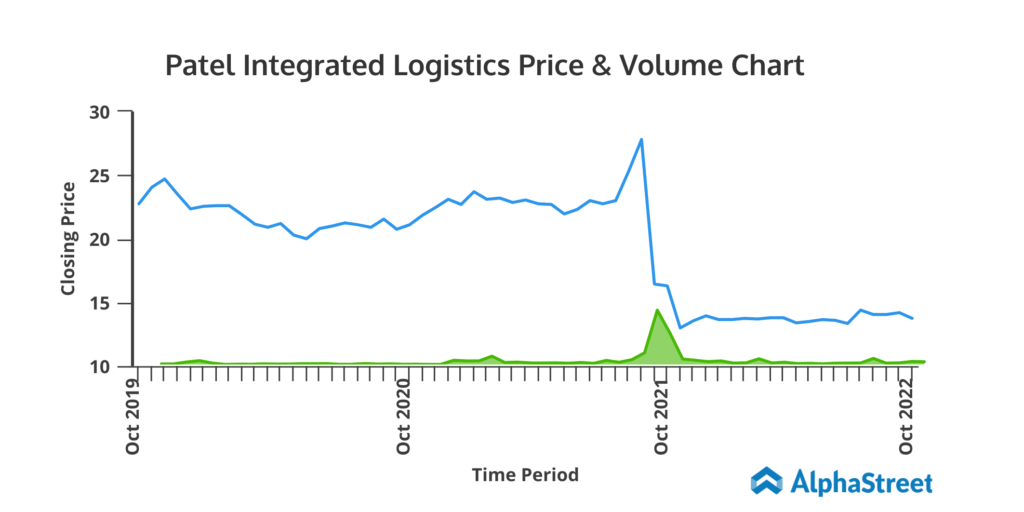

Patel Integrated Logistics Limited (NSE: PATINTLOG) has provided a one-month return of 7.45%, after recording a three-year negative return of 39.65%. Considering the firm to be in the transformational stage, investors can bet on PILL based on its strong fundamentals and long-term growth prospects.

With a market cap of about Rs 94.1 crore, this Small Cap company operates in the Logistics sector globally. Established in 1959 as a one-truck activity, PILL transformed into one of the largest surface logistics and road transportation companies in Asia. It specializes in the main functions of logistics including air freight, warehousing, and ancillary services. Interestingly, the company has a huge market share in the air freight business in India from passenger aircraft.

Notable Factors

In early 2020, due to the COVID-19 pandemic, various sectors such as infrastructure, automotive, logistics, and other industries were impacted to a huge extent. The logistics industry experienced a sharp decline in demand and air freight shipments were considerably low throughout 2020. Therefore, like other small-cap companies, PILL stock was also not unscathed.

The company seems to have experienced a downtrend in price on investors’ concerns and its low-profit margin. But PILL recovered profit-after-tax (PAT) margins post-pandemic from 0.05% in FY21 to 1.54% in the first quarter of FY23.

Recovery in revenues, prudent expense management, and improving margins have supported the financials. Additionally, decent return on capital employed (ROCE) and return on equity (ROE) of 9.6% and 6.74%, respectively, along with reducing debt burden indicate financial stability. The company’s net worth has also remained strong over the past few years.

From the perspective of income-oriented investors, the company seems attractive as it offers consistent dividends, with a strong cash position. With an annual current dividend yield of 0.71%, the company’s efforts to return value to shareholders are visible.

Though the company experienced a top-line contraction in the last two years compared to FY20, its market share in the air freight business and technology advancement remains key to success. Also, the Indian warehouse market is experiencing huge demand. This is due to some factors such as the Government’s push for Make in India, improved trade in various sectors, advanced technology, and the Digital India initiative, along with many other such policies.

Remarkably, India’s Air Freight Market is expected to be $12.41 billion in 2022 and then reach $16.37 billion by 2027, representing a CAGR of 5.7%. Also, the India warehouse market is estimated by IMARC Group to reach Rs 2,069.6 billion by 2027 from Rs 1,113 billion in 2021.

This indicates long-term prospects for Patel Integrated Logistics Limited.

Our View

In the current era of digitization, along with an increasing demand for air freight logistics and warehousing, the company reflects strong business momentum with technological advancement, operational efficiency, and financial stability. Therefore, long-term investors buying the dips might consider the stock as an attractive investment opportunity. Also, the company’s TTM P/E ratio stands at 21.97, compared to the Logistics sector average of 49.1 which indicates that the stock is undervalued at the current level.