Incorporated in 2000, One 97 Communications Ltd is India’s leading digital ecosystem for consumers as well as merchants. As of March 31, 2021, the company has a 333 million+ client base and 21 million+ registered merchants to whom it offers payment services, financial services, and commerce and cloud services.

Q3 FY26 Earnings Results

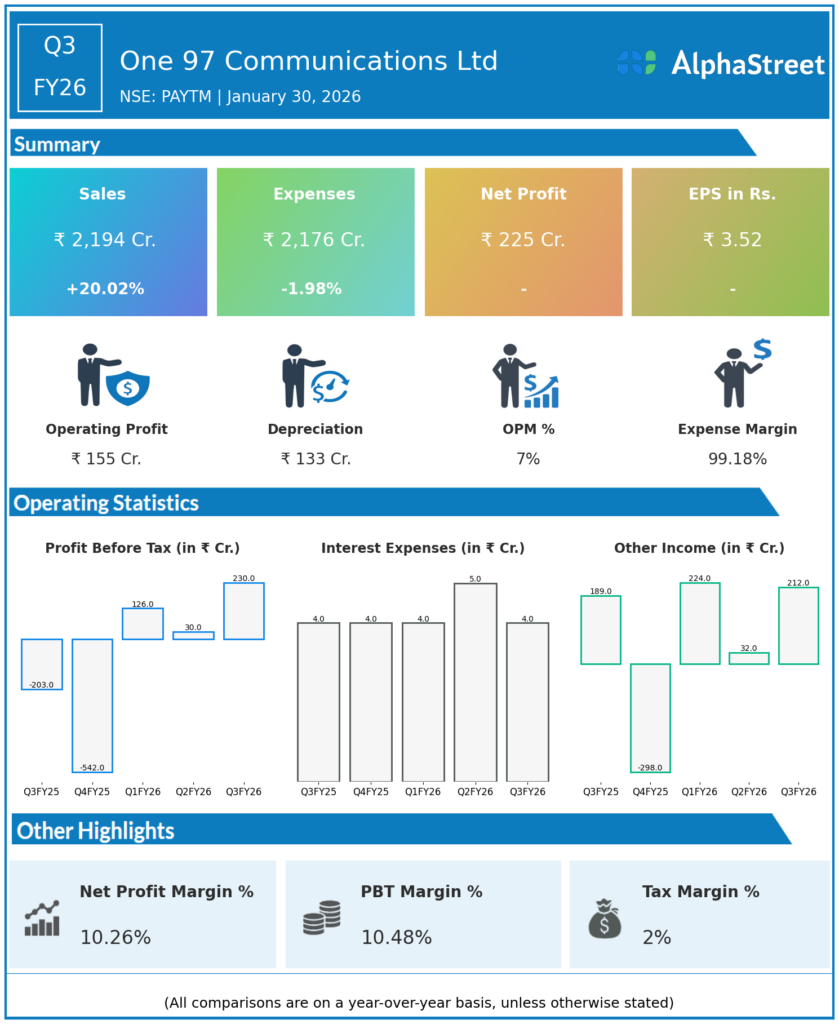

- Revenue from Operations: ₹2,194 cr, +20% YoY vs ₹1,828 cr, +6.5% QoQ vs ₹2,061 cr; payments services +21% YoY to ₹1,284 cr, financial services +34% YoY to ₹672 cr, driven by higher GMV (₹6.2 lakh cr, +24% YoY), merchant subscriptions (1.37 cr, +25 lakh YoY), and AI-led consumer retention.

- EBITDA: ₹156 cr (7% margin), +379 cr YoY from loss; contribution profit ₹1,249 cr (+30% YoY, 57% margin) on payment processing gains, financial distribution share, lower DLG.

- PAT: ₹225 cr (+433 cr YoY from −₹208 cr loss, +971% QoQ vs ₹21 cr), third straight profitable quarter; 9M PAT positive.

- Other key metrics: Average MTU 7.6 cr (+60 lakh YoY); cash ₹13,068 cr; 9M revenue ₹6,173 cr (+24% YoY); ESOPs granted ₹16.6 cr + ₹60 cr.

Management Commentary & Strategic Decisions

- Third consecutive profitable quarter with robust revenue/profitability; AI-first growth, payment margins, financial distribution key drivers; disciplined spending amid consumer growth.

- Strategic moves: RBI payment aggregator license for offline/cross-border; like-for-like revenue +25%; focus on merchant/consumer monetisation, retention.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹2,061 cr, +24% YoY vs ₹1,918 cr (+27% LFL excl entertainment), +27% YoY payments GMV to ₹5.67 lakh cr.

- EBITDA: ₹142 cr (7% margin), contribution profit ₹1,207 cr (+35% YoY, 59% margin).

- PAT: Underlying ₹211 cr (from Q2 FY25 loss ₹415 cr excl one-time); reported impacted by impairments.

- Other key metrics: MTU 7.5 cr; financial services customers 7.1 lakh (+YoY); cash ₹13,068 cr.

Management Commentary Q2

- Revenue/profitability growth on operating leverage; payments/financial services momentum.

- Strategic moves: Subscription merchants growth, EMI affordability; capital flexibility for expansion.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.