Orient Electric is one of the leading consumer electrical brands in India with a diverse portfolio of fans, lighting, home appliances and switch-gears. The company takes pride in its R&D capabilities, spirit of continuous innovation and commitment to manufacturing cutting-edge lifestyle electrical products that meet the needs and expectations of modern consumers. Presenting below are its Q1 FY26 earnings results.

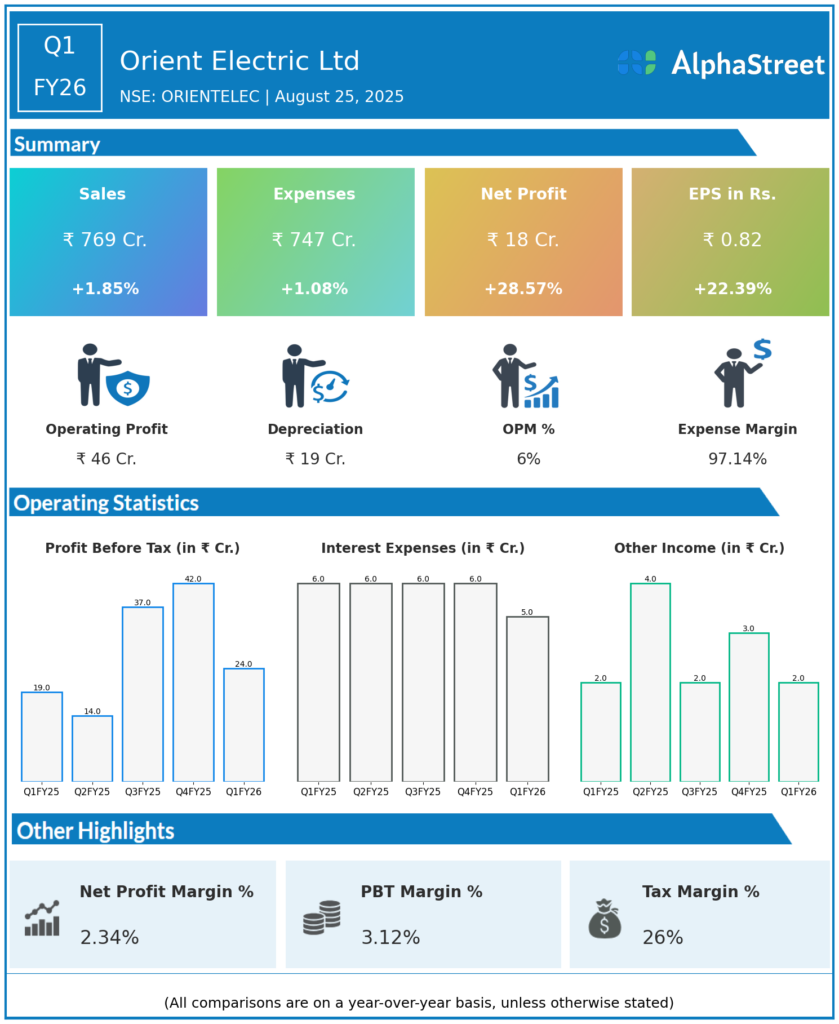

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹769.08 crores, up 1.9% YoY from ₹754.86 crores, but down 10.8% QoQ from ₹861.85 crores (Q4 FY25).

-

Total Income: ₹771.56 crores, up 1.9% YoY from ₹757.33 crores.

-

Total Expenses: ₹747.90 crores, up 1.3% YoY from ₹738.07 crores, down 9.1% QoQ.

-

Profit Before Tax (PBT): ₹23.66 crores, up 22.8% YoY from ₹19.26 crores, but down 43.9% QoQ from ₹42.14 crores.

-

Tax Expense: ₹6.14 crores, up 24.8% YoY.

-

Net Profit (PAT): ₹17.52 crores, up 28.5% YoY compared to ₹14.34 crores, but down 43.9% QoQ from ₹31.26 crores.

-

Basic/Diluted EPS: ₹0.82, up 22.4% YoY from ₹0.67, but down from ₹1.46 QoQ.

Segment Revenue

-

Electrical Consumer Durables (ECD): ₹545.00 crores (flat YoY, down QoQ from ₹614.24 crores).

-

Lighting & Switchgear: ₹224.08 crores, up 6.7% YoY, down QoQ from ₹247.61 crores.

-

Segment Results: ECD profit before interest/tax ₹36.93 crores; Lighting & Switchgear ₹38.96 crores.

Management Commentary & Strategic Decisions

-

CEO Ravindra Singh Negi emphasized a resilient performance despite demand challenges from unseasonal rains affecting fan sales but strong growth in lighting and switchgear segments.

-

The company focused on cost and margin improvements and believes renewed growth momentum should return in future quarters.

-

Strategic push remains on scaling lighting/switchgear, leveraging distribution, and ongoing product innovation for both urban/rural markets.

-

Board appointed Deloitte Touche Tohmatsu as internal auditor for FY26.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹861.85 crores

-

Total Income: ₹865.34 crores

-

Total Expenses: ₹823.20 crores

-

Profit Before Tax (PBT): ₹42.14 crores

-

Net Profit (PAT): ₹31.26 crores

-

Basic/Diluted EPS: ₹1.46

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.