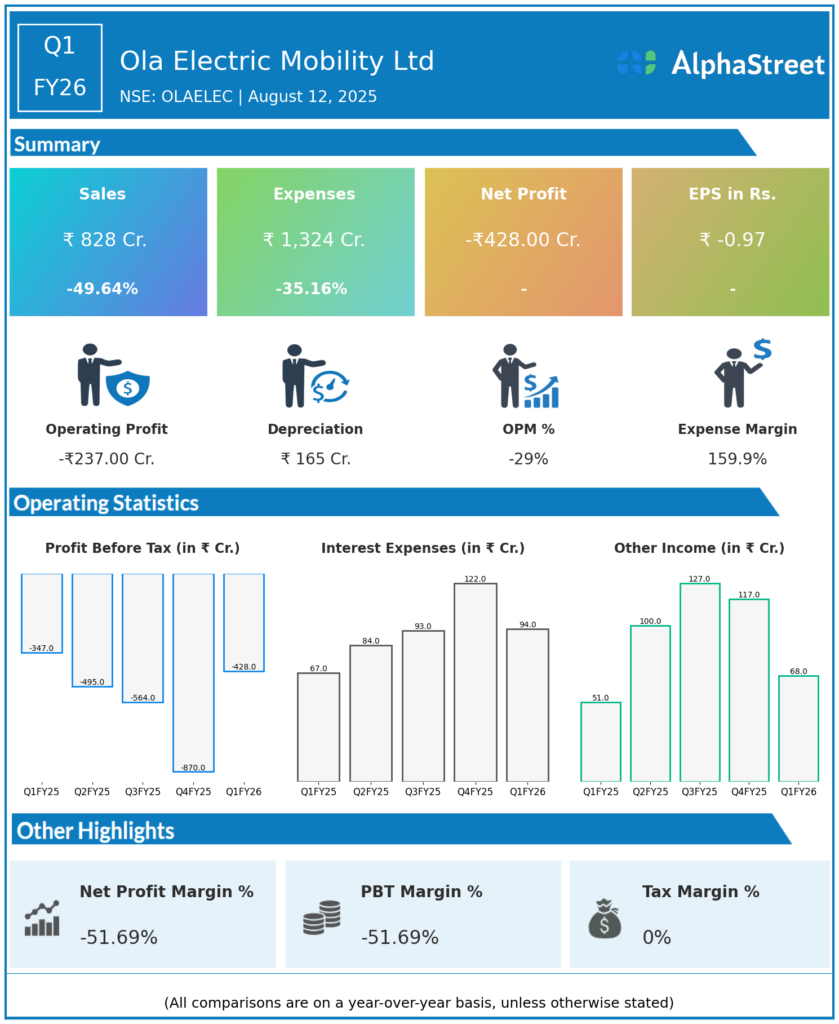

Founded in 2017, Ola Electric Mobility Limited is an electric vehicle company that primarily manufactures electric vehicles and core components for electric vehicles. These components include battery packs, motors, and vehicle frames, all produced at the Ola Futurefactory. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹828 crore, down 49.6% year-over-year (YoY) from ₹1,644 crore in Q1 FY25, but up 35.5% quarter-on-quarter (QoQ) from ₹611 crore in Q4 FY25.

-

Net Loss (PAT): ₹428 crore, wider than ₹347 crore loss in Q1 FY25 but nearly half the ₹870 crore loss in Q4 FY25.

-

Total Income: ₹896 crore, down 47.8% YoY and 46.4% QoQ.

-

EBITDA Margin (Auto Segment): Improved markedly to –11.6% from –90.6% in Q4 FY25; company reported auto EBITDA positive in June 2025.

-

Consolidated EBITDA Margin: –28.6%, showing significant recovery.

-

Free Cash Flow (FCF): Loss reduced to –₹107 crore from –₹455 crore in Q4 FY25.

-

Monthly Auto Opex: Reduced to ₹105 crore from ₹178 crore in Q4, showing cost control effects of ‘Project Lakshya’.

-

EPS: –1.00 for Q1 FY26, down from –0.90 in Q1 FY25.

-

Vehicles Delivered: 68,192 units in Q1 FY26, up 32.7% from 51,375 units in Q4 FY25; Ola holds 19.6% market share.

Key Operational & Strategic Highlights

-

Product Mix: Gen 3 scooters accounted for 80% of sales, boosting gross margins to 25.6% (up from 13.8% Q4).

-

Software Ecosystem: MoveOS+ adoption surged to ~50% of new customers in Q1, up from just 2% in Q4.

-

Engineering & Warranty: Warranty claims dropped substantially, indicating product upgrades and reliability improvements.

-

Expansion & Technology: In-house Bharat 4680 cells and HRE-free motors set for launch in upcoming quarters, targeting further cost and performance gains.

-

Cost Initiatives: Ongoing cost discipline via ‘Project Lakshya’ aims to further cut opex to ₹130 crore/month FY26.

-

Future Guidance: Management projects deliveries of 325,000–375,000 vehicles for FY26 and revenues of ₹4,200–4,700 crore.

Q4 FY25 Earnings Results

-

Revenue: ₹611 crore.

-

Net Loss: ₹870 crore (Q4 loss almost twice Q1 due to seasonality/cost issues).

-

Auto EBITDA Margin: –90.6%.

-

Free Cash Flow: –₹455 crore.

-

Vehicle Deliveries: 51,375 units.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.