Oracle Financial Services Software Ltd provides financial software, custom application development, consulting, IT infrastructure management, and outsourced business processing services to the financial services industry. The company was incorporated in 1989 and is based in Mumbai, India. Oracle Financial Services Software Limited is a subsidiary of Oracle Global (Mauritius) Limited. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

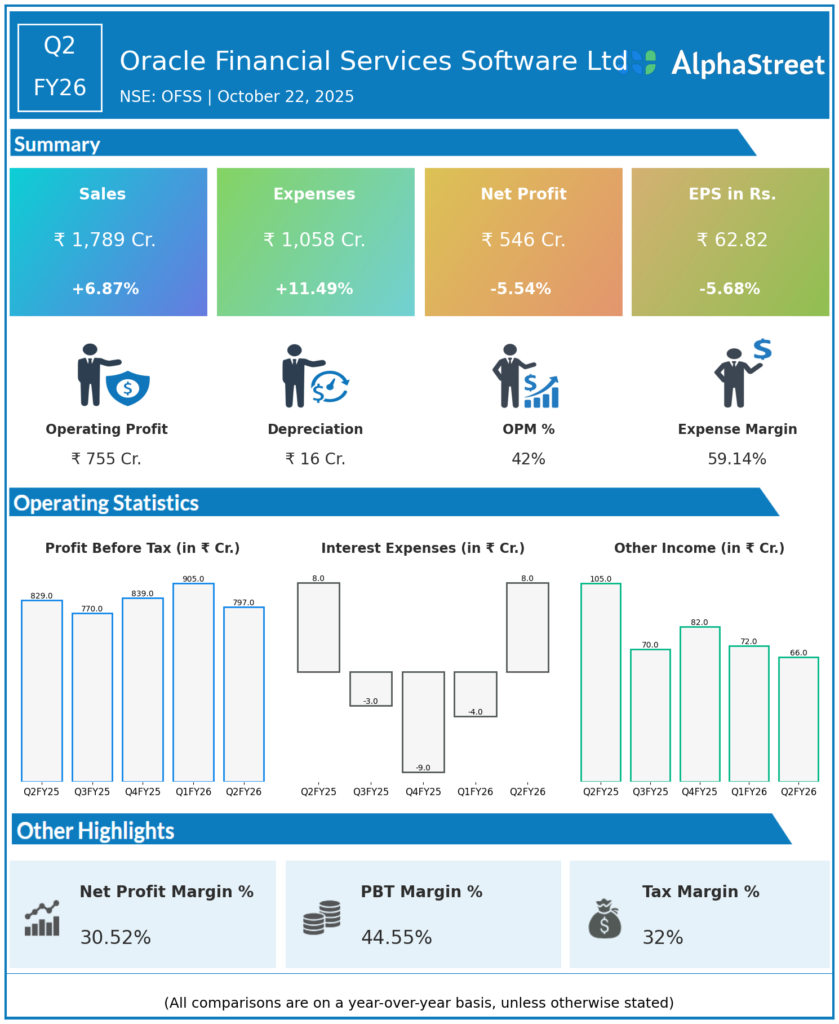

Revenue: ₹1,789 crore, up 7% YoY from ₹1,672 crore in Q2 FY25, driven by growth across product and services segments.

-

Operating Income (EBITDA): ₹731 crore, up 1% YoY from ₹722 crore, with a slight decrease in EBITDA margin to 42.22% from 44.84% YoY due to cost pressures.

-

Net Profit (PAT): ₹546 crore, down 5% YoY from ₹575 crore despite revenue growth, mainly due to margin compression and higher operational costs.

-

Dividend: Interim dividend declared at ₹130 per equity share, reflecting strong cash generation and confidence in financial health.

-

EPS: 271.3, with a Price to Earnings ratio of 31.77, supporting stable market valuation.

-

Segment Revenue:

-

Product revenues: ₹1,623 crore (+7% YoY).

-

Services revenues: ₹166 crore (+6% YoY).

-

Management Commentary and Strategic Insights

-

The company highlighted stable growth driven by its extensive portfolio of banking and financial services software, including Oracle Flexcube and other API-based offerings.

-

Management focused on operational excellence and steady customer acquisition in global financial institutions as core drivers for revenue growth.

-

The slight margin decline was attributed to competitive pricing pressures and increased investment in R&D and cloud offerings to sustain future growth.

-

Confident outlook for H2 FY26 with continued investments in cloud transition and expansion of digital banking solutions.

Q1 FY26 Earnings Results

-

Revenue: ₹1,852 crore, slightly higher than Q2 FY26, indicating stable sequential performance.

-

Net Profit: ₹587 crore, stronger sequential PAT reflecting normal operational cadence and cost management.

-

EBITDA: ₹744 crore with margins in line with historical levels around 43%

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.