Orient Cement Ltd is primarily engaged in the manufacture and sale of Cement and its manufacturing facilities at present are located at Devapur in Telangana, Chittapur in Karnataka and Jalgaon in Maharashtra. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

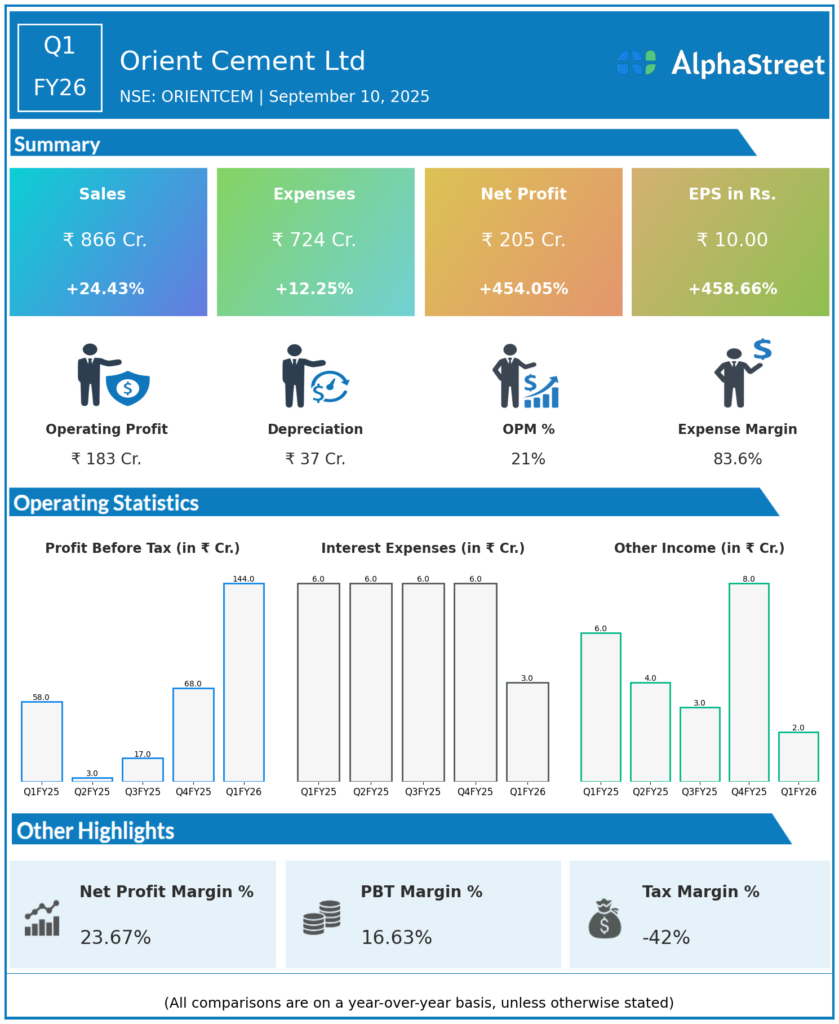

Revenue from Operations: ₹866.48 crores, up 24.44% YoY (Q1 FY25: ₹696.27 crores).

-

Total Income: ₹868.64 crores, up 23.7% YoY.

-

Total Expenses: ₹724.28 crores, up 12.4% YoY.

-

EBITDA: ₹184.78 crores, up 80.96% YoY (Q1 FY25: ₹102.11 crores), with EBITDA margin expanding to 21.33% from 14.67% YoY.

-

Profit After Tax (PAT): ₹205.37 crores, up 454.05% YoY (Q1 FY25: ₹36.71 crores), with PAT margin improving to 23.70% from 5.27% YoY.

-

Significant Note: Orient Cement has become a subsidiary of Ambuja Cements Limited with effect from June 18, 2025, following Ambuja’s acquisition of a 72.66% stake, marking a major structural shift.

-

Cost Management: Total expenses growth at 12.4% YoY, indicating efficient cost control despite revenue surge.

-

Market Response: Positive sentiment with increased investor confidence post acquisition enabling operational synergies and growth prospects.

Key Management Commentary & Strategic Highlights

-

Management emphasized strong operational performance with significant top-line and bottom-line growth led by ramp-up in volumes and better pricing environment.

-

The acquisition by Ambuja Cements is expected to enhance strategic capabilities, improve distribution, and create cost synergies driving long-term value.

- Focus on expanding market share, operational efficiencies, and optimizing power and fuel costs to sustain healthy margins.

-

Management highlighted efforts on clinker production, planned kiln shutdowns impacts and inventory benefits expected in upcoming quarters.

-

Continued investment in capacity expansion and quality product delivery aligned with overall group strategy under Ambuja Cements.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹825 crores.

-

EBITDA recorded healthy margin consistent with prior quarters.

-

Net Profit (PAT): ₹42 crore, before acquisition-related items.

-

EBITDA margins showed improvement prior to consolidation.

-

Q4 FY25 reflected steady operational metrics with Q1 FY26 showing substantial financial and structural improvements post acquisition.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.