Incorporated in 2000, One 97 Communications Ltd is India’s leading digital ecosystem for consumers as well as merchants. As of March 31, 2021, the company has a 333 million+ client base and 21 million+ registered merchants to whom it offers payment services, financial services, and commerce and cloud services. Presenting below are its Q1 FY26 earnings.

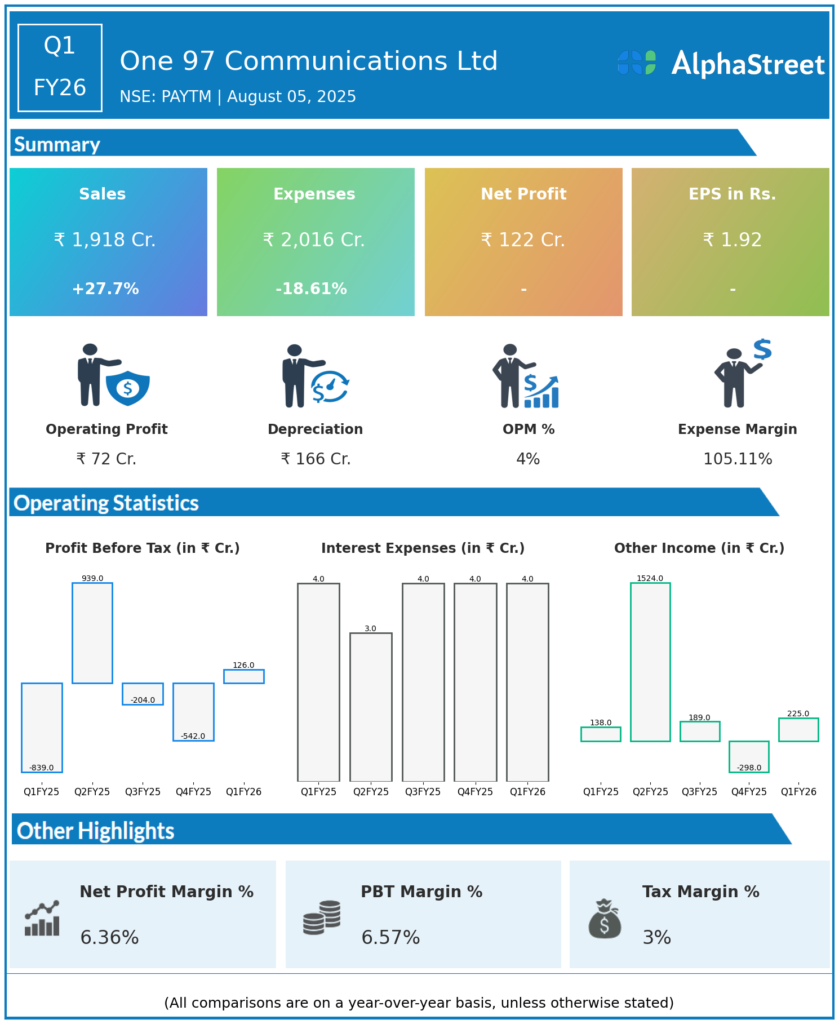

Q1 FY26 Earnings Summary

-

Consolidated Revenue from Operations: ₹1,918 crore, up 27.7% year-over-year (YoY) from ₹1,502 crore in Q1 FY25.

-

Net Profit (PAT): ₹122 Crore, swinging to profit from a loss of ₹839 crore YoY—Paytm’s first-ever quarterly profit at both EBITDA and PAT levels.

-

EBITDA: ₹72 crore (margin ~4%).

-

Contribution Profit: ₹1,151 crore, up 52% YoY; contribution margin of 60%, up 10 percentage points YoY.

-

Net Payment Revenue: ₹529 crore, up 38% YoY, driven by growth in subscription merchants and increased payment processing margins.

-

Financial Services Revenue: ₹561 crore, up 100% YoY, led by strong growth in merchant loans, trail revenue from the Default Loss Guarantee (DLG) portfolio, and improved collection performance.

-

Merchant Device Subscriptions: 1.30 crore as of June 2025, maintaining leadership in merchant payments.

-

Other Notes: Cash balance of ₹12,872 crore, providing strategic flexibility to invest and grow.

Key Management Commentary & Strategic Highlights

-

Management celebrated Paytm’s landmark quarter achieving profitability across EBITDA and PAT, attributing this to AI-led operating leverage, disciplined cost control, and robust revenue growth in merchant services and financial distribution.

-

The company’s leadership reaffirmed guidance to exit FY26 with significantly better margins, targeting an EBITDA margin of 15–20% longer term.

-

Focus areas include deepening product-led growth, continued operational efficiency, and a payments-first business strategy.

-

Plans to move away from the “super-app” approach, re-emphasizing payments as the business core.

-

Expectation to sustain contribution margins (already at 60%) and further improve overall profitability by tight cost control and digital innovation.

Q4 FY25 Earnings Summary

-

Consolidated Revenue: ₹1,911 crore, down ~16% YoY, but up 5% sequentially.

-

Net Profit (Loss): Loss of ₹23 crore (excluding a ₹522 crore exceptional ESOP-related charge; reported loss was ₹540 crore).

-

EBITDA Before ESOP: Positive ₹81 crore.

-

Contribution Profit: ₹1,071 crore, up 12% sequentially; margin 56%.

-

Merchant Loan Disbursement: ₹4,315 crore, with strong repeat borrower base.

-

Cash Balance: ₹12,809 crore; healthy financial position for future investments.

-

Key Context: Q4 saw strong operational metrics, margin improvement, but also a large one-off cost related to ESOPs.

To view the company’s previous earnings, click here