PB Fintech Ltd, popularly known as Policy Bazar is India’s largest online platform for insurance and lending products through its flagship brands – Policybazaar and Paisabazaar platform through which they provide convenient access to insurance, credit and other financial products. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

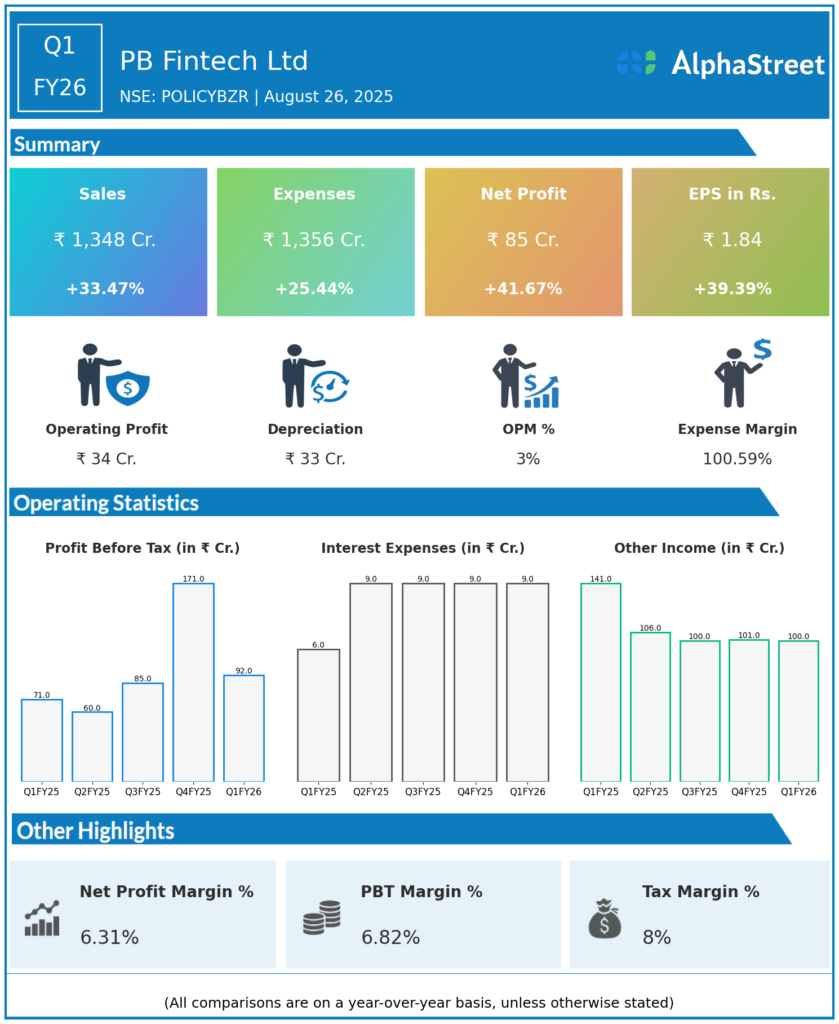

Revenue from Operations: ₹1,348.00 crores, up 33% YoY (Q1 FY25: ₹1,010 crores) but down 10.6% QoQ (Q4 FY25: ₹1,508 crores).

-

Total Income: ₹1,447.00 crores (includes ₹99 crore interest, financial income), up 30.2% YoY (Q1 FY25: ₹1,110.75 crores).

-

Total Expenses: ₹1,356.00 crores, up 25% YoY (Q1 FY25: ₹1,081 crores), down 5.6% QoQ (Q4 FY25: ₹1,437 crores).

-

Employee Benefits Cost: ₹560 crores, up 23% YoY.

-

Profit Before Tax (PBT): ₹90.89 crores, up 28.6% YoY (Q1 FY25: ₹70.67 crores), up 23.9% QoQ (Q4 FY25: ₹73.36 crores).

-

Profit After Tax (PAT): ₹85.00 crores, up 41–42% YoY (Q1 FY25: ₹60 crores), down 51% QoQ (Q4 FY25: ₹171 crores).

-

EBITDA: ₹133.14 crores.

-

EPS: ₹1.84, up 39.3% YoY (Q1 FY25: ₹1.30).

-

Online Insurance Revenue: ₹732 crores, up 37% YoY.

-

Insurance Premium: ₹6,616 crores, up 36% YoY; new health insurance premiums up 65% YoY, UAE insurance premium up 68% YoY.

-

PAT Margin: 6%, up from 2% last year.

-

Renewal Revenue (12-month rolling): ₹725 crores, up 43% YoY.

-

Market Capitalization: ₹83,033 crores ($9.5 billion).

Management Commentary & Strategic Decisions

-

Management highlighted outstanding growth in core online insurance revenue, new client acquisitions, strong premium growth, and renewal revenue as key levers.

-

PB Fintech invested ₹539.4 crores in PB Healthcare Services (stake now 40.32%) and received RBI authorization for PB Pay as an Online Payment Aggregator.

-

Company focus is on tech-driven innovation, enhancing customer service, and scaling international business, particularly in UAE insurance.

-

Despite a regulatory IRDAI penalty (₹5 crore), management maintained an upbeat outlook on top-line momentum and market share gains.

-

Leadership expects continued robust demand for digital insurance products and strong operating leverage, with sector-wide tailwinds.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹1,508 crores, up 38% YoY.

-

Total Income: ₹1,187.88 crores.

-

Total Expenses: ₹1,114.52 crores.

-

Profit Before Tax (PBT): ₹73.36 crores.

-

Profit After Tax (PAT): ₹171.00 crores, up 139% QoQ and 184–185% YoY.

-

EBITDA: ₹113.00 crores.

-

EPS: ₹3.72.

-

Insurance Premium: ₹7,030 crores, up 37% YoY.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.