PB Fintech Ltd, popularly known as Policy Bazar is India’s largest online platform for insurance and lending products through its flagship brands – Policybazaar and Paisabazaar platform through which they provide convenient access to insurance, credit and other financial products.

Q2 FY26 Earnings Results

-

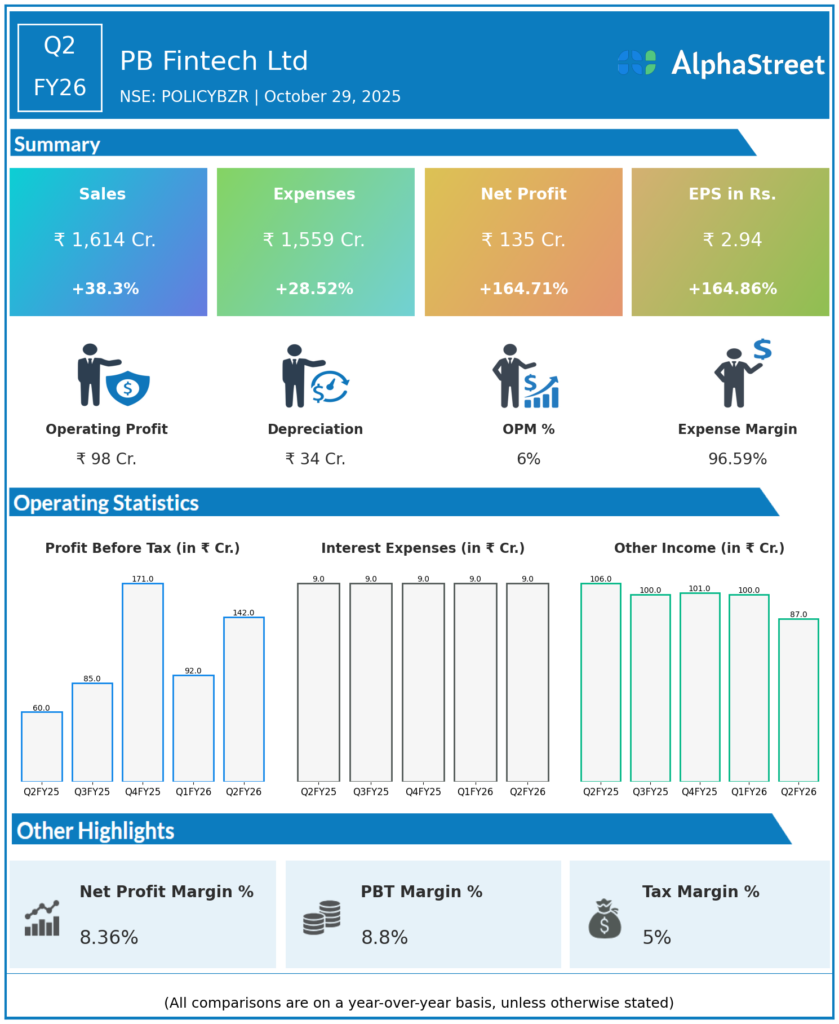

Revenue from Operations: ₹1,613.5 crore, increased 38% YoY from ₹1,167 crore in Q2 FY25 and grew 20% QoQ from ₹1,348 crore in Q1 FY26.

-

PAT: ₹134.9 crore, surged 165% YoY from ₹51 crore; up 59% QoQ from ₹84.69 crore.

-

Revenue growth drivers: Significant increase in insurance premiums, driven by new protection policies and core online insurance growth.

-

Insurance premiums: ₹7,605 crore, up 40% YoY, with online insurance premiums rising 34%, and new protection premiums increasing 44%.

-

Renewal revenue: 12-month rolling, increased 39% YoY to ₹774 crore.

-

Lending disbursal: ₹2,280 crore, with credit revenue of ₹106 crore, impacted by ongoing challenges but showing signs of sequential recovery.

-

International operations: UAE business grew 64% YoY and continued to be profitable in the latest quarter.

-

Operational expenses: Employee benefits increased 18% YoY; marketing expenses remained steady at ₹280 crore.

-

Financial position: Total assets at about ₹18,277,671 million (~₹1.83 lakh crore); net income increased from FY2024 figures, with detailed cash flow statements indicating active investment and financing activities.

Management Commentary & Strategic Decisions:

-

Focus on expanding insurance and protection premiums, along with growing agent networks and digital capabilities.

-

Continued investment in technology and operational efficiencies to enhance customer experience.

-

International business in UAE remains a key growth driver.

-

Steady marketing investments to support growth and market penetration.

Q1 FY26 Results Summary:

-

-

Revenue: ₹1,348 crore, up 33% YoY from ₹1,010 crore.

-

PAT: ₹84.59 crore, increased 40.56% YoY from ₹60.18 crore.

-

Growth driven primarily by health insurance and renewal revenue expansion.

-

Challenges in savings and credit disbursal due to macroeconomic headwinds but overall positive trend in profitability and revenue streams.

-

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.