PI Industries Ltd is a leading player in the agro-chemicals space having strong presence in both Domestic and Export markets. It has state-of-art facilities in Gujarat having integrated process development teams with in-house engineering capabilities. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

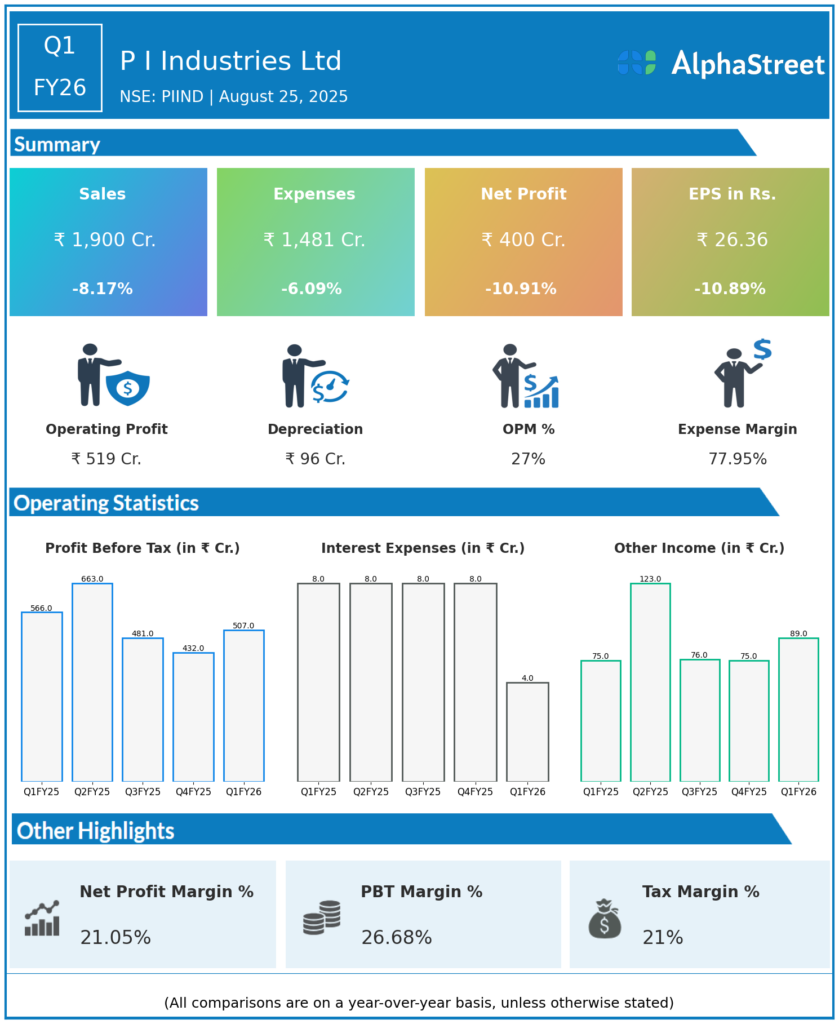

Consolidated Revenue: ₹1,900.5 crores, down 8.1% YoY (Q1 FY25: ₹2,068.9 crores).

-

Total Income: ₹1,986.4 crores, down 7.2% YoY (Q1 FY25: ₹2,141.6 crores), but up 10.4% QoQ (Q4 FY25: ₹1,798.9 crores).

-

Profit Before Tax (PBT): ₹605.0 crores, down 7.7% YoY (Q1 FY25: ₹655.9 crores).

-

Profit After Tax (PAT): ₹400.0 crores, down 10.9% YoY (Q1 FY25: ₹448.8 crores), up 8.3% QoQ (Q4 FY25: ₹369.5 crores).

-

EBITDA: ₹521 crores, margin 27.4%, down 11% YoY (Q1 FY25: ₹585 crores, margin 28.2%).

-

EPS: ₹26.36, down 10.8% YoY (Q1 FY25: ₹29.60), up 8.2% QoQ (Q4 FY25: ₹24.40).

-

Total Expenses: ₹1,473.3 crores, down 6.4% YoY.

-

Domestic business: Up 6% YoY; agchem exports volume down 9% YoY; new export products grew 46% YoY; pharma revenue up 186% YoY.

-

Biologicals products: Revenue was down 38% YoY.

Management Commentary & Strategic Decisions

-

The management reaffirmed margin guidance for FY26 (27–28%) despite Q1 pressure, highlighting operating discipline and cost management.

-

Two new products were commercialized for exports and two for domestic agri brands in Q1; new products contributed 46% YoY growth in exports.

-

Management expects a recovery and growth acceleration in H2 FY26 as global agchem demand normalizes and domestic seasonality improves.

-

Strategic focus remains on further expanding export product portfolio, scaling up pharma vertical, and investing in regulated market/green molecule development.

-

CapEx guidance maintained at ₹800–900 crores for FY26.

-

Management targets to grow biologicals revenue 5x in five years, and expects sustained double-digit growth in domestic branded agri business over medium term.

-

Healthy net cash position provides buffer for investments and expansion.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹1,798.9 crores, up 3% YoY (Q4 FY24: ₹1,741 crores).

-

Profit Before Tax (PBT): ₹408.9 crores, up 23.4% YoY (Q4 FY24: ₹331.3 crores).

-

Profit After Tax (PAT): ₹330 crores, down 10.8% YoY.

-

EBITDA: ₹455.6 crores, up 3.1% YoY, margin at 25.6%.

-

EPS: ₹21.78, down 10.5% YoY.

-

Dividend: ₹10 per share declared for FY25, total ₹16 per share in FY25.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.