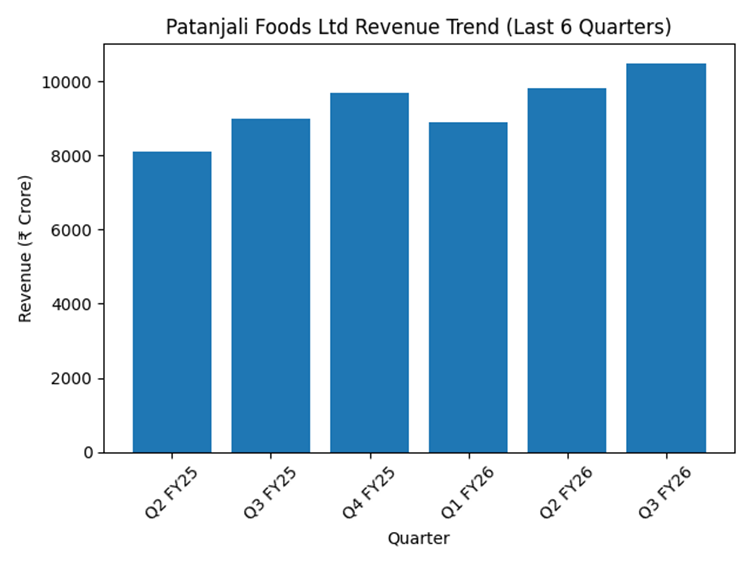

Patanjali Foods Ltd (NSE: PATANJALI, BSE: 500368) reports revenue from operations of ₹10,483.71 crore in Q3 FY26, up 16.53% year-on-year. Profit before tax stands at ₹364.54 crore, translating into a margin of 3.46%. The quarter includes an exceptional item of ₹30.19 crore related to labor code implementation.

For the nine months ended FY26, revenue from operations stands at ₹29,013.98 crore. Profit before tax is ₹1,118.24 crore, with a margin of 3.84%.

Financial Performance

Total EBITDA for Q3 FY26, excluding exceptional items, stands at ₹492.06 crore. EBITDA margin is 4.69%. For the nine-month period, EBITDA stands at ₹1,429.56 crore with a margin of 4.93%.

The quarter includes pricing revisions and packaging adjustments linked to GST 2.0 implementation.

Palm oil prices declined 12.6% year-on-year and 3.7% sequentially during the quarter. India’s palm oil imports fall 20% in December, while soybean oil imports rise 20.2%. Wheat prices remain range-bound. Sugar prices stay firm during the festive season.

Segment Performance

The edible oil segment reports revenue of ₹7,335.71 crore, up 8.9% year-on-year. Segment EBITDA margin stands at 2.39%. For the nine months, segment revenue is ₹20,989.43 crore, rising 16.55% year-on-year, with an EBITDA margin of 2.57%. Branded edible oils account for nearly 85% of total edible oil sales.

The oil palm plantation business reports revenue of ₹418 crore in the quarter with an EBITDA margin of 22.4%. For nine months, revenue stands at ₹1,610 crore with a margin of 21.53%. The area under cultivation is 108,000 hectares at the end of calendar year 2025.

The FMCG segment reports revenue of ₹3,248 crore, rising 38.93% year-on-year and 12.31% sequentially. EBITDA margin for the segment is 10.88%. For the nine-month period, FMCG revenue stands at ₹8,297 crore with an EBITDA margin of 11.06%. The segment contributes 30.68% of total revenue and 66.33% of EBITDA during the quarter.

Within FMCG, biscuits generate ₹490 crore, up 26.4% year-on-year. Staples revenue stands at ₹1,255 crore, rising 68.70% year-on-year. Ghee revenue is ₹467 crore, up 46% year-on-year and 21% sequentially. Home and personal care revenue stands at ₹627 crore.

Distribution and Operations

The company expands its retail presence to over 2 million outlets, adding an estimated 0.2–0.25 million outlets during the calendar year.

Management Commentary

Chief Executive Officer Sanjeev Asthana says GST 2.0 reforms and tax measures are expected to support consumption over time. He states that rural consumption has outperformed urban demand for seven consecutive quarters. He adds that the company expects demand recovery and volume growth to strengthen in the coming quarters.