoY. On a reported basis, Q1 FY25 PAT was ₹156 crore (with a large exceptional gain).

-

EBITDA: ₹128 crore, a rise of 147% from ₹52 crore YoY.

-

EBITDA Margin: 17.6%, expanding from 12.9% in Q1 FY25.

-

Gross Profit: ₹144 crore (vs ₹65 crore Q1 FY25).

-

Sales Volume: Up sharply YoY, with Q1 FY26 turnover entirely from domestic sales, zero export exposure.

-

Finance Costs: Rose to ₹42 crore (vs ₹2 crore YoY) but management continues rapid deleveraging.

-

Debt Reduction: Net debt cut by over 50% in FY25, then further reduced by 8.7% in Q1 FY26, with another 10.1% paid off in July 2025.

Key Management Commentary & Strategic Highlights

-

Management highlighted “exceptional sales and profit growth, solely from the domestic market,” demonstrating resilience against global volatility and FX swings.

-

The company is executing a clear debt-free roadmap: After repaying ₹335 crore in bank loans during April–July 2025, net debt stood at ₹1,445 crore (down from ₹1,780 crore at FY start). Plans for a ₹1,800 crore equity infusion are in place (₹500 crore via preferential allotment, ₹1,300 crore via warrants).

-

“We aim to be fully debt-free by March 2026,” said the MD, focusing on increased internal accruals and new capital raising.

-

PC Jeweller now operates 52 showrooms (49 company-owned), with continued focus on expanding reach and avoiding risky international sales exposure.

-

Regulatory initiatives (mandatory hallmarking) seen as tailwinds for formal sector growth.

-

The Jamshedpur showroom was closed in Q1 FY26 as part of a rationalization strategy.

-

Board remains committed to operational transparency and sustainable growth, with showroom network realignment and franchise expansion.

Additional Highlights and FY25 Context (for trend)

-

FY25 Full Year: Net profit of ₹577.7 crore on revenue of ₹2,371.9 crore.

-

Showroom footprint: 52 total, 49 directly owned, across 37 cities as of June 30, 2025.

-

Stock Performance: Shares have been extremely volatile but are up nearly 60% in the previous 12 months and up over 800% over five years

To view the company’s earnings: Please Click Here