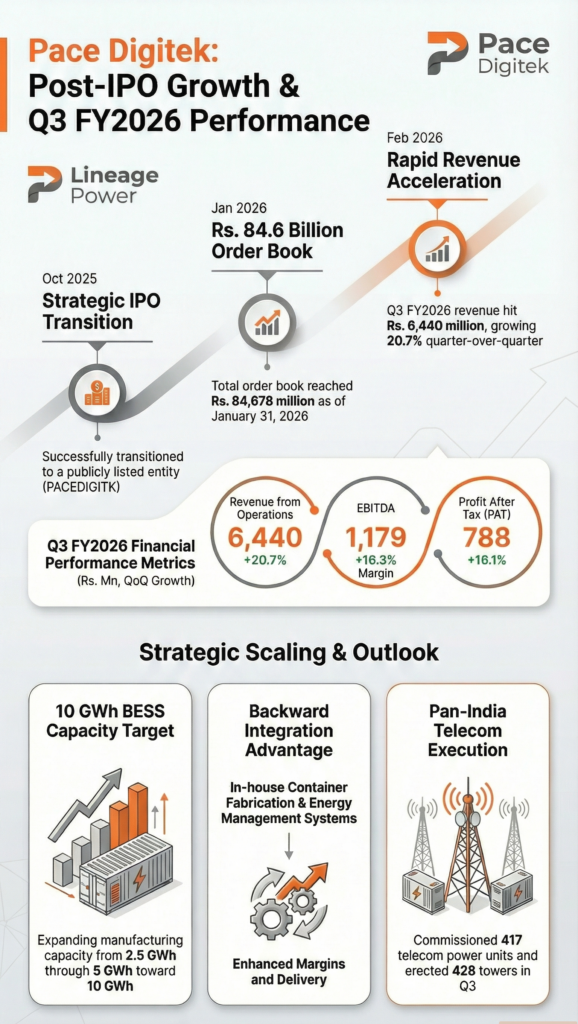

The infrastructure provider reported consolidated revenue of ₹6,440 million, driven by expansion in the energy storage and telecom sectors. This performance follows the company’s recent strategic shift toward backward-integrated manufacturing and grid-scale battery solutions.

Pace Digitek Ltd (NSE: PACEDIGITK, BSE: 544550) consolidated net profit reached ₹788 million for the third quarter ended December 31, 2025. This represents an 11.3% year-over-year (YoY) increase and a 16.1% increase compared to the previous quarter. Quarterly revenue from operations grew 13.5% YoY to ₹6,440 million.

Equity analysts note the company’s scaling in the energy vertical as a primary performance driver. The stock recently completed its Initial Public Offering (IPO), raising ₹8,191.48 million in gross proceeds. The company’s market capitalization is supported by a robust order book of ₹84,678 million as of January 31, 2026.

Where Does Pace Digitek Ltd Stand Today?

Pace Digitek is an integrated infrastructure solutions provider with over 18 years of industry experience. The company operates three manufacturing facilities in Karnataka, specializing in telecom power systems, lithium-ion batteries, and Battery Energy Storage Systems (BESS). To date, the firm has developed over 30,000 telecom sites and is currently scaling its BESS capacity from 2.5 GWh to 10 GWh.

Performance by Business Vertical

• Energy Solutions: This segment holds an order book of ₹60,042 million, representing 71% of the total pipeline. Major projects include Build-Own-Operate (BOO) contracts with MESDCL and KPTCL, as well as BESS EPC projects for the Solar Energy Corporation of India (SECI).

• Telecom & ICT: The segment holds an order book of ₹24,637 million. During Q3 FY2026, the company commissioned 417 telecom power equipment units, erected 428 towers, and deployed 1,891 km of optical fiber cable (OFC).

Core Growth Strategies and Strategic Expansion

The company’s growth is centered on backward integration. It is developing an in-house container fabrication facility at Bidadi to control costs and improve delivery timelines, with target completion in Q1 FY2027.

Strategic expansion includes the incorporation of TransGreenX Energy Private Limited to act as an asset-holding entity for renewable projects. Internationally, the company is increasing its presence in Saudi Arabia, Kenya, and other African markets for telecom and energy storage solutions.

Financial Performance and Strategic Analysis

The 9M FY2026 revenue stands at ₹15,445 million, with a Profit After Tax (PAT) of ₹2,013 million. This follows a period of rapid growth, with a 120.1% Revenue CAGR between FY2023 and FY2025.

The company maintains a healthy balance sheet with a debt-to-equity ratio of 0.1x as of FY2025. Fixed Asset Turnover improved significantly to 22.0x in FY2025 compared to 4.7x in FY2023.

Broader Industry Trends and Business Model

The business model leverages structural demand for grid stability as India scales its renewable energy capacity. The National Electricity Policy 2026 provides a tailwind for domestic manufacturing. Pace Digitek’s integrated platform spans manufacturing, EPC execution, and Operations & Maintenance (O&M), creating recurring revenue streams through long-term service contracts.

Future Outlook and Guidance

Management has issued a revenue guidance of ₹26,500–27,000 million for FY2026. The target for FY2027 is ₹30,000–31,000 million. Growth will be supported by the scale-up of the Bidadi BESS plant and improved working capital management to address receivable cycles.

Regulatory Milestones and Management Commentary

A key milestone includes the 4G Saturation Project awarded by a public sector operator. Management highlights that the recent Initial Public Offering has provided the capital strength required to fund a ₹6,300 million investment in BESS projects in Maharashtra. No interim dividend was declared during the February 2026 board meeting.

52-Week Context and Reasons to Pass

The stock has maintained a positive trend following its October 2025 listing. However, investors may consider certain risks. Trade payables increased from ₹10,150 million in FY2025 to ₹12,389 million by mid-FY2026. High working capital intensity and dependence on imported battery cells remain critical factors for monitoring.