OneSource Specialty Pharma Ltd (BSE: 544292 / NSE: ONESOURCE) reported consolidated revenue of ₹2.9 billion for the quarter ended December 31, 2025, a decline of 26% year-on-year, according to its Q3 FY26 earnings release. EBITDA stood at ₹173 million, down 88% from the corresponding quarter last year, while adjusted profit after tax was a loss of ₹472 million. The company attributed the performance to delays in customer approvals for semaglutide in Canada, which led to revenue deferrals during the quarter.

Business Overview

OneSource Specialty Pharma operates as a contract development and manufacturing organisation (CDMO) focused on complex pharmaceutical products, including biologics, drug-device combinations, sterile injectables, and oral technologies such as soft gelatin capsules. The company operates five manufacturing facilities and serves global pharmaceutical customers across multiple therapeutic and technology platforms.

Financial Performance

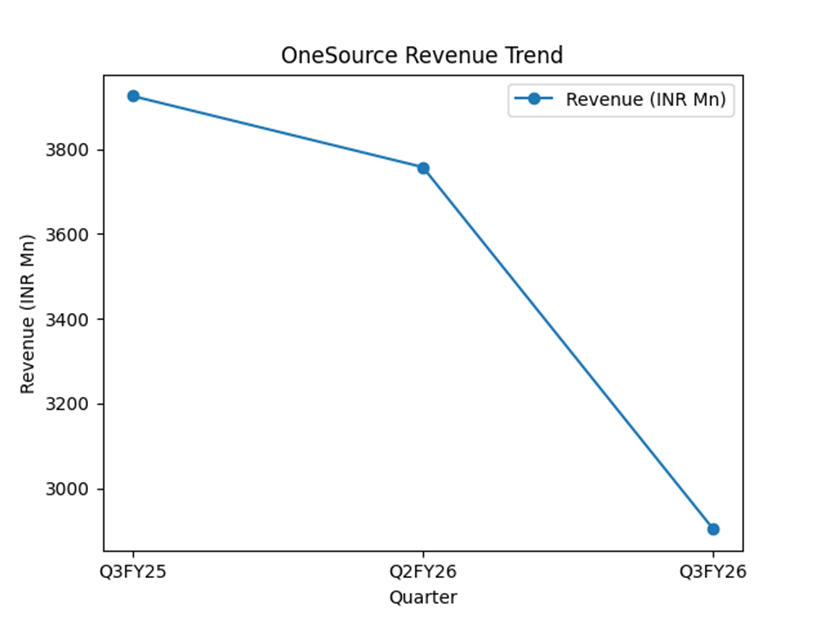

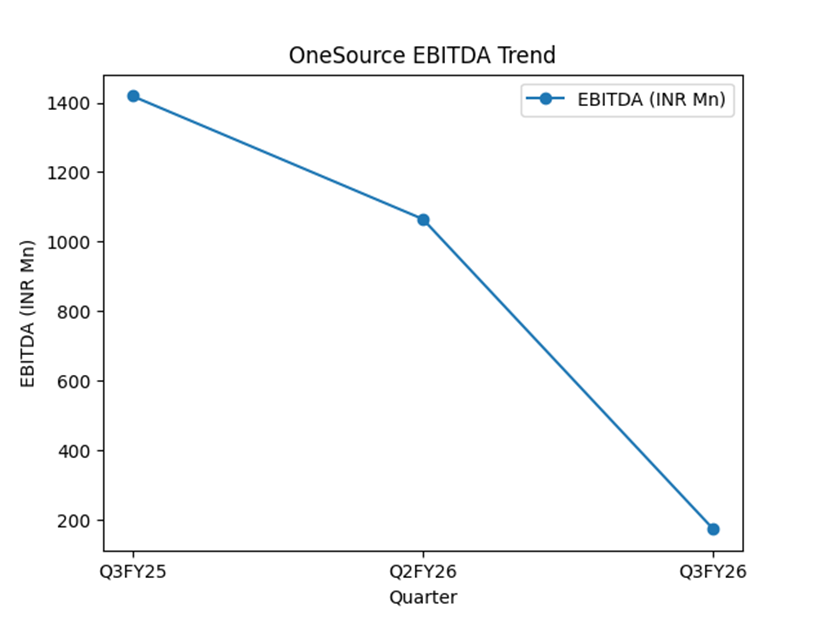

Revenue for Q3 FY26 was ₹2,903 million, compared with ₹3,758 million in Q2 FY26 and ₹3,926 million in Q3 FY25. EBITDA for the quarter was ₹173 million, compared with ₹1,065 million in the preceding quarter and ₹1,419 million in the same quarter last year. EBITDA margin was 6%, compared with 28% in Q2 FY26 and 36% in Q3 FY25.

Adjusted PAT for Q3 FY26 was a loss of ₹472 million, compared with ₹449 million in Q2 FY26 and ₹672 million in Q3 FY25. Adjusted EPS stood at ₹(4.1).

The company stated that lower revenue combined with a largely fixed cost base affected profitability during the quarter.

Operating Metrics

OneSource reported revenue of $33.1 million in Q3 FY26, compared with $42.9 million in Q2 FY26 and $44.8 million in Q3 FY25. The company reported EBITDA of $2.0 million and an EBITDA margin of 6%.

The company highlighted continued growth in its biologics pipeline, onboarding of a global biosimilar customer, and expansion of its project funnel with more than 10 biologics projects at various stages.

During the quarter, OneSource signed multiple new master service agreements and licensing deals, with a significant portion of new business coming from existing customers.

Key Developments

The board approved unaudited standalone and consolidated financial results for the quarter and declared a third interim dividend of ₹4 per equity share, with January 31, 2026 set as the record date.

The company reiterated its FY28 outlook, targeting organic revenue of $400 million and $500 million including a proposed acquisition, with an EBITDA margin outlook of around 40%, subject to approvals.

Risks and Constraints

The company noted that delays in regulatory approvals and customer transitions affected revenue recognition during the quarter, highlighting the dependence of performance on regulatory timelines and customer approvals.

Outlook / Guidance

OneSource reaffirmed its medium-term growth outlook and stated that demand in its core business remains intact, supported by an expanding order book and biologics pipeline.