Ruchi Soya Industries Limited is engaged primarily in the business of processing of oil-seeds and refining of oil for edible use.

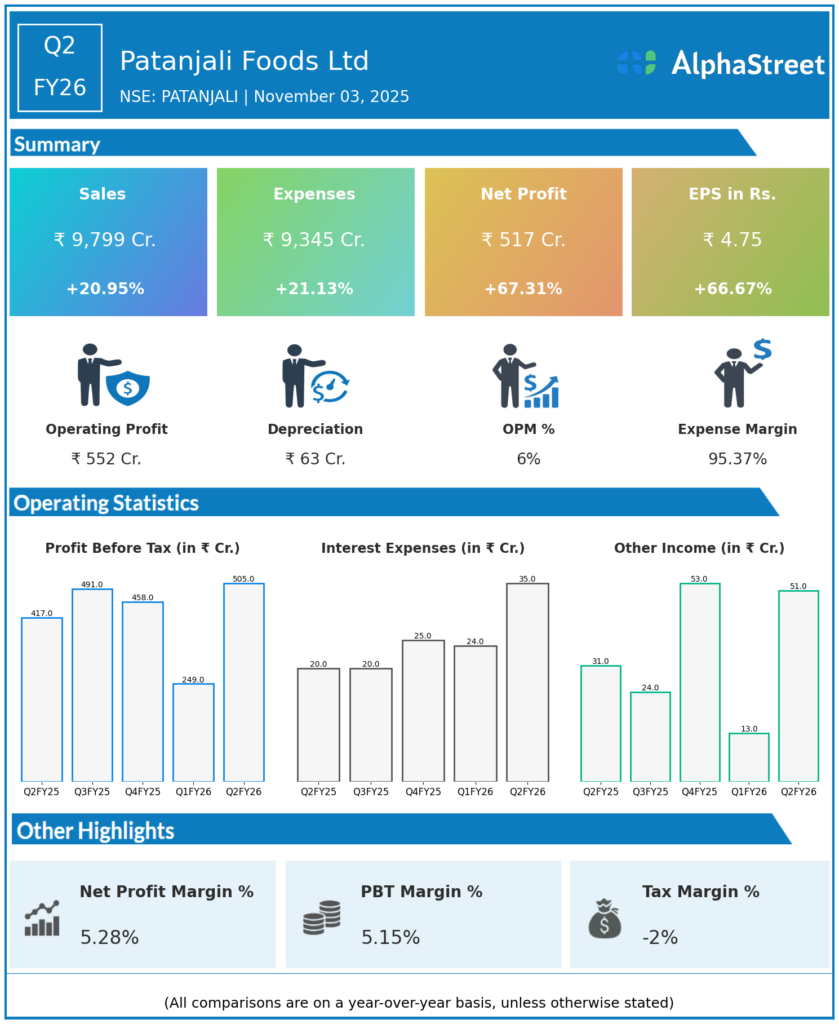

Q2 FY26 Earnings Results:

-

Revenue from Operations: ₹9,798.80 crore, up 20.9% YoY from ₹8,101.56 crore.

-

Profit After Tax (PAT): ₹516.69 crore, up 67% YoY from ₹308.58 crore.

-

EBITDA: ₹552.05 crore, up 19% YoY from ₹462.25 crore.

-

EBITDA margin slightly contracted to 5.6% from 5.7% YoY.

-

Gross profit for the quarter grew 22.46% YoY to ₹1,502.65 crore with a margin of 15.26%.

-

Export revenue: ₹51.69 crore; Wind turbine power generation segment contributed ₹13.33 crore.

-

Despite strong revenue and profit growth, quarterly PAT margin contracted to 2.03% due to pricing and input cost pressures.

-

The quarter saw GST rate rationalisation impacting operations and margins briefly.

Management Commentary & Strategic Insights:

-

Management described this as a milestone quarter with all-time high revenue and profitability despite challenging operating environment.

-

Emphasized focus on mitigating raw material cost volatility and enhancing operational efficiency.

-

Business strategy centers on sustained growth in FMCG and edible oil sectors.

-

The company has maintained strong cash flows and capital discipline.

-

Market headwinds and competitive intensity remain, but the firm is confident in long-term growth drivers like rising demand and expansion.

Q1 FY26 Earnings Results:

-

Revenue: ₹8,899.71 crore, up 24% YoY.

-

PAT: ₹180.36 crore, down 31.35% YoY from ₹262.73 crore.

-

EBITDA and margins contracted during the quarter due to input cost pressure.

-

Operating profit (excluding other income): ₹321.16 crore; margin dropped to 3.61%.

-

Increase in expenses including raw materials and employee benefits impacted profitability.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.