Oswal Pumps Ltd (OSWALPUMPS.NS) reported higher quarterly profit and revenue for the third quarter of fiscal 2026, driven by continued execution of projects under India’s PM-KUSUM solar irrigation program and robust order inflows.

Financial Highlights

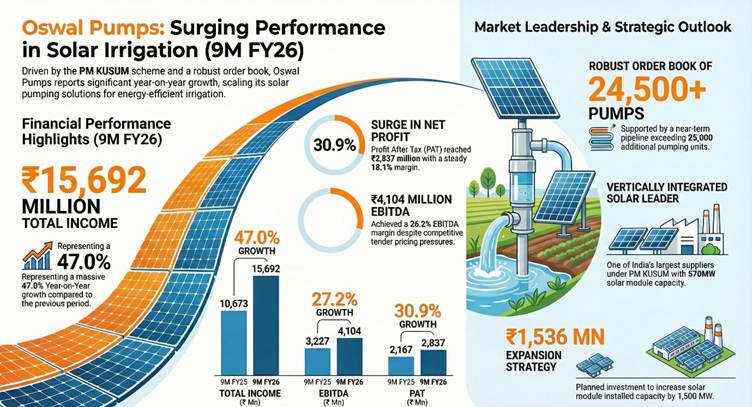

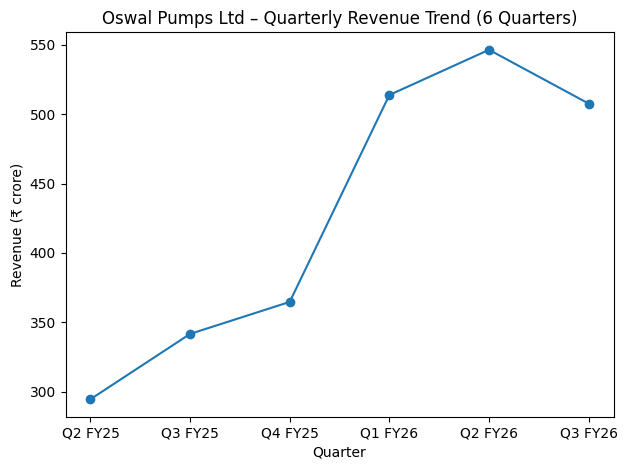

For the quarter ended Dec. 31, 2025 (Q3 FY26), consolidated operating income rose 31.9% year-on-year (YoY) to ₹5,011 million (₹501.1 crore), compared with the same period last year. Profit after tax (PAT) for the quarter was ₹916 million (₹91.6 crore), up 13.9% YoY. Operating EBITDA stood at ₹1,271 million (₹127.1 crore) with a margin of 25.4%, reflecting a sequential improvement of about 164 basis points.

On a nine-month basis, the company posted operating income of ₹15,547 million (₹1,554.7 crore), up 45.9% YoY, with PAT of ₹2,837 million (₹283.7 crore) and operating EBITDA of ₹3,958 million (₹395.8 crore) at a margin of 25.5%.

Segment & Business Performance

Oswal Pumps, a manufacturer of solar and electric pumps serving agricultural, industrial, and residential markets, attributed its revenue growth to strong execution under solar irrigation schemes, including PM-KUSUM and related programs. It maintained a robust order book of over 24,500 pumps, with a near-term pipeline exceeding 25,000 pumps, reflecting sustained demand for energy-efficient pumping solutions.

In its investor presentation, Oswal noted that competitive pricing pressures in tendered projects persisted, but value-engineering initiatives helped expand margins quarter-on-quarter. Management also highlighted broad demand across solar water pumping and electric motor segments.

Management Commentary

The performance was primarily driven by strong project execution under government-backed solar irrigation programs, and that structural demand for renewable-powered irrigation was expected to persist as policy focus remains on sustainable irrigation solutions. They noted that the company’s manufacturing capacity expansions and execution track record positioned it to capture demand from expanding solarization initiatives.

Management also noted the impact of new labor code provisions, which resulted in an exceptional liability recognized in the quarter, and that ongoing initiatives were in place to manage competitive tender dynamics while supporting margin resilience.

Balance Sheet & Cash Flow

Oswal Pumps’ net debt decreased to ₹1,882 million as of Dec. 31, 2025, from ₹3,223 million in March 2025, reflecting continued focus on deleveraging and working capital management, according to the investor presentation. Cash and cash equivalents stood at ₹138 million, and fixed assets increased to ₹1,584 million, indicating investments in capacity expansion. The company’s cash conversion cycle lengthened to 177 days, partly due to payment timing.

Outlook

Management reiterated its focus on expanding market share in solar and government-linked irrigation segments. It highlighted planned capacity additions funded through previously raised IPO proceeds and expected to support future growth.

Market Context

The broader pump manufacturing sector in India is influenced by government incentives for solar irrigation and renewable energy adoption. While competitive tender pricing continues to exert pressure on margins industry-wide, demand from agricultural irrigation schemes and renewable-linked programs remains a key driver for players in this space.

Share Price Reaction

Oswal Pumps’ shares showed modest gains around result announcements and major contract wins, with investor interest tied to its execution visibility under government schemes and improving financial metrics. Share price movements through early February reflected broader market volatility in small-cap and industrial sectors.

Overall, Oswal Pumps delivered YoY growth in both top and bottom lines in Q3 FY26, underpinned by execution under government programs and order book expansion, while focusing on margin improvement and balance-sheet strengthening.