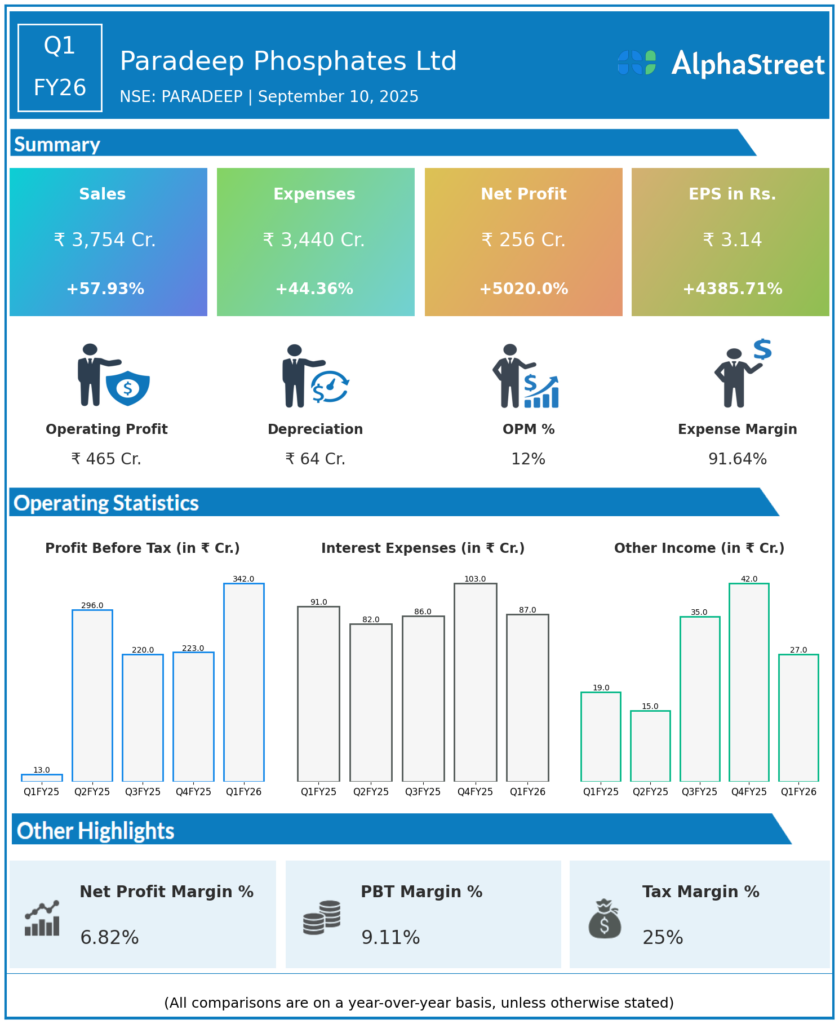

Incorporated in 1981, Paradeep Phosphates Limited is a manufacturer of non-urea fertilizers and India’s second largest private sector phosphatic company. The company is engaged in manufacturing, trading, distribution, and sales of a variety of complex fertilizers such as DAP, three grades of Nitrogen-Phosphorus-Potassium (namely NPK-10, NPK-12, and NP-20), Zypmite, Phospho-gypsum, and Hydroflorosilicic Acid. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹3,754 crores, up 7.4% QoQ and 57.9% YoY (Q4 FY25: ~₹3,494 crores).

-

EBITDA: ₹493 crores, nearly doubled YoY, with a margin expansion to 13.1% from 7.9% last year.

-

Profit Before Tax (PBT): ₹342 crores, up 53.4% QoQ and substantially from ₹14 crores YoY.

-

Profit After Tax (PAT): ₹256 crores, up 59.7% QoQ and sharply from ₹6 crores YoY.

-

EPS: ₹3.14, up from ₹2.07 QoQ and 0.08 YoY.

-

Production Volume: 6.64 lakh tonnes, up 23% YoY, with primary sales at 7.42 lakh tonnes (up 34% YoY).

-

N-20 Sales: Record 2.24 lakh tonnes during the quarter, contributing significantly to revenue growth.

-

Nano Fertilizer Sales: Approximately 7 lakh bottles sold, showcasing innovation and market acceptance.

-

Operational Efficiencies: Backward integration and strategic sourcing helped improve cost control despite input price inflation.

-

Farm Reach: Over 9.5 million farmers served across 15 states with a retail network exceeding 95,000 points.

Key Management Commentary & Strategic Highlights

-

MD & CEO Suresh Krishnan noted strong operational momentum driven by favorable monsoon, robust demand for crop- and soil-specific fertilizers, and effective execution.

-

Focus on value-added products such as N-20 and multiple NPK grades supported volume growth and margin improvement.

-

Backward integration projects for sulphuric and phosphoric acid expansions remain on track to enhance profitability further in the medium term.

-

A merger with Mangalore Chemicals & Fertilizers, approved by shareholders in June, is progressing through regulatory processes to create expanded scale and synergy.

-

Management is optimistic about sustained demand growth, favorable government policies, and increasing farmer awareness on balanced fertilization.

Q4 FY25 Earnings Results

-

Revenue from operations: ₹3,494 crores.

-

Profit After Tax (PAT) was reported around ₹160 crores, showing solid profitability.

-

EBITDA margins improved year-on-year but were lower than Q1 FY26.

-

Q4 reflected steady operational performance and set the stage for strong Q1 growth.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.