Incorporated in 1995, Page Industries Limited is the exclusive licensee of JOCKEY International Inc. for manufacturing, distribution, and marketing of the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal, and the UAE. Page Industries is also the exclusive licensee of Speedo International Ltd. for the manufacturing, marketing, and distribution of the Speedo brand in India. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Results

-

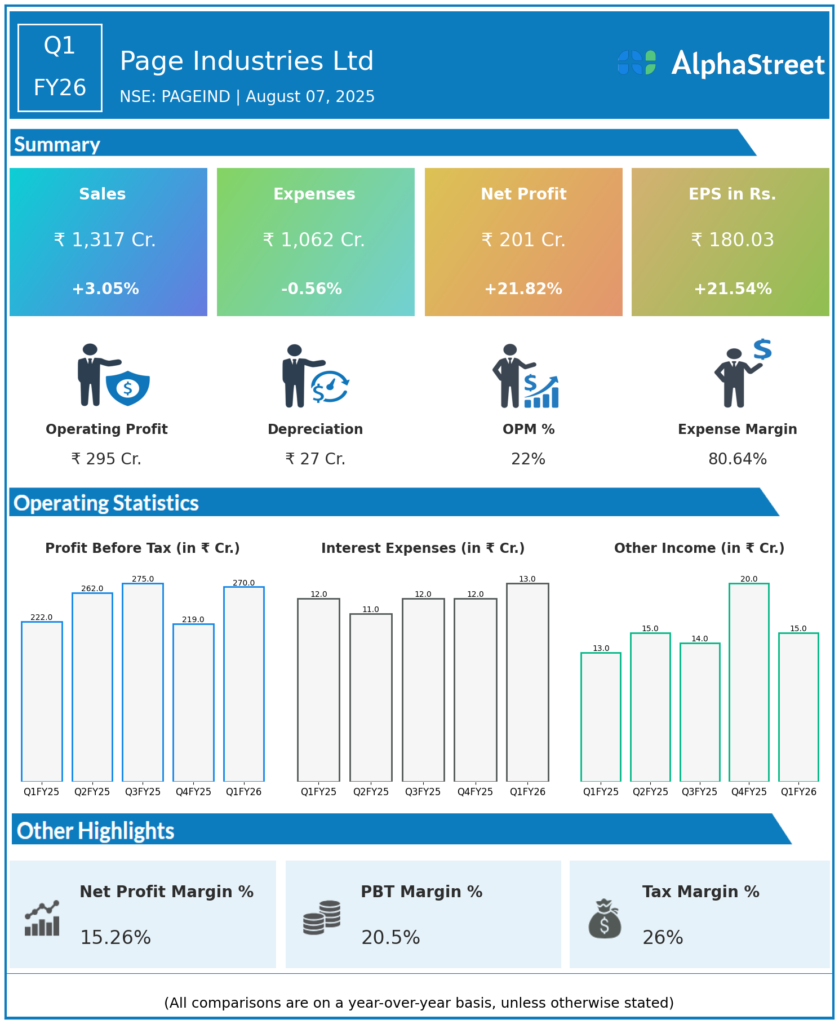

Net Profit (PAT): ₹200.8 crore, up 21.8% year-over-year (YoY) from ₹165.3 crore in Q1 FY25.

-

Revenue from Operations: ₹1,316.6 crore, up 3% YoY (Q1 FY25: ₹1,277.5 crore).

-

EBITDA: ₹295 crore, up 21.4% YoY (Q1 FY25: ₹243 crore).

-

EBITDA Margin: 22.4%, a significant expansion from 19.05% last year, driven by operational efficiencies and a better product mix.

-

Sales Volume: Grew 1.9% YoY to 58.6 million pieces.

-

Total Expenses: ₹1,061 crore, marginally lower than previous year, which supported margin growth.

-

Dividend: Interim dividend of ₹150 per equity share. Record date: August 13, 2025; payment on or before September 5, 2025.

-

Sequential Performance: Profit and revenue also improved over Q4 FY25 (PAT: ₹164 crore, Revenue: ₹1,098 crore).

Key Management Commentary & Strategic Highlights

-

Operational Performance: Management underscored robust profitability and margin expansion due to cost optimization, product innovation, and supply chain efficiency.

-

Market Position: The Jockey India licensee continues to maintain leadership in the innerwear and athleisure segment, supported by steady demand and strong brand recall.

-

Distribution & Expansion: The company is capitalizing on growth opportunities, especially in Tier 2 and Tier 3 cities, while also expanding its brand outlets and presence in multi-brand retail locations.

-

Outlook: Management remains optimistic about long-term growth, citing a positive outlook for the innerwear and athleisure market due to rising urbanization, higher disposable incomes, and continued investments in product innovation and consumer experience.

-

Industry Trends: Input cost deflation and benign raw material prices supported margin improvement, even as overall industry demand was steady but not exuberant.

Q4 FY25 Earnings Results

-

Net Profit (PAT): ₹164 crore, up 52% YoY from ₹108 crore in Q4 FY24.

-

Revenue from Operations: ₹1,098 crore, up 10.6% YoY.

-

EBITDA: ₹235 crore, up 43% YoY; margin improved to 21.4% from 16.5%.

-

Sales Volume: 49.2 million pieces, up 8.5% YoY.

-

Interim Dividend: ₹200/share was paid for FY25.

-

Growth Highlights: The company posted record profit and robust volumes, with particular strength in non-metro markets and cost management initiatives.

-

Full Year FY25: Revenue ₹4,935 crore (+8% YoY), PAT ₹729 crore (+28% YoY), EBITDA ₹1,063 crore (+23.6% YoY).

To view the company’s previous earnings, click here